- China

- /

- Construction

- /

- SZSE:002081

3 Promising Penny Stocks With Market Caps Below US$2B

Reviewed by Simply Wall St

As global markets show signs of recovery, with U.S. indexes nearing record highs and smaller-cap stocks outperforming their larger counterparts, investors are exploring diverse opportunities. Penny stocks, often representing smaller or newer companies, remain a notable area for those seeking growth potential beyond mainstream investments. Despite the term's outdated connotation, these stocks can offer intriguing prospects when backed by solid financial health and strategic positioning in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.22 | £834.53M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.92 | £66.37M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.20 | £415.73M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$2.79 | A$231.32M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.97 | £67.4M | ★★★★★★ |

Click here to see the full list of 5,763 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

DISA (Catalist:532)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DISA Limited is an investment holding company involved in the technology sector across Singapore, China, Hong Kong, and the United States with a market cap of SGD21.01 million.

Operations: The company generates SGD7.54 million in revenue from its technology segment.

Market Cap: SGD21.01M

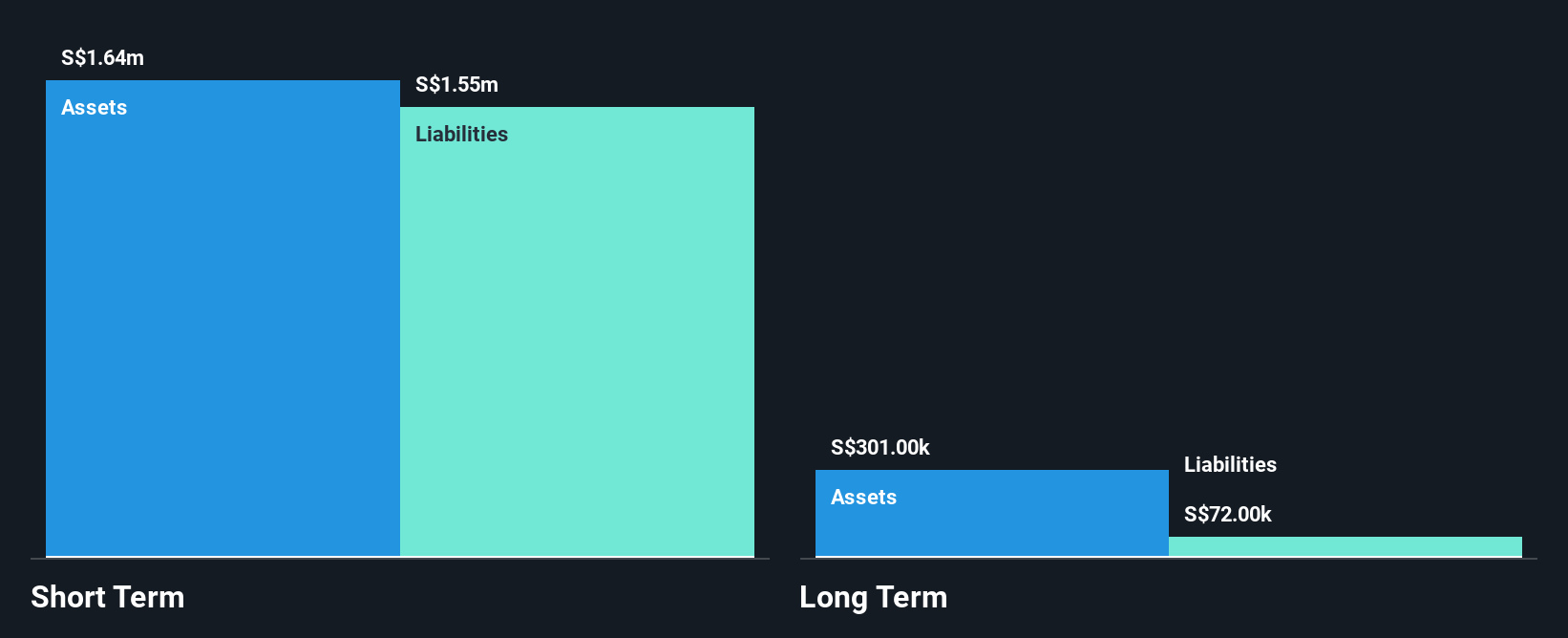

DISA Limited, with a market cap of SGD21.01 million, operates in the technology sector across multiple regions. Despite being unprofitable, it has reduced losses by 55.3% annually over the past five years and maintains a debt-free status with sufficient cash runway for over a year based on current free cash flow trends. However, its share price remains highly volatile and shareholders experienced dilution with an increase in shares outstanding by 4%. Recent board changes include the resignation of key directors as part of a rejuvenation process following their long tenures on the board.

- Dive into the specifics of DISA here with our thorough balance sheet health report.

- Explore historical data to track DISA's performance over time in our past results report.

Shanxi Antai GroupLtd (SHSE:600408)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shanxi Antai Group Co., Ltd operates in China, manufacturing and selling coal washing products, coke, cement, pig iron, and electrical products with a market cap of CN¥2.20 billion.

Operations: The company generates revenue of CN¥7.38 billion from its Metal Processors and Fabrication segment.

Market Cap: CN¥2.2B

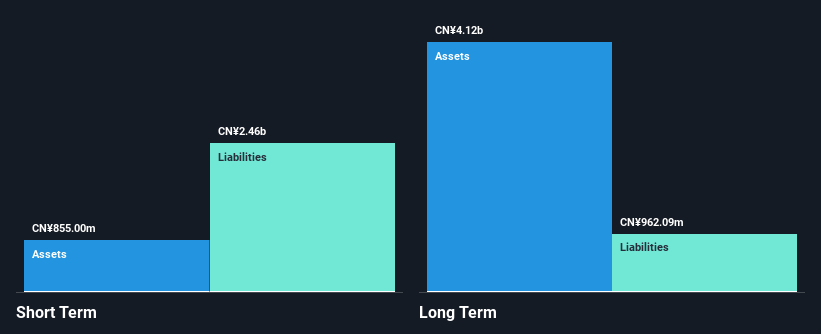

Shanxi Antai Group Co., Ltd, with a market cap of CN¥2.20 billion, faces challenges as it reported a net loss of CN¥300.71 million for the nine months ending September 2024, despite generating significant revenue from its Metal Processors and Fabrication segment. The company has managed to reduce its debt to equity ratio from 92.8% to 56.2% over five years and maintains an experienced board with an average tenure of 8.4 years. However, short-term assets do not cover liabilities, and while unprofitable, it has a cash runway exceeding three years without shareholder dilution recently occurring.

- Jump into the full analysis health report here for a deeper understanding of Shanxi Antai GroupLtd.

- Assess Shanxi Antai GroupLtd's previous results with our detailed historical performance reports.

Suzhou Gold Mantis Construction Decoration (SZSE:002081)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suzhou Gold Mantis Construction Decoration Co., Ltd. operates in China, focusing on the design and construction of interior decoration, curtain walls, furniture, and landscape projects, with a market cap of CN¥9.72 billion.

Operations: The company generates CN¥18.33 billion in revenue from its operations within China.

Market Cap: CN¥9.72B

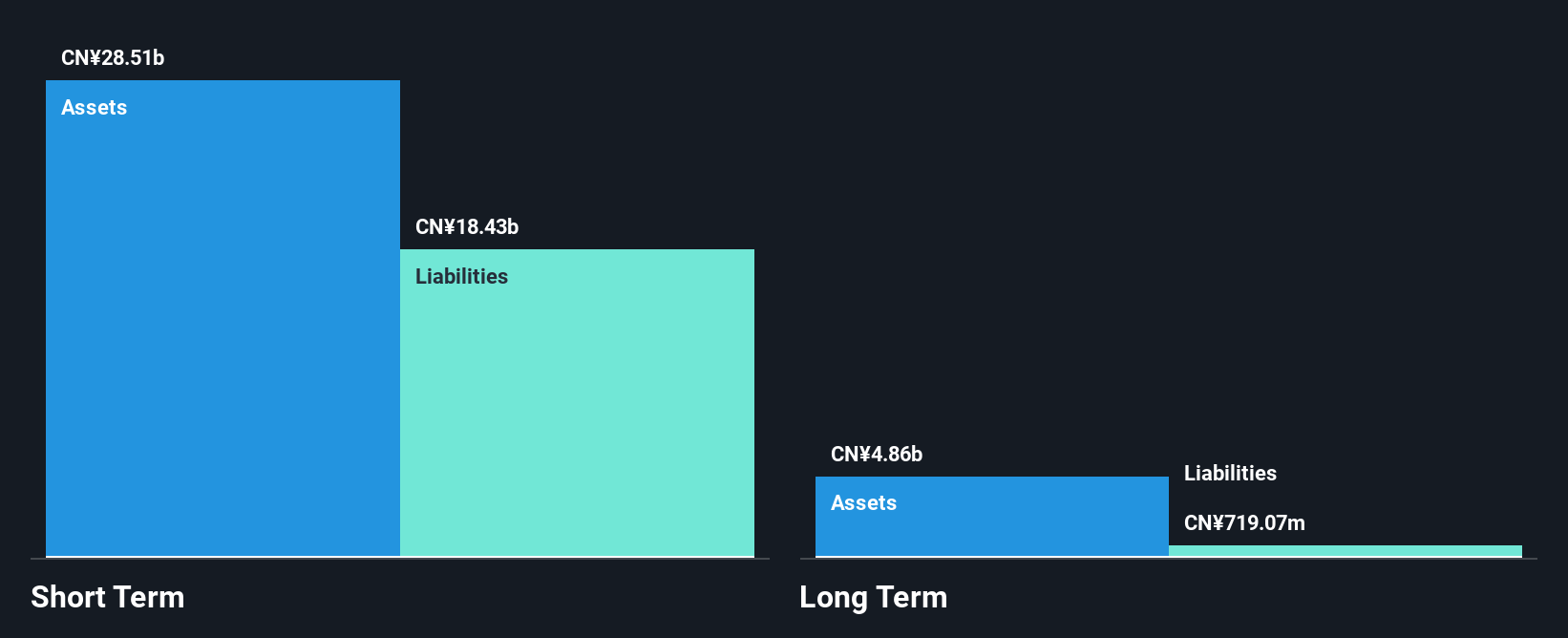

Suzhou Gold Mantis Construction Decoration Co., Ltd. faces financial challenges, with a decline in revenue to CN¥14.62 billion for the nine months ending September 2024, down from CN¥16.47 billion the previous year. Despite having more cash than total debt and a strong asset base covering liabilities, earnings have decreased significantly by 30.5% over the past year and are forecasted to continue declining slightly over the next three years. The company's low return on equity of 4.8% and reduced net profit margins highlight operational inefficiencies, although its price-to-earnings ratio suggests potential undervaluation compared to market averages.

- Navigate through the intricacies of Suzhou Gold Mantis Construction Decoration with our comprehensive balance sheet health report here.

- Understand Suzhou Gold Mantis Construction Decoration's earnings outlook by examining our growth report.

Summing It All Up

- Gain an insight into the universe of 5,763 Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002081

Suzhou Gold Mantis Construction Decoration

Engages in the design and construction of interior decoration, curtain walls, furniture, and landscape in China.

Excellent balance sheet average dividend payer.