- China

- /

- Electronic Equipment and Components

- /

- SZSE:301556

Insider Backed Growth Companies Leading The Way

Reviewed by Simply Wall St

As global markets continue to reach new heights, with indices like the Dow Jones Industrial Average and S&P 500 hitting record intraday highs, investor sentiment remains buoyant despite geopolitical uncertainties and tariff concerns. In such a climate, companies with strong insider ownership are often seen as attractive investments due to the confidence their executives have in their growth potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Miracle Automation EngineeringLtd (SZSE:002009)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Miracle Automation Engineering Co. Ltd offers intelligent equipment solutions and services both in China and internationally, with a market cap of CN¥5.97 billion.

Operations: I'm unable to provide a summary of the company's revenue segments as the necessary financial details are missing from the provided text.

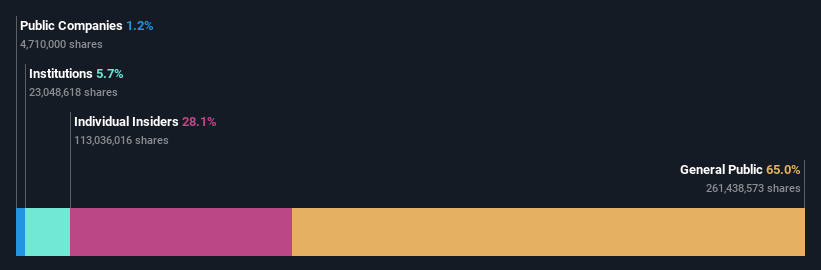

Insider Ownership: 28.1%

Earnings Growth Forecast: 114.2% p.a.

Miracle Automation Engineering Ltd. is positioned for robust growth, with revenue expected to increase at 47.3% annually, significantly outpacing the Chinese market's average. Despite a current net loss of CNY 58.03 million for the first nine months of 2024, this marks an improvement from the previous year's larger deficit. The company is trading at a good value relative to peers and anticipates becoming profitable within three years, aligning with above-average market growth expectations.

- Click to explore a detailed breakdown of our findings in Miracle Automation EngineeringLtd's earnings growth report.

- According our valuation report, there's an indication that Miracle Automation EngineeringLtd's share price might be on the cheaper side.

Huatu Cendes (SZSE:300492)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huatu Cendes Co., Ltd. is an architectural design company offering professional design, consulting, and engineering services to various entities in China, with a market cap of CN¥10.67 billion.

Operations: Huatu Cendes generates its revenue through providing architectural design, consulting, and engineering services to a diverse range of clients including state-owned enterprises, multinational corporations, private companies, and government agencies in China.

Insider Ownership: 22.4%

Earnings Growth Forecast: 61.7% p.a.

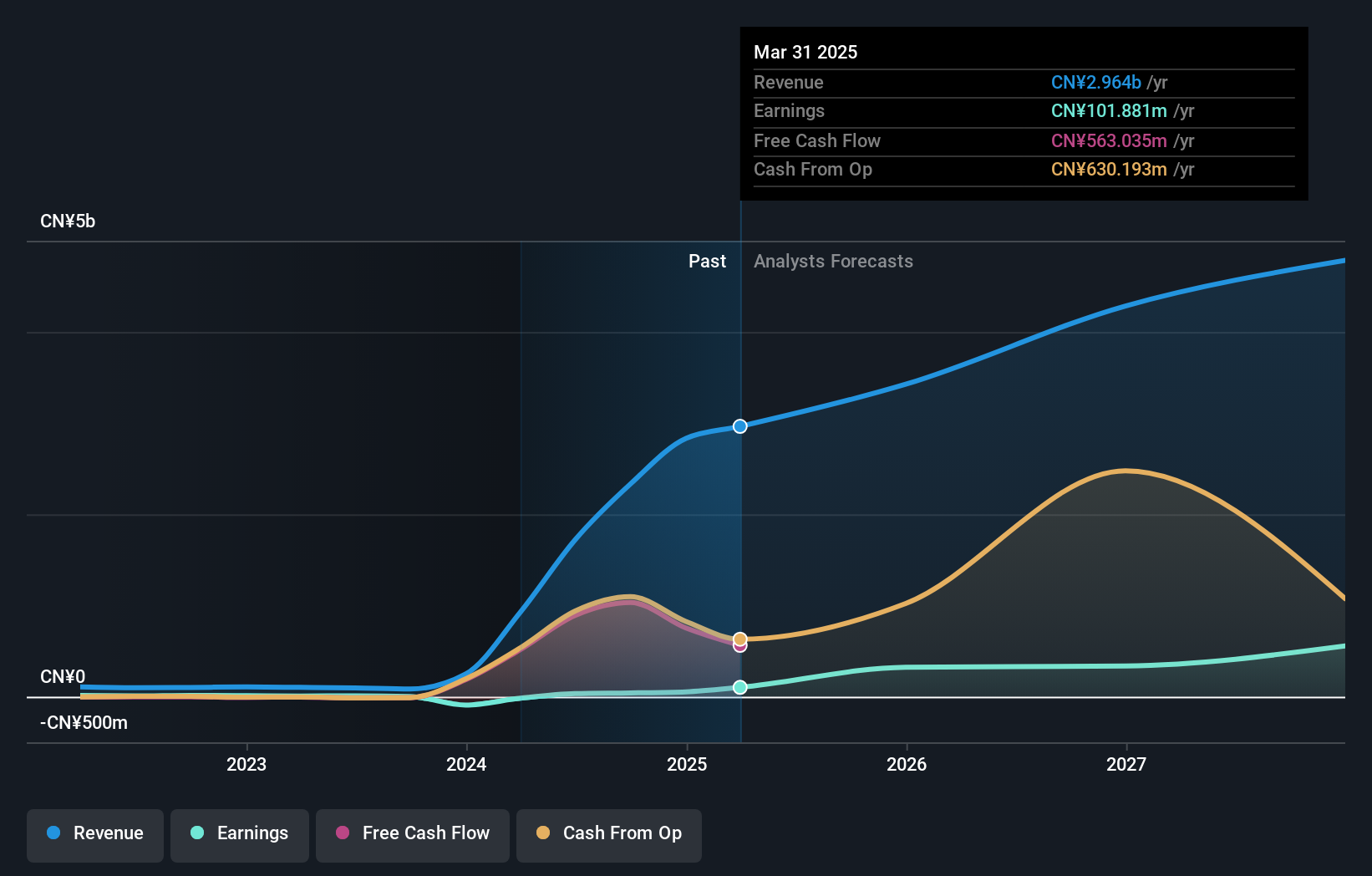

Huatu Cendes is experiencing significant growth, with earnings surging by 2933.6% over the past year and revenue reaching CNY 2.13 billion for the first nine months of 2024, up from CNY 44.37 million a year ago. Earnings are forecast to grow at an impressive rate of 61.75% annually, outpacing market averages. Recent board changes include new director and supervisor appointments, potentially influencing strategic direction amid strong financial performance expectations.

- Click here to discover the nuances of Huatu Cendes with our detailed analytical future growth report.

- Our valuation report unveils the possibility Huatu Cendes' shares may be trading at a premium.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. (SZSE:301556) operates in the agricultural technology sector and has a market cap of CN¥7.51 billion.

Operations: Zhejiang Top Cloud-agri Technology Co., Ltd. generates its revenue from various segments within the agricultural technology sector.

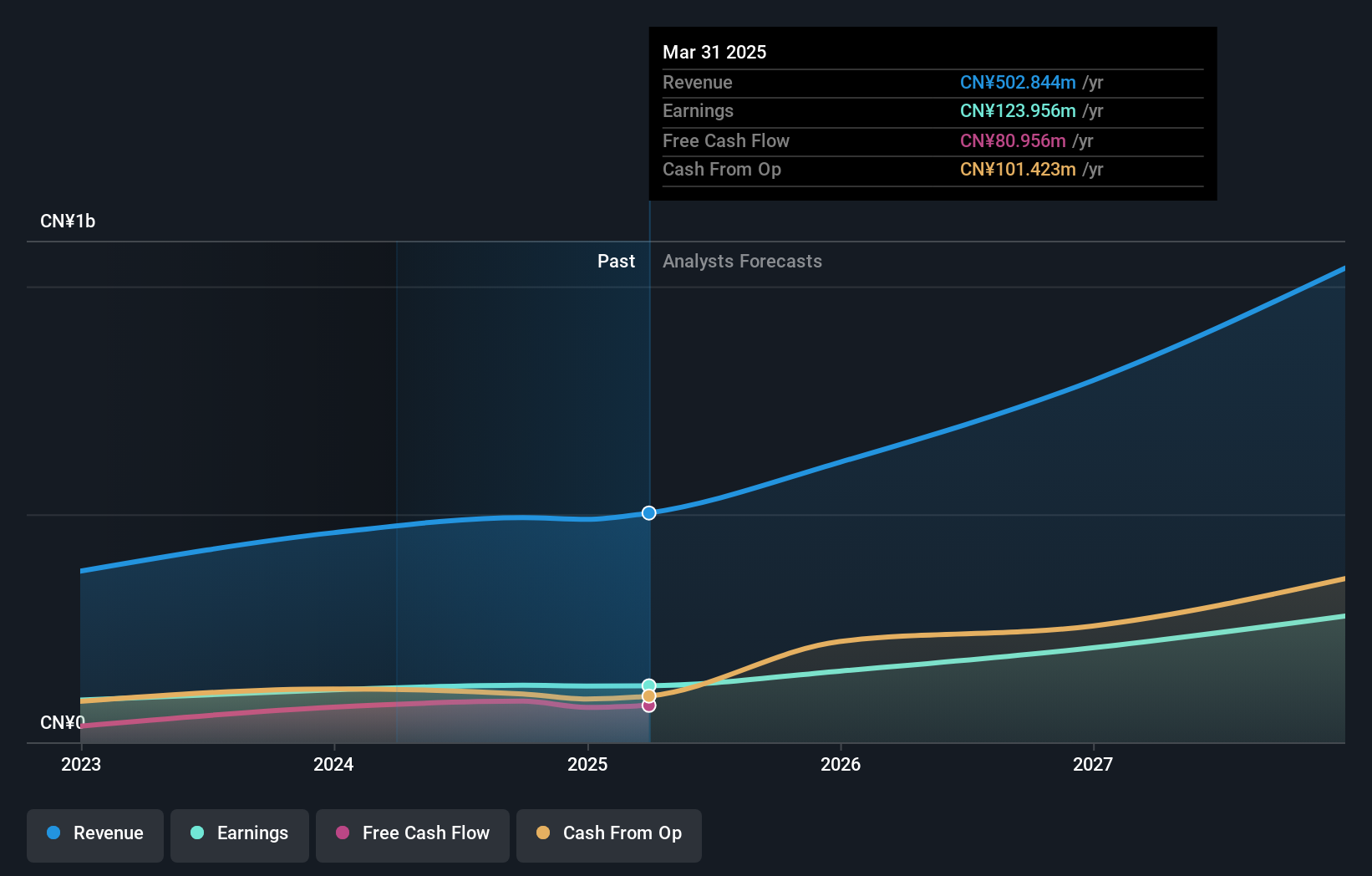

Insider Ownership: 10.7%

Earnings Growth Forecast: 31.1% p.a.

Zhejiang Top Cloud-agri Technology is experiencing robust growth, with earnings expected to increase by 31.07% annually, surpassing the Chinese market average. Revenue for the first nine months of 2024 rose to CNY 335.51 million from CNY 302.3 million a year ago, while net income improved to CNY 76.6 million from CNY 66.7 million. The company recently completed a successful IPO raising CNY 309.14 million, enhancing its financial position for future expansion initiatives.

- Take a closer look at Zhejiang Top Cloud-agri TechnologyLtd's potential here in our earnings growth report.

- According our valuation report, there's an indication that Zhejiang Top Cloud-agri TechnologyLtd's share price might be on the expensive side.

Seize The Opportunity

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1514 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Top Cloud-agri TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301556

Zhejiang Top Cloud-agri TechnologyLtd

Zhejiang Top Cloud-agri Technology Co.,Ltd.

Flawless balance sheet with high growth potential.