- China

- /

- Energy Services

- /

- SZSE:002629

Infund Holding And 2 Other Promising Penny Stocks To Consider

Reviewed by Simply Wall St

As global markets continue to reach record highs, buoyed by strong performances from major indices like the Dow Jones Industrial Average and S&P 500, investors are exploring diverse opportunities beyond traditional blue-chip stocks. Penny stocks, often associated with smaller or newer companies, remain a relevant investment area despite their somewhat outdated terminology. These stocks can offer a mix of affordability and growth potential when backed by solid financials; this article will explore several such penny stocks that exhibit notable financial strength.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$145.87M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.14B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.98 | HK$44.38B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| V.S. Industry Berhad (KLSE:VS) | MYR1.07 | MYR4.1B | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.345 | £432.14M | ★★★★☆☆ |

Click here to see the full list of 5,698 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Infund Holding (SZSE:002141)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Infund Holding Co., Ltd. operates in the micro enameled wire and veterinary vaccine sectors in China, with a market cap of CN¥1.61 billion.

Operations: Infund Holding Co., Ltd. does not report separate revenue segments for its operations in the micro enameled wire and veterinary vaccine sectors in China.

Market Cap: CN¥1.61B

Infund Holding Co., Ltd. has shown some positive financial developments despite being unprofitable. The company reported sales of CN¥45.55 million for the first nine months of 2024, narrowing its net loss to a net income of CN¥1.6 million from a previous loss, reflecting improved financial health. Its short-term assets exceed both short and long-term liabilities, indicating solid liquidity management. Recently, a significant acquisition saw 27.41% ownership change hands for approximately CN¥270 million, potentially signaling investor confidence in future prospects. Additionally, Infund completed a share buyback program worth CN¥1.34 million without shareholder dilution over the past year.

- Click here to discover the nuances of Infund Holding with our detailed analytical financial health report.

- Examine Infund Holding's past performance report to understand how it has performed in prior years.

Zhejiang Renzhi (SZSE:002629)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Renzhi Co., Ltd. offers professional services in the oil and gas drilling and engineering sectors primarily within China, with a market cap of CN¥1.45 billion.

Operations: The company's revenue segment includes CN¥184.82 million from its operations in China.

Market Cap: CN¥1.45B

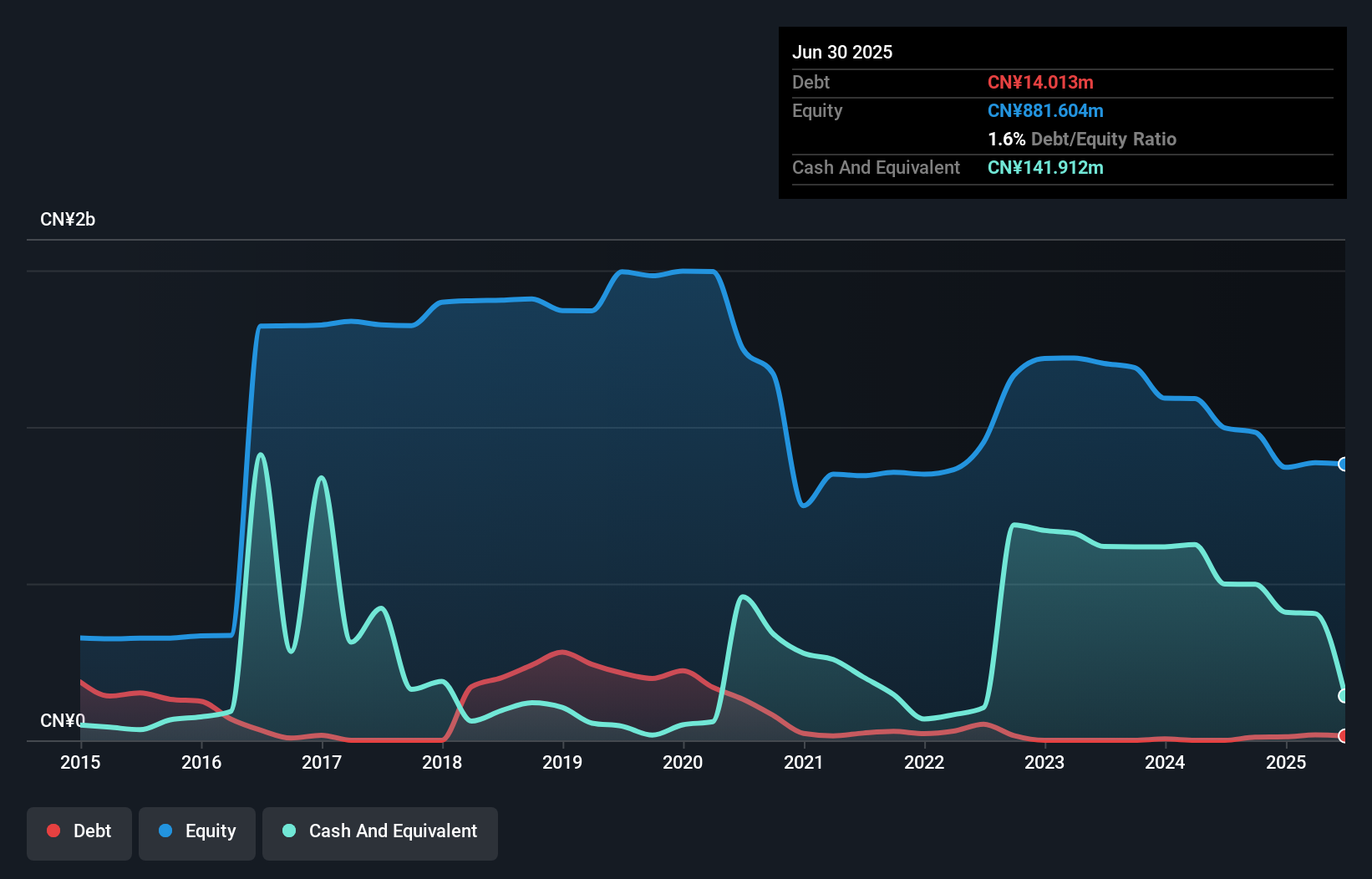

Zhejiang Renzhi Co., Ltd. operates in the oil and gas drilling sector, reporting sales of CN¥131.68 million for the first nine months of 2024, a decrease from CN¥155.1 million last year, yet it reduced its net loss to CN¥10.3 million from CN¥18 million previously. The company maintains more cash than total debt and has improved its debt-to-equity ratio significantly over five years while facing shareholder dilution with a 3% increase in shares outstanding last year. Despite being unprofitable, Zhejiang Renzhi's short-term assets exceed both short and long-term liabilities, reflecting solid liquidity management amidst financial challenges.

- Take a closer look at Zhejiang Renzhi's potential here in our financial health report.

- Evaluate Zhejiang Renzhi's historical performance by accessing our past performance report.

Tong Petrotech (SZSE:300164)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tong Petrotech Corp. provides perforation technology services to oilfield customers both in China and internationally, with a market capitalization of CN¥2.78 billion.

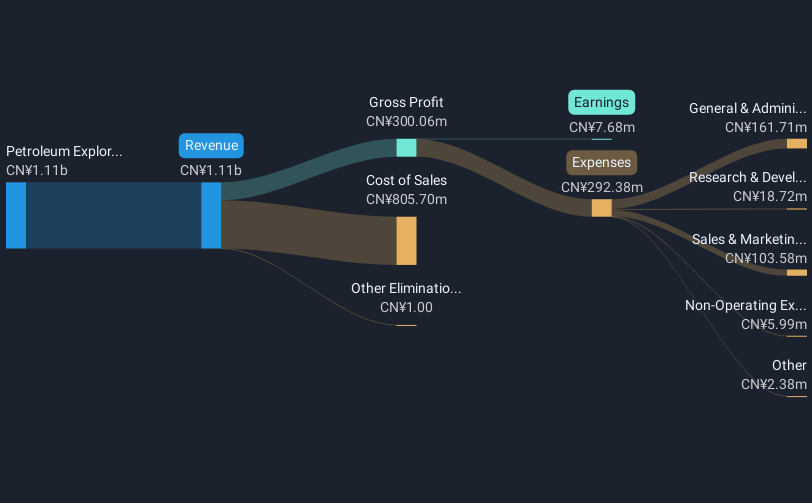

Operations: The company generates revenue of CN¥1.11 billion from its Petroleum Exploration Development segment.

Market Cap: CN¥2.78B

Tong Petrotech Corp. reported sales of CN¥866.67 million for the first nine months of 2024, an increase from CN¥790.21 million a year ago, though net income declined to CN¥48.12 million from CN¥90.72 million, reflecting challenges in profit margins which dropped to 0.7% from 9.2%. The company benefits from strong liquidity with short-term assets exceeding liabilities and has reduced its debt-to-equity ratio over five years while maintaining more cash than total debt, ensuring financial stability despite negative earnings growth and a large one-off gain impacting recent results. The management team is seasoned with an average tenure of 3.2 years.

- Jump into the full analysis health report here for a deeper understanding of Tong Petrotech.

- Learn about Tong Petrotech's historical performance here.

Seize The Opportunity

- Get an in-depth perspective on all 5,698 Penny Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Renzhi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002629

Zhejiang Renzhi

Provides professional services in the oil and gas drilling and engineering fields primarily in China.

Adequate balance sheet very low.