- China

- /

- Auto Components

- /

- SZSE:300643

Unearthing Three Promising Small Cap Stocks in Asia

Reviewed by Simply Wall St

As global markets navigate the complexities of new tariffs and mixed economic signals, Asian small-cap stocks are attracting attention for their potential resilience and growth prospects. In this context, identifying promising small-cap stocks involves looking for companies that can adapt to changing trade dynamics while maintaining strong fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xuchang Yuandong Drive ShaftLtd | 0.03% | -13.23% | -30.14% | ★★★★★★ |

| TCM Biotech International | 2.98% | 5.76% | -0.13% | ★★★★★★ |

| Showbox | NA | 10.08% | 7.87% | ★★★★★★ |

| Suzhou Sepax Technologies | 0.04% | 21.44% | 34.83% | ★★★★★★ |

| Hokkan Holdings | 66.84% | -5.71% | 18.42% | ★★★★★☆ |

| Nikko | 29.66% | 6.43% | -3.15% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| KC | 2.19% | 8.76% | -0.47% | ★★★★★☆ |

| Huang Hsiang Construction | 268.99% | 13.29% | 10.70% | ★★★★☆☆ |

| Shanghai Material Trading | 3.58% | -6.74% | -5.92% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Zhejiang Cheng Yi Pharmaceutical (SHSE:603811)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Cheng Yi Pharmaceutical Co., Ltd. operates in the pharmaceutical industry and has a market cap of CN¥4.15 billion.

Operations: Cheng Yi Pharmaceutical generates revenue from its operations in the pharmaceutical industry, with a market capitalization of CN¥4.15 billion.

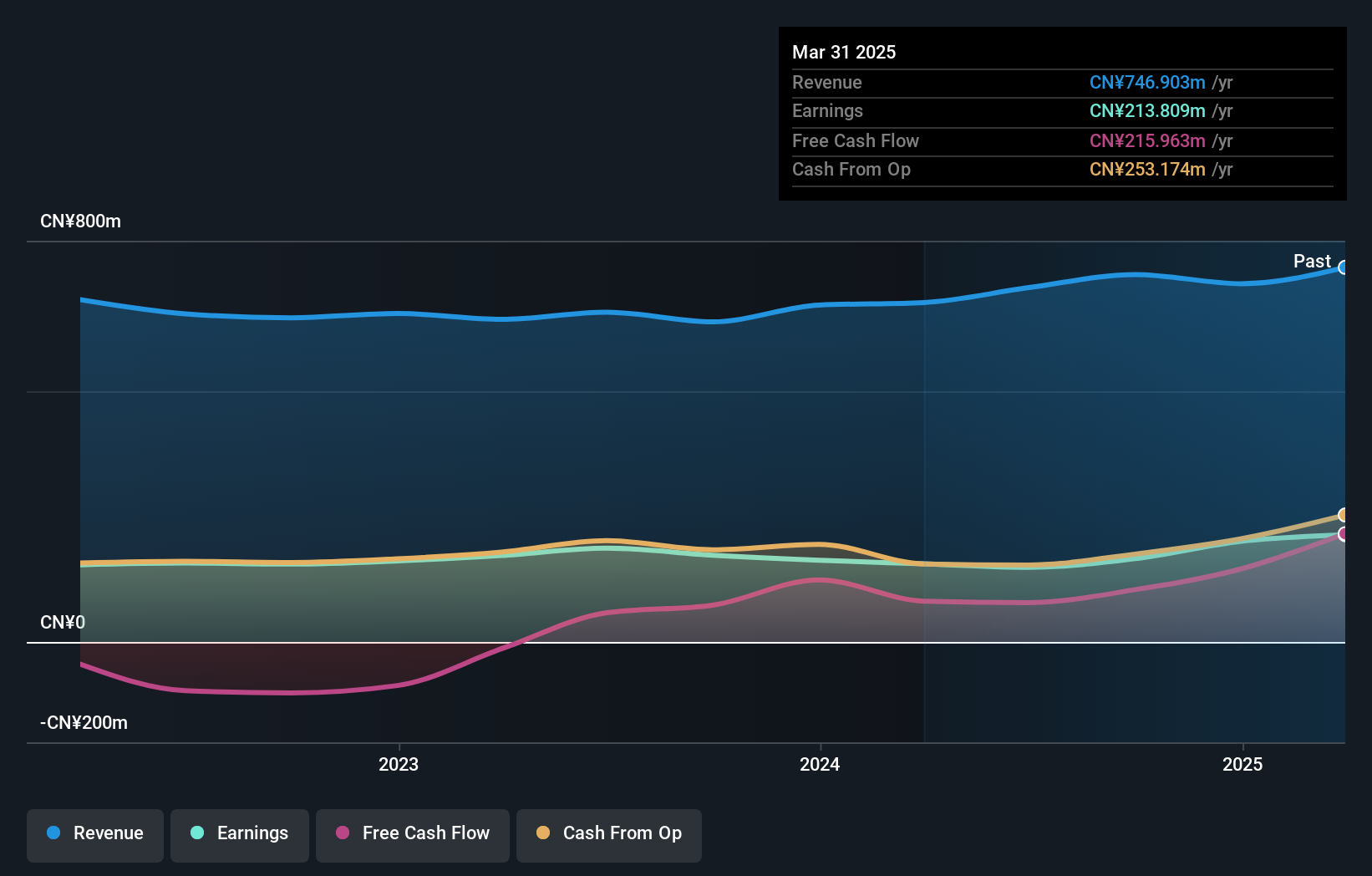

Zhejiang Cheng Yi Pharmaceutical, with its robust earnings growth of 37.2% over the past year, outperformed the broader Pharmaceuticals industry, which saw a -2.5% change. Despite a volatile share price recently, it trades at 31.3% below estimated fair value, suggesting potential undervaluation. The company reported net income of CNY 200.7 million for 2024 and basic earnings per share rose to CNY 0.61 from CNY 0.50 last year, reflecting strong financial health despite an increased debt-to-equity ratio from 1.3% to 14.9%. A notable one-off gain of CN¥60 million also influenced recent results positively.

Moon Environment TechnologyLtd (SZSE:000811)

Simply Wall St Value Rating: ★★★★★★

Overview: Moon Environment Technology Co., Ltd. engages in the refrigeration and air conditioning industry both within China and internationally, with a market capitalization of CN¥11.70 billion.

Operations: Moon Environment Technology Co., Ltd. generates revenue through its operations in the refrigeration and air conditioning sectors, serving both domestic and international markets. The company has a market capitalization of CN¥11.70 billion.

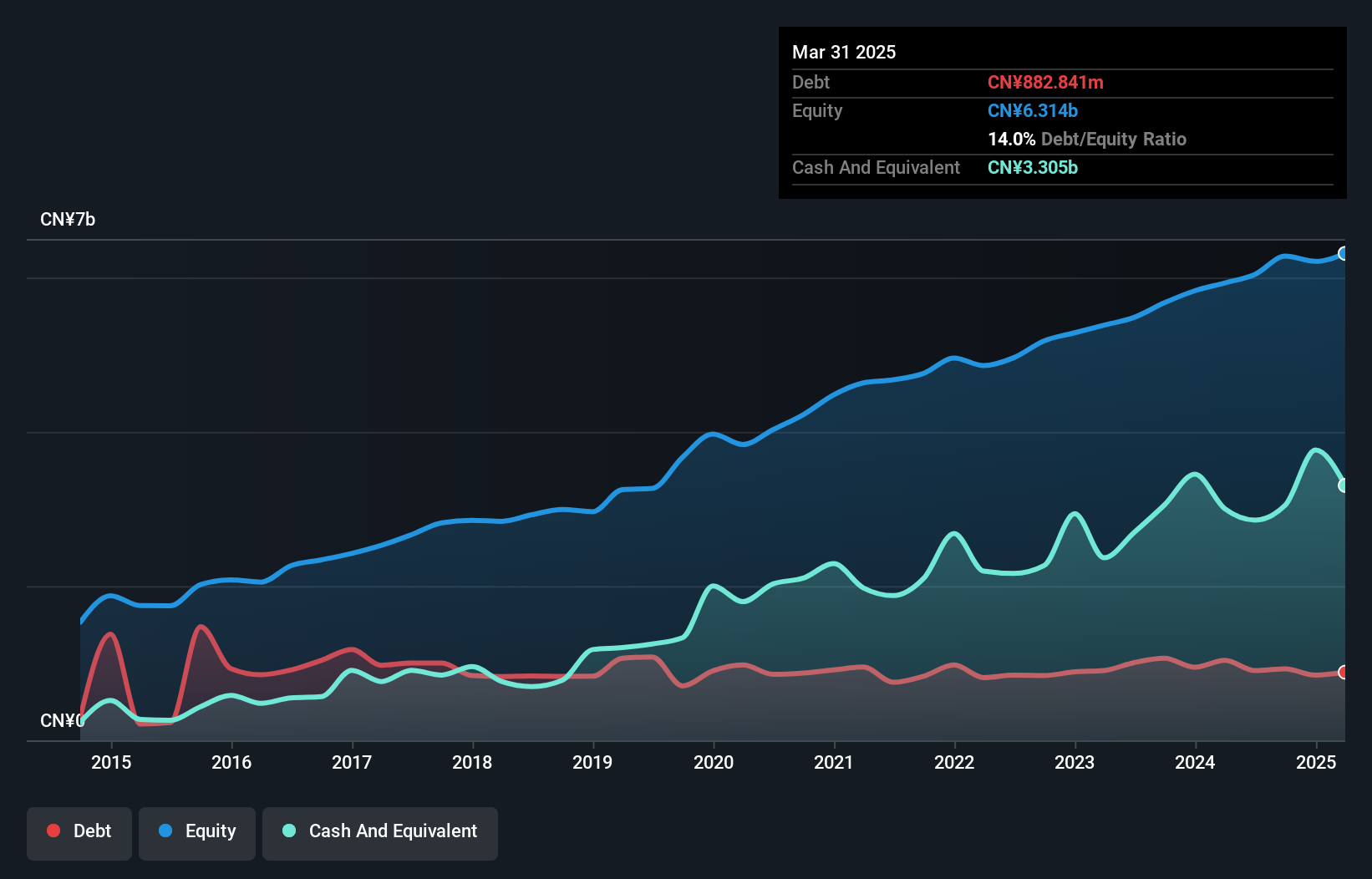

Moon Environment Technology, a small player in the machinery sector, offers an intriguing mix of financial metrics. Despite a 10.7% negative earnings growth last year, the company is projected to boost earnings by 12.71% annually. Trading at 41.3% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. The debt-to-equity ratio has improved significantly from 25.5% to 14% over five years, reflecting prudent financial management with more cash than total debt on hand and positive free cash flow reported consistently. Recent events include a stock split and dividend approval, indicating shareholder-friendly policies amidst executive changes and updated bylaws.

Hamaton Automotive Technology (SZSE:300643)

Simply Wall St Value Rating: ★★★★★★

Overview: Hamaton Automotive Technology Co., Ltd is a global manufacturer and supplier of automotive products, with a market capitalization of CN¥5.29 billion.

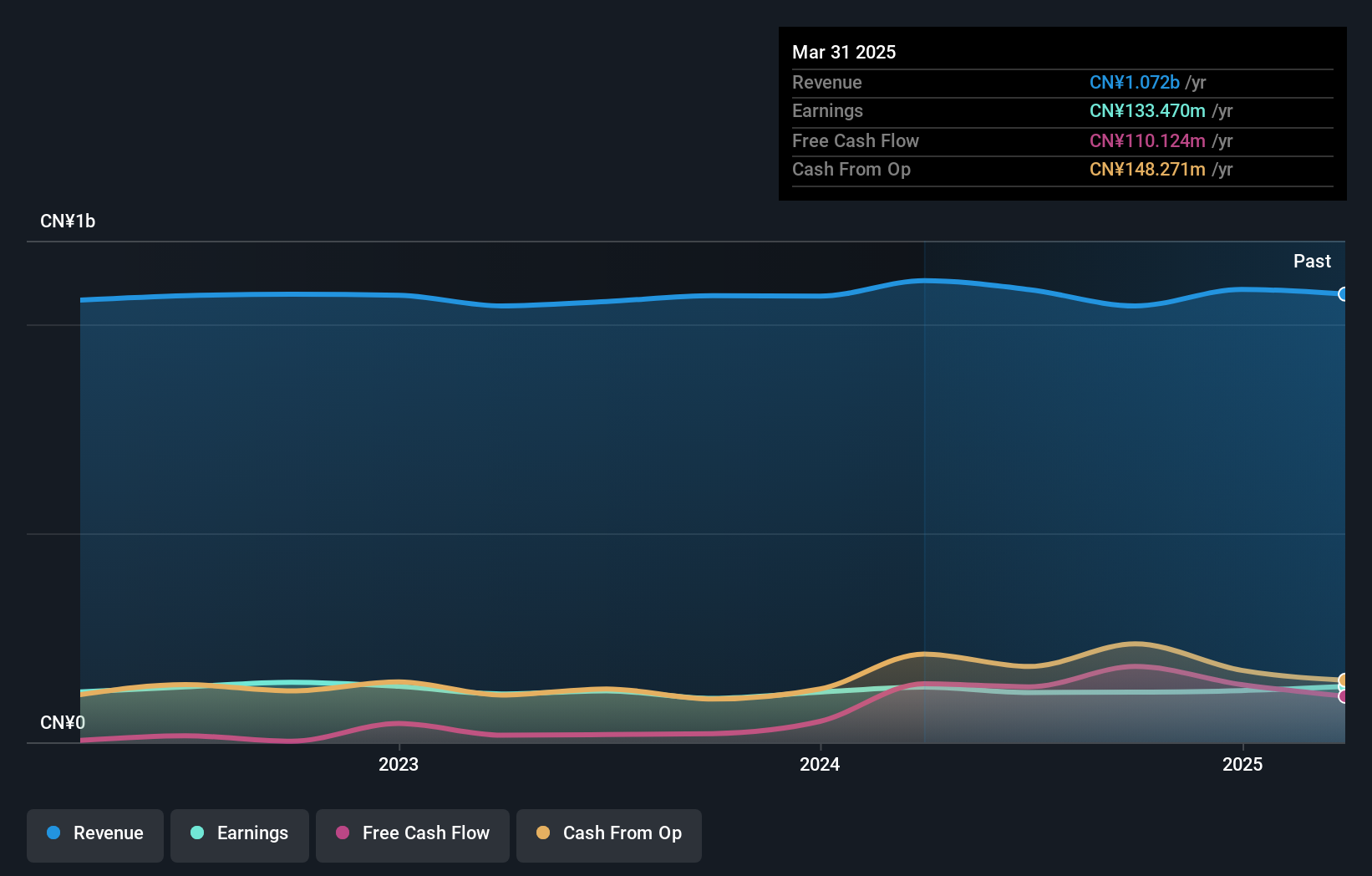

Operations: Hamaton Automotive Technology generates revenue primarily from its car parts segment, which contributed CN¥1.07 billion.

Hamaton Automotive Technology, a small cap player in the auto components sector, showcases a robust financial profile. Over the past five years, its earnings have grown an impressive 22.2% annually, while maintaining a healthy debt-to-equity ratio that has significantly decreased from 49.7% to just 1%. The company also enjoys high-quality earnings and positive free cash flow. Recent performance highlights include net income of CNY 123.62 million for 2024 and a first-quarter net income of CNY 36.93 million in 2025, reflecting solid operational efficiency despite slightly lower quarterly sales compared to last year.

- Click to explore a detailed breakdown of our findings in Hamaton Automotive Technology's health report.

Learn about Hamaton Automotive Technology's historical performance.

Summing It All Up

- Click here to access our complete index of 2608 Asian Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamaton Automotive Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300643

Hamaton Automotive Technology

Manufactures and supplies various products to automotive industry worldwide.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives