Improved Revenues Required Before Kunming Yunnei Power Co.,Ltd. (SZSE:000903) Stock's 25% Jump Looks Justified

Kunming Yunnei Power Co.,Ltd. (SZSE:000903) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 84% in the last year.

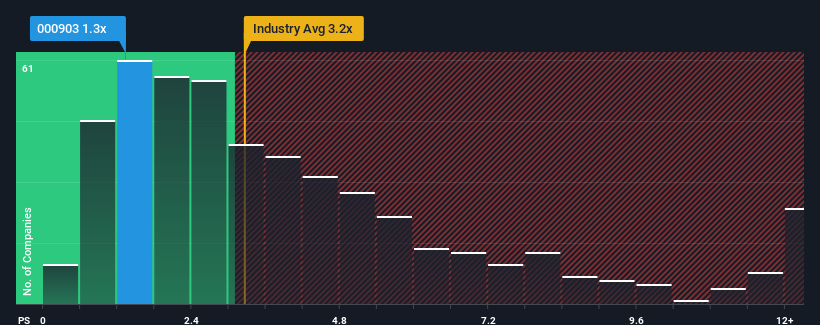

In spite of the firm bounce in price, Kunming Yunnei PowerLtd may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.3x, since almost half of all companies in the Machinery industry in China have P/S ratios greater than 3.2x and even P/S higher than 6x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Kunming Yunnei PowerLtd

How Kunming Yunnei PowerLtd Has Been Performing

Revenue has risen firmly for Kunming Yunnei PowerLtd recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Kunming Yunnei PowerLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kunming Yunnei PowerLtd's earnings, revenue and cash flow.How Is Kunming Yunnei PowerLtd's Revenue Growth Trending?

Kunming Yunnei PowerLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.3%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 45% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 22% shows it's an unpleasant look.

With this information, we are not surprised that Kunming Yunnei PowerLtd is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Kunming Yunnei PowerLtd's P/S?

Despite Kunming Yunnei PowerLtd's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Kunming Yunnei PowerLtd revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Kunming Yunnei PowerLtd you should be aware of.

If you're unsure about the strength of Kunming Yunnei PowerLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kunming Yunnei PowerLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000903

Kunming Yunnei PowerLtd

Engages in the research and development, manufacture, and sale of diesel engines for commercial vehicles and passenger cars in the People’s Republic of China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives