There's Reason For Concern Over TangshanJidong Equipment and Engineering Co.,Ltd.'s (SZSE:000856) Massive 29% Price Jump

TangshanJidong Equipment and Engineering Co.,Ltd. (SZSE:000856) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

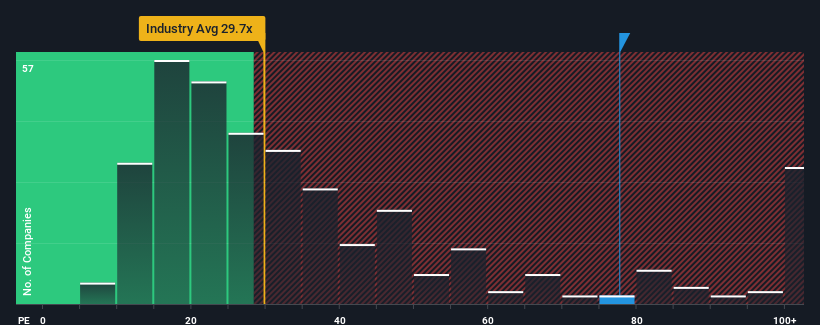

Since its price has surged higher, TangshanJidong Equipment and EngineeringLtd's price-to-earnings (or "P/E") ratio of 77.7x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 30x and even P/E's below 18x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been quite advantageous for TangshanJidong Equipment and EngineeringLtd as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for TangshanJidong Equipment and EngineeringLtd

Is There Enough Growth For TangshanJidong Equipment and EngineeringLtd?

The only time you'd be truly comfortable seeing a P/E as steep as TangshanJidong Equipment and EngineeringLtd's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 174%. Still, incredibly EPS has fallen 26% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's alarming that TangshanJidong Equipment and EngineeringLtd's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From TangshanJidong Equipment and EngineeringLtd's P/E?

The strong share price surge has got TangshanJidong Equipment and EngineeringLtd's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that TangshanJidong Equipment and EngineeringLtd currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with TangshanJidong Equipment and EngineeringLtd, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than TangshanJidong Equipment and EngineeringLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TangshanJidong Equipment and EngineeringLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000856

TangshanJidong Equipment and EngineeringLtd

Manufactures and sells cement equipment in China and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives