Global Penny Stocks: Ningbo BirdLtd And 2 Other Promising Picks

Reviewed by Simply Wall St

Amidst a backdrop of market volatility and renewed tariff threats, global stock indexes have experienced declines, with small- and mid-cap indexes particularly affected. Despite these challenges, the concept of penny stocks remains relevant for investors seeking opportunities beyond well-known names. These smaller or newer companies can offer surprising value when they possess strong financial foundations, as they may provide potential for significant returns while maintaining greater stability.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.04 | SGD8.03B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 4 ⚠️ 2 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.98 | MYR1.53B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.365 | MYR1.06B | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.14 | HK$719.28M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.85 | £293.89M | ✅ 5 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.74 | £421.42M | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.515 | A$72.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Tasmea (ASX:TEA) | A$2.92 | A$690.41M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,647 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ningbo BirdLtd (SHSE:600130)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ningbo Bird Co., Ltd. is engaged in the research, development, production, and sale of mobile phones and motherboards in China, with a market capitalization of CN¥2.48 billion.

Operations: Ningbo Bird Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.48B

Ningbo Bird Co., Ltd. recently announced a share repurchase program worth up to CN¥120 million, aiming to enhance shareholder value through an Employee Stock Ownership Plan or Equity Incentive. The company reported first-quarter 2025 revenue of CN¥95.39 million, reflecting growth from the previous year, though net income decreased to CN¥2.08 million from CN¥3.31 million. Despite low return on equity at 0.6%, Ningbo Bird maintains strong liquidity with short-term assets significantly exceeding liabilities and debt well-covered by operating cash flow (169.9%). However, earnings have declined substantially over the past year and five years, indicating challenges in profitability growth.

- Click here to discover the nuances of Ningbo BirdLtd with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Ningbo BirdLtd's track record.

Shanghai Huili Building Materials (SHSE:900939)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Huili Building Materials Co., Ltd. operates in the building materials industry with a market capitalization of approximately $58.99 million.

Operations: The company generates its revenue primarily from China, amounting to CN¥15.27 billion.

Market Cap: $58.99M

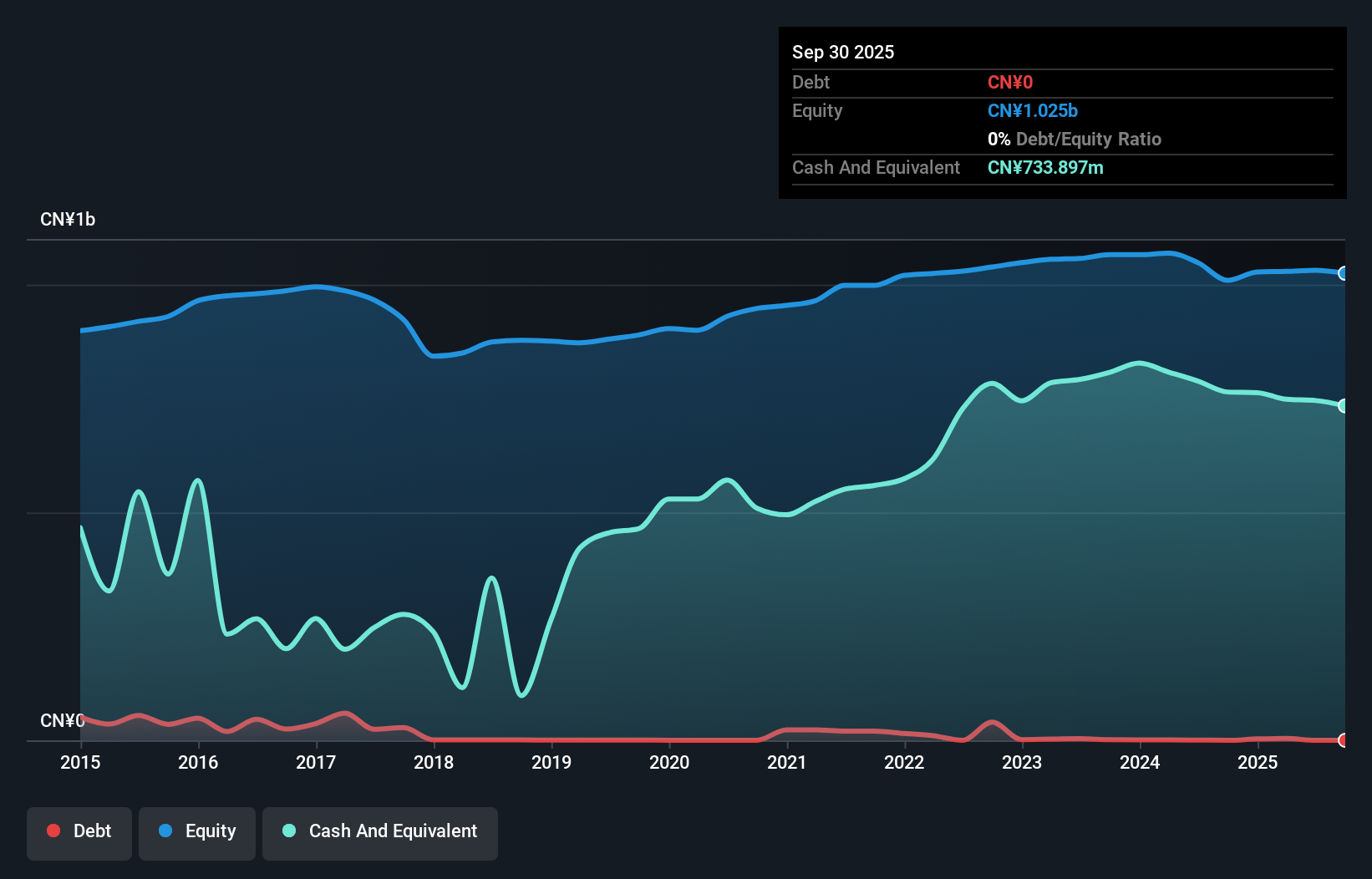

Shanghai Huili Building Materials Co., Ltd. operates with a market capitalization of approximately US$58.99 million, primarily generating revenue from China, amounting to CN¥15.27 billion annually. The company recently announced a share repurchase program worth up to CN¥6 million, aiming to maintain company value and protect shareholders' rights. Despite high-quality past earnings and no debt on its balance sheet, the company's earnings growth has been negative over the past year, with declining net profit margins from 54.3% to 46.2%. Additionally, its return on equity is low at 5.1%, reflecting challenges in achieving profitability growth amidst volatile share price movements.

- Get an in-depth perspective on Shanghai Huili Building Materials' performance by reading our balance sheet health report here.

- Gain insights into Shanghai Huili Building Materials' historical outcomes by reviewing our past performance report.

SanluxLtd (SZSE:002224)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sanlux Co., Ltd specializes in the research, development, production, and sales of rubber V-belts both in China and internationally, with a market cap of CN¥4.13 billion.

Operations: The company's revenue is primarily derived from the construction industry, contributing CN¥941.93 million.

Market Cap: CN¥4.13B

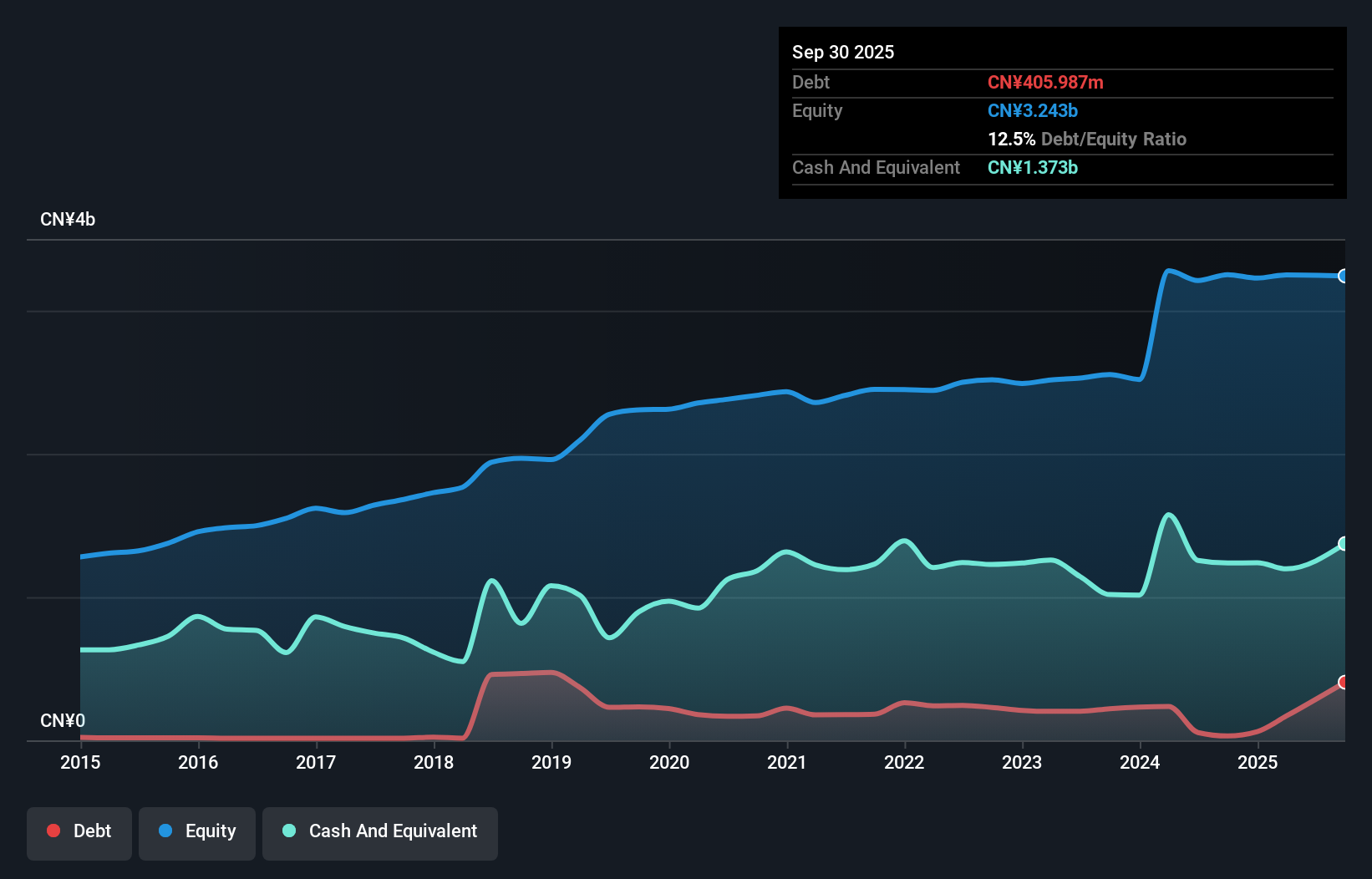

Sanlux Co., Ltd, with a market cap of CN¥4.13 billion, primarily generates revenue from the construction industry, reporting CN¥941.93 million in sales. Recent earnings show a significant increase in net income to CN¥19.61 million for Q1 2025 compared to the previous year, though profit margins have decreased from 7.9% to 5%. The company has more cash than debt and its short-term assets exceed liabilities significantly, indicating financial stability despite low return on equity at 1.4%. A dividend of CNY 0.30 per share was approved recently but is not well covered by free cash flows.

- Unlock comprehensive insights into our analysis of SanluxLtd stock in this financial health report.

- Assess SanluxLtd's previous results with our detailed historical performance reports.

Seize The Opportunity

- Dive into all 5,647 of the Global Penny Stocks we have identified here.

- Searching for a Fresh Perspective? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002224

SanluxLtd

Engages in the research and development, production, and sales of rubber V-belts in China and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives