- China

- /

- Tech Hardware

- /

- SHSE:688036

Asian Value Stocks With Estimated Attractive Pricing In November 2025

Reviewed by Simply Wall St

As global markets grapple with AI-related concerns and fluctuating valuations, Asian markets have mirrored this sentiment, experiencing declines across major indices. Despite these challenges, opportunities arise for discerning investors seeking value stocks in Asia, where careful analysis can uncover companies with strong fundamentals and attractive pricing.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.71 | CN¥9.38 | 49.8% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.485 | SGD0.95 | 49% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.25 | CN¥26.07 | 49.2% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥14.80 | CN¥29.39 | 49.6% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥9.99 | CN¥19.98 | 50% |

| Last One MileLtd (TSE:9252) | ¥3510.00 | ¥6845.48 | 48.7% |

| Global Tax Free (KOSDAQ:A204620) | ₩6410.00 | ₩12550.95 | 48.9% |

| China Ruyi Holdings (SEHK:136) | HK$2.44 | HK$4.82 | 49.4% |

| Beijing Roborock Technology (SHSE:688169) | CN¥154.25 | CN¥301.03 | 48.8% |

| ASE Technology Holding (TWSE:3711) | NT$217.50 | NT$434.53 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Shenzhen Transsion Holdings (SHSE:688036)

Overview: Shenzhen Transsion Holdings Co., Ltd. operates in the smart devices and mobile services sector across Africa, South and Southeast Asia, the Middle East, Latin America, and other international markets, with a market cap of CN¥74.91 billion.

Operations: Revenue segments for Shenzhen Transsion Holdings Co., Ltd. include smart devices and mobile services across Africa, South and Southeast Asia, the Middle East, Latin America, and other international markets.

Estimated Discount To Fair Value: 39.6%

Shenzhen Transsion Holdings is trading at a significant discount to its estimated fair value of CNY 107.78, offering an attractive entry point for investors focused on cash flow valuation. Despite recent declines in sales and net income, the company's earnings are expected to grow significantly at 32.8% annually, outpacing the broader Chinese market's growth rate. However, revenue growth projections remain slightly below market averages and the company has an unstable dividend track record.

- According our earnings growth report, there's an indication that Shenzhen Transsion Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of Shenzhen Transsion Holdings stock in this financial health report.

Higold Group (SZSE:001221)

Overview: Higold Group Co., LTD. is involved in the research, production, and sale of home hardware products globally, with a market cap of CN¥23.63 billion.

Operations: The company's revenue segments primarily consist of the research, production, and sale of home hardware products on a global scale.

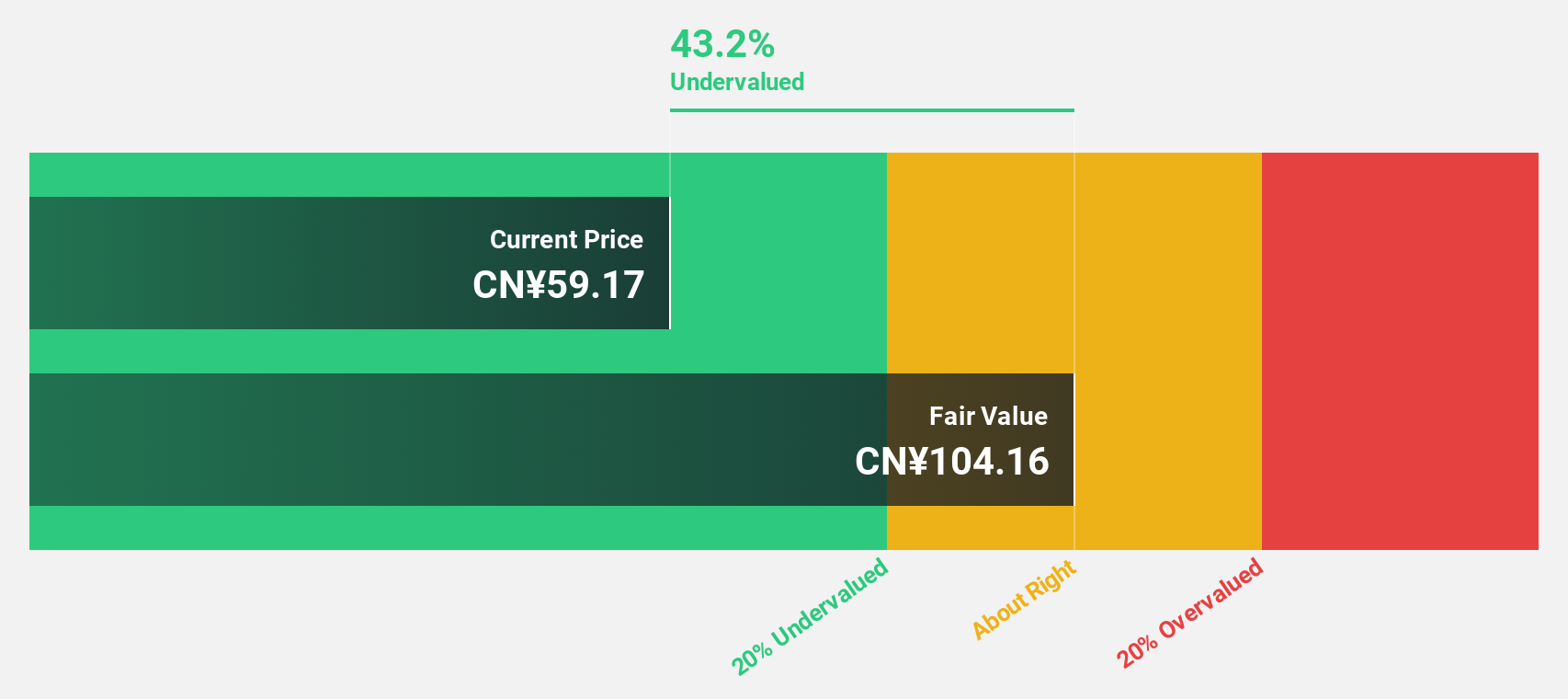

Estimated Discount To Fair Value: 43.4%

Higold Group is currently trading at a substantial discount to its estimated fair value of CNY 104.33, presenting potential opportunities for investors prioritizing cash flow metrics. The company has demonstrated strong financial performance, with net income rising to CNY 483.47 million for the nine months ending September 2025. Despite high share price volatility recently, earnings and revenue are projected to grow significantly over the next three years, surpassing broader market expectations in China.

- Our growth report here indicates Higold Group may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Higold Group's balance sheet health report.

Nan Ya Printed Circuit Board (TWSE:8046)

Overview: Nan Ya Printed Circuit Board Corporation manufactures and sells printed circuit boards (PCBs) across Taiwan, the United States, Mainland China, Korea, and internationally with a market cap of NT$166.06 billion.

Operations: The company's revenue is primarily derived from its operations in Asia (NT$14.39 billion) and domestic markets (NT$26.67 billion), with additional contributions from America (NT$30.35 million).

Estimated Discount To Fair Value: 30.3%

Nan Ya Printed Circuit Board is trading at NT$257, significantly below its estimated fair value of NT$368.78, highlighting potential for investors focused on cash flow valuation. Recent earnings showed strong growth with Q3 sales reaching NT$10.97 billion and net income surging to NT$724.87 million from a year ago. Despite recent share price volatility, the company's revenue and earnings are forecasted to grow well above Taiwan's market averages over the next three years.

- In light of our recent growth report, it seems possible that Nan Ya Printed Circuit Board's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Nan Ya Printed Circuit Board.

Next Steps

- Gain an insight into the universe of 274 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688036

Shenzhen Transsion Holdings

Provides smart devices and mobile services in Africa, South and Southeast Asia, the Middle East, Latin America, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success