With EPS Growth And More, Create Technology & ScienceLtd (SZSE:000551) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Create Technology & ScienceLtd (SZSE:000551). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Create Technology & ScienceLtd

Create Technology & ScienceLtd's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Create Technology & ScienceLtd's EPS has grown 24% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

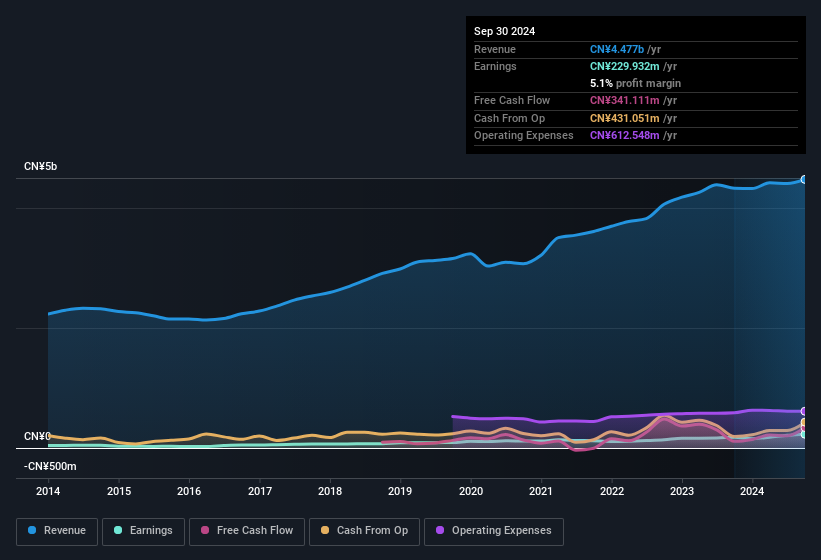

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Create Technology & ScienceLtd's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The good news is that Create Technology & ScienceLtd is growing revenues, and EBIT margins improved by 2.3 percentage points to 8.2%, over the last year. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Create Technology & ScienceLtd Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Create Technology & ScienceLtd insiders have a significant amount of capital invested in the stock. As a matter of fact, their holding is valued at CN¥101m. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 1.9%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Create Technology & ScienceLtd Deserve A Spot On Your Watchlist?

You can't deny that Create Technology & ScienceLtd has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Create Technology & ScienceLtd that you should be aware of.

Although Create Technology & ScienceLtd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000551

Create Technology & ScienceLtd

Engages in the research and development, production, and sale of high-voltage insulators for power transmission and transformation, clean environmental protection equipment and engineering in China and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives