As rising U.S. Treasury yields exert pressure on global markets, small-cap stocks face particular challenges amid a shallower Fed rate-cutting cycle and tepid economic growth. Despite these headwinds, the search for undiscovered gems in the stock market remains compelling, as investors look for companies with strong fundamentals and potential resilience in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

HMT (Xiamen) New Technical Materials (SHSE:603306)

Simply Wall St Value Rating: ★★★★★☆

Overview: HMT (Xiamen) New Technical Materials Co., Ltd. operates in the technical materials industry with a market capitalization of CN¥7.88 billion.

Operations: HMT (Xiamen) New Technical Materials generates revenue primarily from its operations in the technical materials sector. The company's financial performance is highlighted by a net profit margin of 8.5%, indicating efficiency in converting revenue into actual profit.

HMT (Xiamen) New Technical Materials is showing promising signs, with earnings growth of 30% over the past year, outpacing the Luxury industry’s 5.7%. The company reported net income of CNY 196.15 million for the first nine months of 2024, up from CNY 148.6 million a year prior. While its debt-to-equity ratio rose to 21.7% over five years, interest payments are comfortably covered by EBIT at a multiple of 155x, indicating strong financial health. Despite recent share price volatility and no shares repurchased in Q3, its valuation appears compelling at a significant discount to estimated fair value.

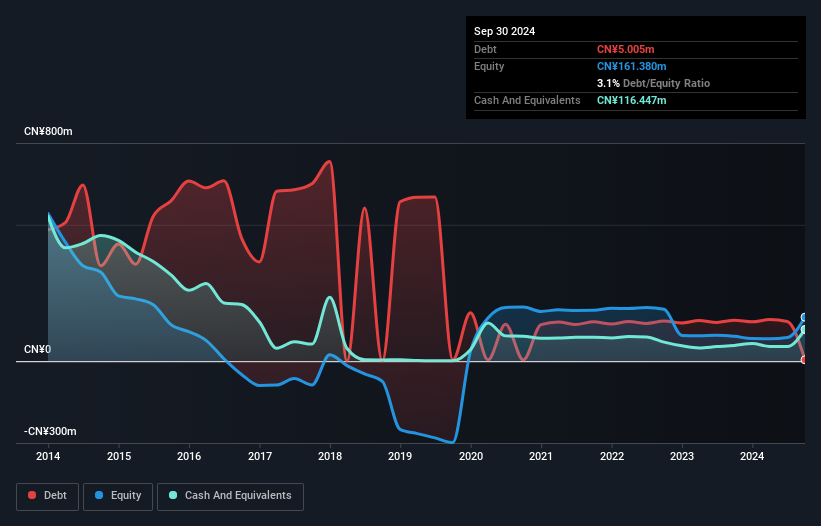

Guangxi Hechi Chemical (SZSE:000953)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangxi Hechi Chemical Co., Ltd focuses on the research, development, production, and sale of chemical raw materials and their preparations in China with a market cap of CN¥2.06 billion.

Operations: Guangxi Hechi Chemical generates revenue through the sale of chemical raw materials and their preparations in China. The company operates with a market cap of CN¥2.06 billion.

Guangxi Hechi Chemical, a smaller player in the chemicals sector, has shown notable progress recently. The company reported sales of CNY 166.7 million for the first nine months of 2024, up from CNY 151.31 million last year, while net income jumped to CNY 79.29 million from a loss of CNY 3.83 million previously. Their price-to-earnings ratio stands at an attractive 31.7x compared to the broader CN market's 34x, indicating potential value for investors. Additionally, they repurchased over 878k shares worth CNY 2.24 million this year, reflecting confidence in their stock's future prospects despite recent volatility concerns.

- Get an in-depth perspective on Guangxi Hechi Chemical's performance by reading our health report here.

Gain insights into Guangxi Hechi Chemical's past trends and performance with our Past report.

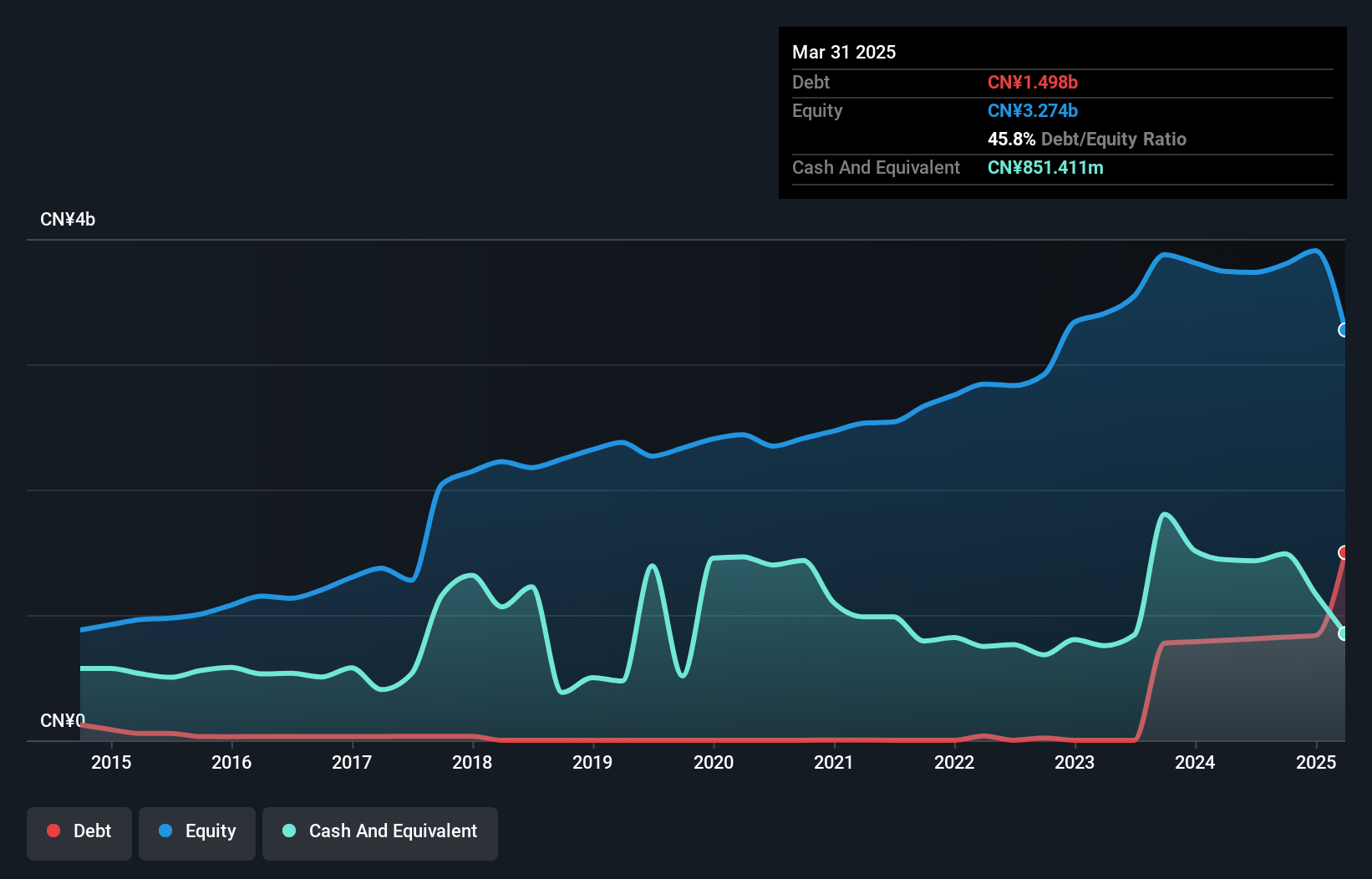

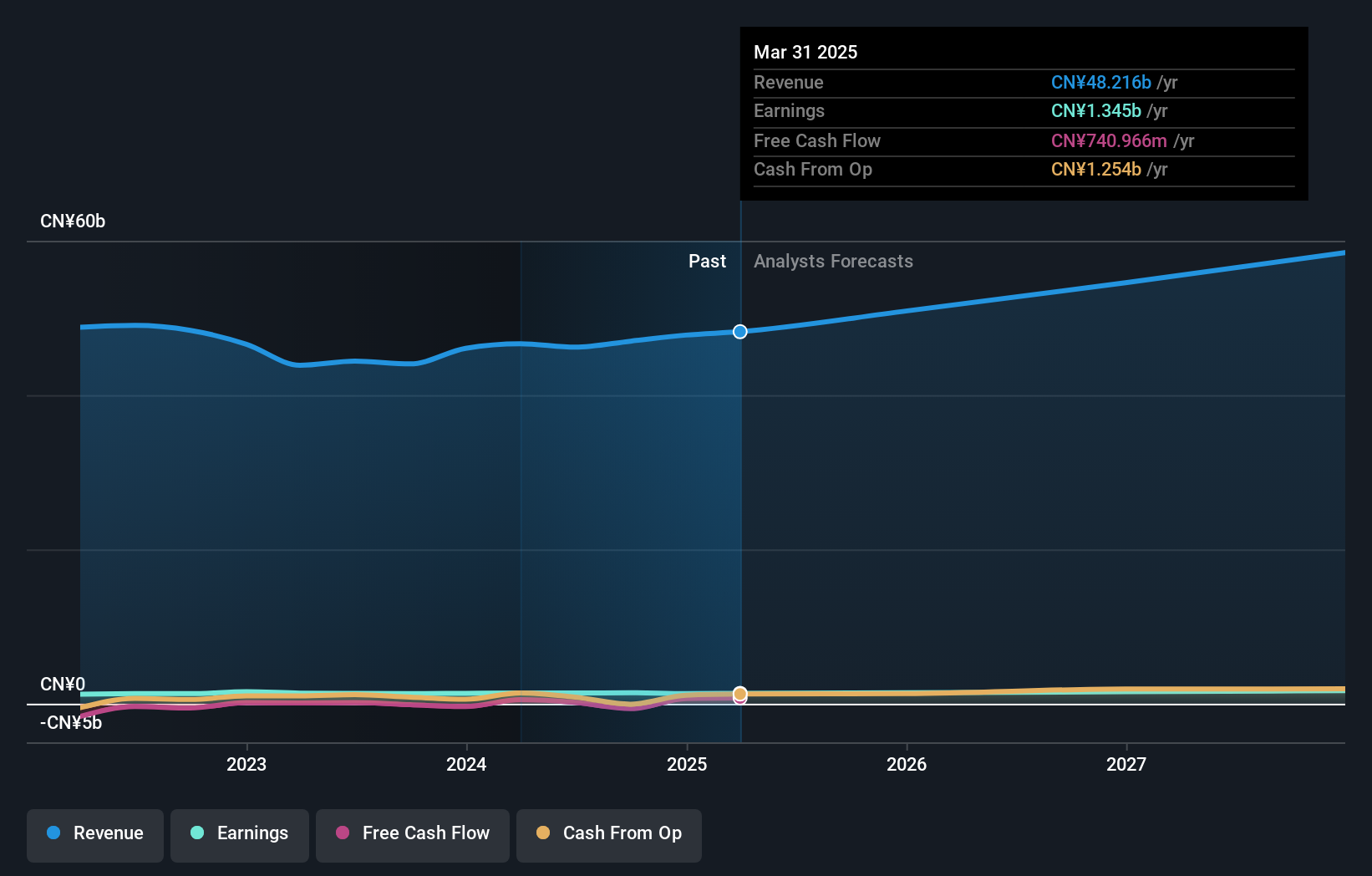

Zhejiang Communications Technology (SZSE:002061)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Communications Technology Co., Ltd. operates in the infrastructure sector, focusing on the development and construction of transportation projects, with a market cap of CN¥10.60 billion.

Operations: Zhejiang Communications Technology generates revenue primarily from infrastructure development and construction projects. The company has a market cap of CN¥10.60 billion.

Zhejiang Communications Technology, a company with a promising trajectory, has shown impressive earnings growth of 8.7% over the past year, outpacing the construction industry's -5.4%. A price-to-earnings ratio of 7.8x indicates it's trading at an attractive valuation compared to the broader CN market's 34x. Despite its debt-to-equity ratio rising from 66% to 82.6% over five years, its net debt to equity remains satisfactory at 31.5%. Recent earnings reveal sales reaching CNY30.65 billion for nine months in 2024, with net income climbing to CNY838.95 million from CNY758.33 million last year, reflecting solid financial health and potential for future growth.

- Take a closer look at Zhejiang Communications Technology's potential here in our health report.

Learn about Zhejiang Communications Technology's historical performance.

Make It Happen

- Click here to access our complete index of 4734 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000953

Guangxi Hechi Chemical

Researches, develops, produces, and sells chemical raw materials and their preparations in China.

Excellent balance sheet with acceptable track record.