- South Korea

- /

- Auto Components

- /

- KOSE:A036530

Undiscovered Gems in Asia to Watch This September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape shaped by economic indicators and shifting interest rate expectations, Asia's small-cap sector presents intriguing opportunities for investors. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial, particularly as smaller companies often exhibit greater sensitivity to economic changes and market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sesoda | 63.26% | 9.12% | 15.19% | ★★★★★★ |

| CMC | 0.07% | 2.92% | 8.37% | ★★★★★★ |

| Shanghai Guangdian Electric Group | 1.14% | -2.80% | -30.27% | ★★★★★★ |

| HeBei Jinniu Chemical IndustryLtd | NA | 1.40% | 16.29% | ★★★★★★ |

| LanZhou Foci PharmaceuticalLtd | 0.71% | 9.04% | -13.02% | ★★★★★★ |

| Taiyo KagakuLtd | 0.67% | 5.77% | 2.06% | ★★★★★☆ |

| ShenZhen Click TechnologyLTD | 2.45% | 30.45% | 15.64% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| Bank of Iwate | 87.84% | 1.47% | 13.86% | ★★★★☆☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 33.09% | 1.94% | 13.11% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

SNT Holdings (KOSE:A036530)

Simply Wall St Value Rating: ★★★★★☆

Overview: SNT Holdings CO., LTD operates in the auto parts and industrial facilities sectors, with a market cap of ₩1.13 trillion.

Operations: SNT Holdings generates revenue primarily from its auto parts and industrial facilities segments. The company's financial performance is influenced by the cost structure within these sectors.

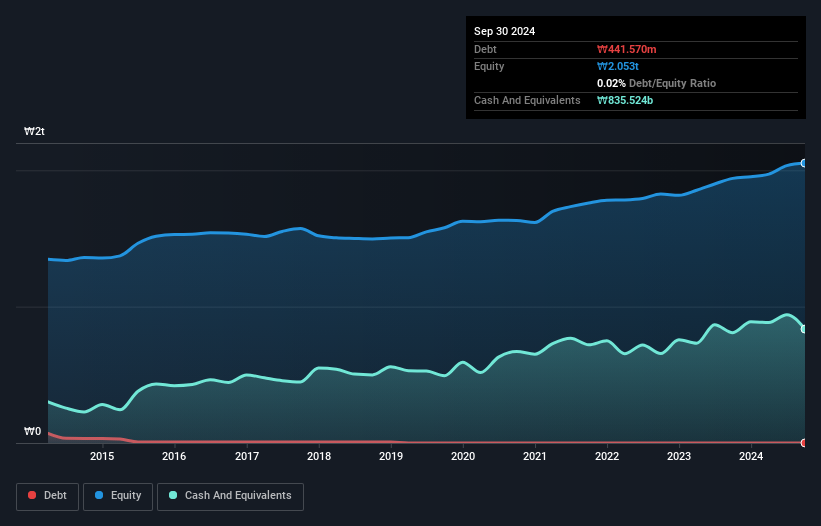

SNT Holdings, a smaller player in the Auto Components sector, has shown resilience with an 18.8% earnings growth over the past year, outpacing the industry's -19.7%. Despite a slight rise in its debt to equity ratio from 0.01% to 0.02% over five years, it remains financially sound with more cash than total debt and positive free cash flow of KRW 204086 million as of June 2024. The company's P/E ratio stands at a favorable 8.6x compared to the KR market's 14.6x, suggesting potential value for investors seeking opportunities in Asia's dynamic markets.

- Take a closer look at SNT Holdings' potential here in our health report.

Gain insights into SNT Holdings' historical performance by reviewing our past performance report.

China Qinfa Group (SEHK:866)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Qinfa Group Limited is an investment holding company involved in coal mining, purchasing, selling, filtering, storage, and blending operations in China and Indonesia with a market capitalization of HK$7.49 billion.

Operations: The primary revenue stream for China Qinfa Group comes from its coal business, generating CN¥3.20 billion.

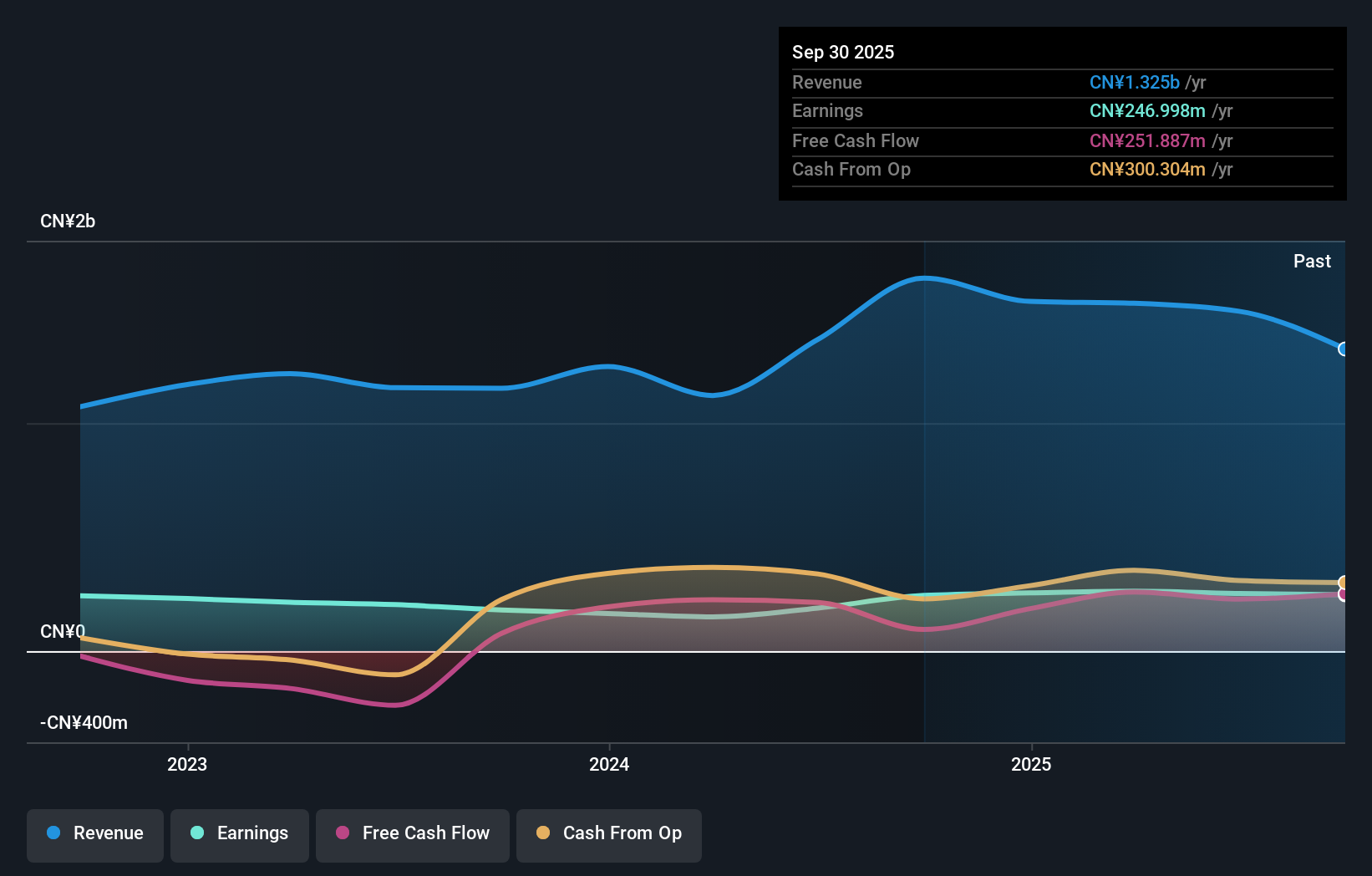

Qinfa Group, a relatively smaller player in the energy sector, has shown remarkable earnings growth of 425.7% over the past year, outpacing its industry peers significantly. This surge comes despite a net debt to equity ratio of 13.9%, which seems satisfactory under current standards. However, interest payments on its debt are not well covered by EBIT at only 2.6 times coverage, suggesting potential financial strain if not addressed. Recent results highlight sales reaching CN¥1.09 billion for the half-year ending June 2025, with net income turning positive at CN¥24 million from a previous loss of CN¥43 million last year.

Wuxi Chemical Equipment (SZSE:001332)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Chemical Equipment Co., Ltd. is engaged in the design, development, manufacture, and marketing of metal pressure vessels in China with a market capitalization of CN¥5.07 billion.

Operations: Wuxi Chemical Equipment generates revenue primarily from its Heat Exchange Container segment, contributing CN¥1.14 billion, followed by the Storage Container and Separation Container segments at CN¥144.13 million and CN¥95.31 million, respectively.

Wuxi Chemical Equipment, a smaller player in the machinery industry, showcases intriguing financial dynamics. Over the past year, it achieved earnings growth of 33.7%, outpacing the industry's 4% rise. The company is debt-free and boasts high-quality earnings, reflecting its strong operational footing. Despite a dip in recent revenue to CNY 622.79 million from CNY 666.03 million last year, its price-to-earnings ratio of 20x remains attractive compared to the broader CN market at nearly double that figure. Proposed dividends and bylaw amendments suggest active shareholder engagement while maintaining profitability with net income at CNY 122.63 million for the half-year ended June 2025.

- Navigate through the intricacies of Wuxi Chemical Equipment with our comprehensive health report here.

Assess Wuxi Chemical Equipment's past performance with our detailed historical performance reports.

Seize The Opportunity

- Dive into all 2408 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A036530

SNT Holdings

SNT Holdings Co., Ltd engages in manufacturing and selling automobile parts and industrial facilities businesses.

Excellent balance sheet and good value.

Market Insights

Community Narratives