Chengdu Xinzhu Road&Bridge Machinery Co.,LTD (SZSE:002480) Held Back By Insufficient Growth Even After Shares Climb 29%

Chengdu Xinzhu Road&Bridge Machinery Co.,LTD (SZSE:002480) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

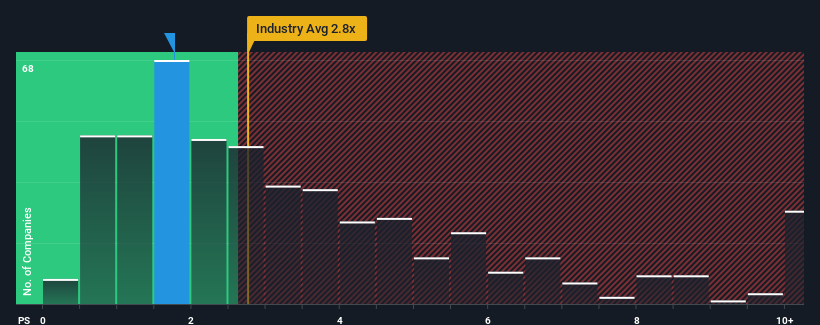

In spite of the firm bounce in price, Chengdu Xinzhu Road&Bridge MachineryLTD's price-to-sales (or "P/S") ratio of 1.8x might still make it look like a buy right now compared to the Machinery industry in China, where around half of the companies have P/S ratios above 2.8x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Chengdu Xinzhu Road&Bridge MachineryLTD

How Has Chengdu Xinzhu Road&Bridge MachineryLTD Performed Recently?

The revenue growth achieved at Chengdu Xinzhu Road&Bridge MachineryLTD over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chengdu Xinzhu Road&Bridge MachineryLTD's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Chengdu Xinzhu Road&Bridge MachineryLTD's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. Still, revenue has fallen 32% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 27% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Chengdu Xinzhu Road&Bridge MachineryLTD's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Chengdu Xinzhu Road&Bridge MachineryLTD's P/S?

The latest share price surge wasn't enough to lift Chengdu Xinzhu Road&Bridge MachineryLTD's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Chengdu Xinzhu Road&Bridge MachineryLTD revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Chengdu Xinzhu Road&Bridge MachineryLTD that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002480

Chengdu Xinzhu Road&Bridge MachineryLTD

Provides products and services for urban rail transit systems in China and internationally.

Imperfect balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success