Investors Aren't Entirely Convinced By J.S. Corrugating Machinery Co., Ltd.'s (SZSE:000821) Earnings

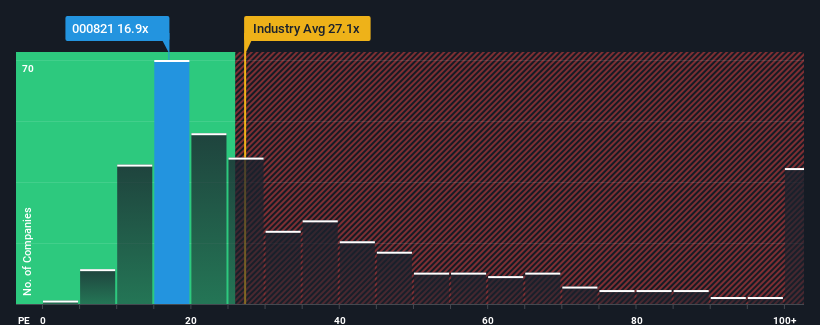

With a price-to-earnings (or "P/E") ratio of 16.9x J.S. Corrugating Machinery Co., Ltd. (SZSE:000821) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 29x and even P/E's higher than 53x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

J.S. Corrugating Machinery certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for J.S. Corrugating Machinery

Is There Any Growth For J.S. Corrugating Machinery?

The only time you'd be truly comfortable seeing a P/E as low as J.S. Corrugating Machinery's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 22%. Pleasingly, EPS has also lifted 219% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 33% per year during the coming three years according to the three analysts following the company. With the market only predicted to deliver 25% per annum, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that J.S. Corrugating Machinery's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On J.S. Corrugating Machinery's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of J.S. Corrugating Machinery's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with J.S. Corrugating Machinery, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on J.S. Corrugating Machinery, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000821

J.S. Corrugating Machinery

Engages in the research and development, design, production, and sale of non-standard smart equipment for use in photovoltaics, corrugated packaging, and other industries in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026