As global markets navigate a landscape of shifting economic indicators and evolving investor sentiment, Asia's small-cap stocks are emerging as intriguing opportunities for those looking to diversify their portfolios. With the recent outperformance of small-cap indices like the Russell 2000, investors may find value in exploring lesser-known companies that demonstrate resilience and potential amid broader market trends. Identifying a good stock often involves assessing its growth prospects, financial health, and ability to capitalize on regional economic developments—factors that can be particularly compelling in dynamic Asian markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CYMECHS | NA | -4.49% | -14.34% | ★★★★★★ |

| Suzhou Chunqiu Electronic Technology | 42.72% | 0.34% | -11.76% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Toukei Computer | NA | 5.71% | 14.11% | ★★★★★☆ |

| TianJin JinRong TianYu Precision Machinery | 45.51% | 11.78% | 7.42% | ★★★★★☆ |

| Xuelong GroupLtd | 0.98% | -6.79% | -22.33% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Changjiu Holdings | 50.46% | 54.90% | 14.57% | ★★★★☆☆ |

| Qingdao Daneng Environmental Protection Equipment | 57.57% | 29.08% | 28.94% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shanxi Huaxiang Group (SHSE:603112)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanxi Huaxiang Group Co., Ltd. specializes in the research, development, production, and sale of customized metal parts both domestically and internationally, with a market capitalization of CN¥9.72 billion.

Operations: Shanxi Huaxiang Group generates revenue primarily through the sale of customized metal parts. The company's financial performance is highlighted by a net profit margin of 12.5%, reflecting its profitability in the sector.

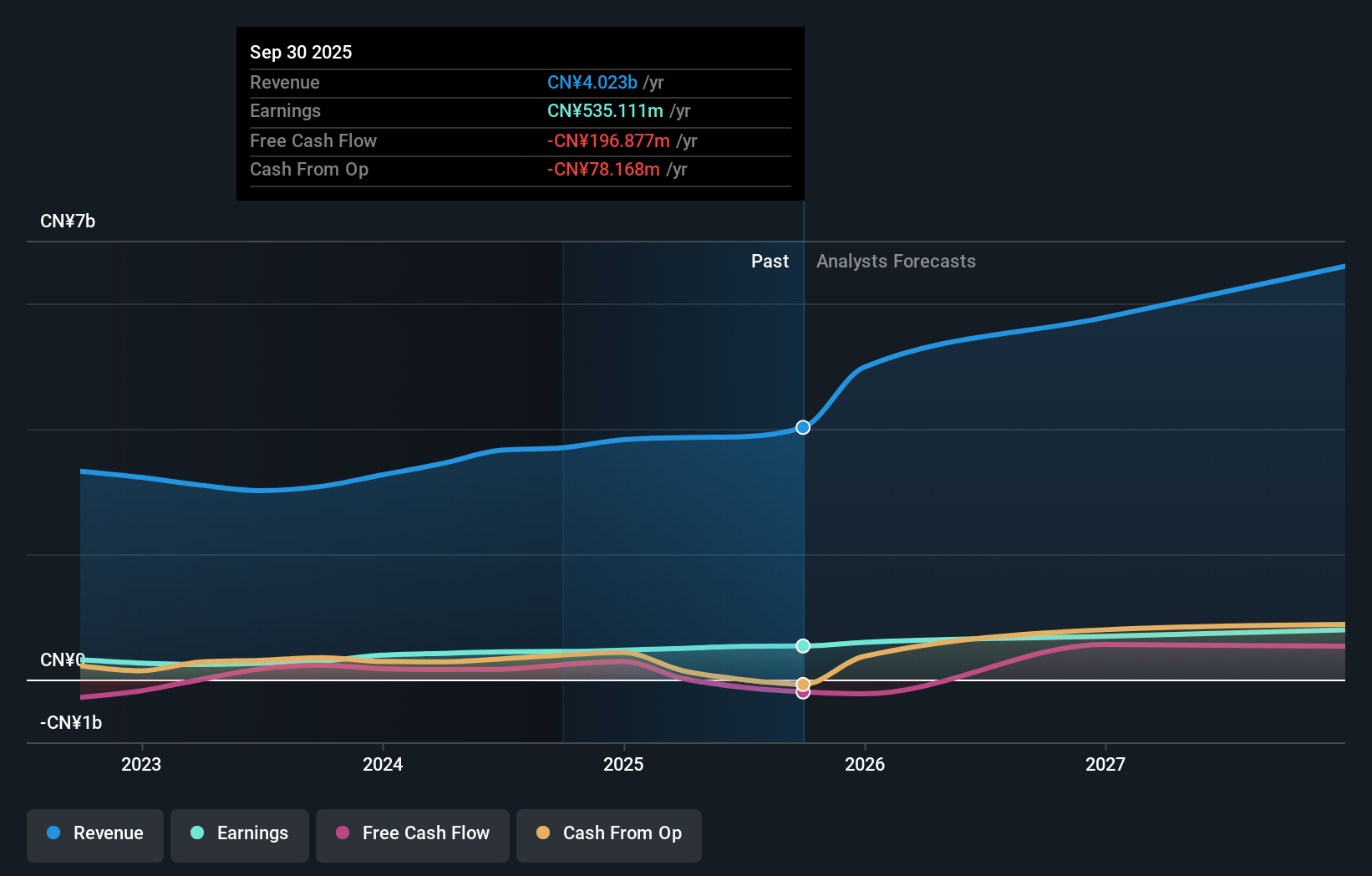

Shanxi Huaxiang Group, a relatively small player in the machinery sector, has shown promising financial performance. Over the past year, earnings grew by 19.3%, outpacing the industry's 6.3% growth rate, and its price-to-earnings ratio of 18.2x suggests it is trading at a good value compared to the broader CN market's 43.9x. The company reported sales of CNY 2.98 billion for the first nine months of 2025, up from CNY 2.79 billion last year, with net income rising to CNY 405 million from CNY 341 million previously—demonstrating robust profitability despite an increase in its debt-to-equity ratio over five years from 4.9% to 16.2%.

- Take a closer look at Shanxi Huaxiang Group's potential here in our health report.

Understand Shanxi Huaxiang Group's track record by examining our Past report.

Bingshan Refrigeration & Heat Transfer Technologies (SZSE:000530)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bingshan Refrigeration & Heat Transfer Technologies Co., Ltd. is a company focused on the production and distribution of refrigeration and air-conditioning equipment, with a market capitalization of CN¥4.88 billion.

Operations: Bingshan generates revenue primarily from its refrigeration and air-conditioning equipment segment, totaling CN¥4.33 billion.

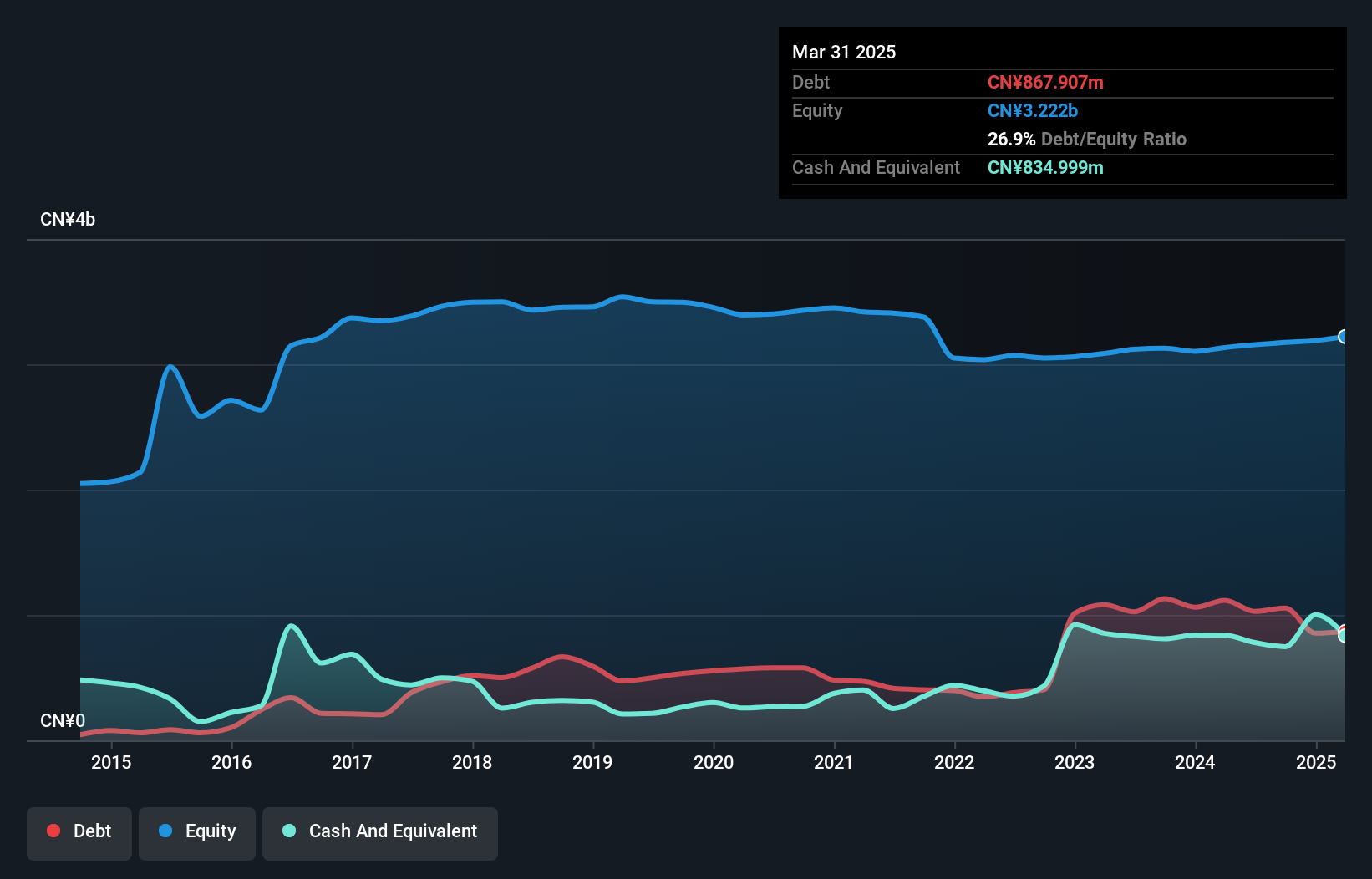

Bingshan Refrigeration, a notable player in the cooling technology space, offers an intriguing investment profile with its current trading value at 75.6% below fair market estimates. Despite a slight dip in sales to CN¥3.61 billion from CN¥3.71 billion year-on-year, the company remains profitable and maintains strong interest coverage. A significant one-off gain of CN¥25.2 million bolstered recent earnings, while its net debt to equity ratio stands at a satisfactory 0.7%. Over the past year, earnings surged by 47.2%, outpacing industry growth of 6.3%, with forecasts suggesting continued robust performance ahead at an annual growth rate of 23.59%.

Guangdong Tapai Group (SZSE:002233)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Tapai Group Co., Ltd. and its subsidiaries focus on the production and sale of cement in China, with a market capitalization of CN¥10.76 billion.

Operations: Guangdong Tapai Group generates revenue primarily through the production and sale of cement in China. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its net profit margin. With a market capitalization of CN¥10.76 billion, it operates within a competitive industry where cost efficiency can significantly affect profitability.

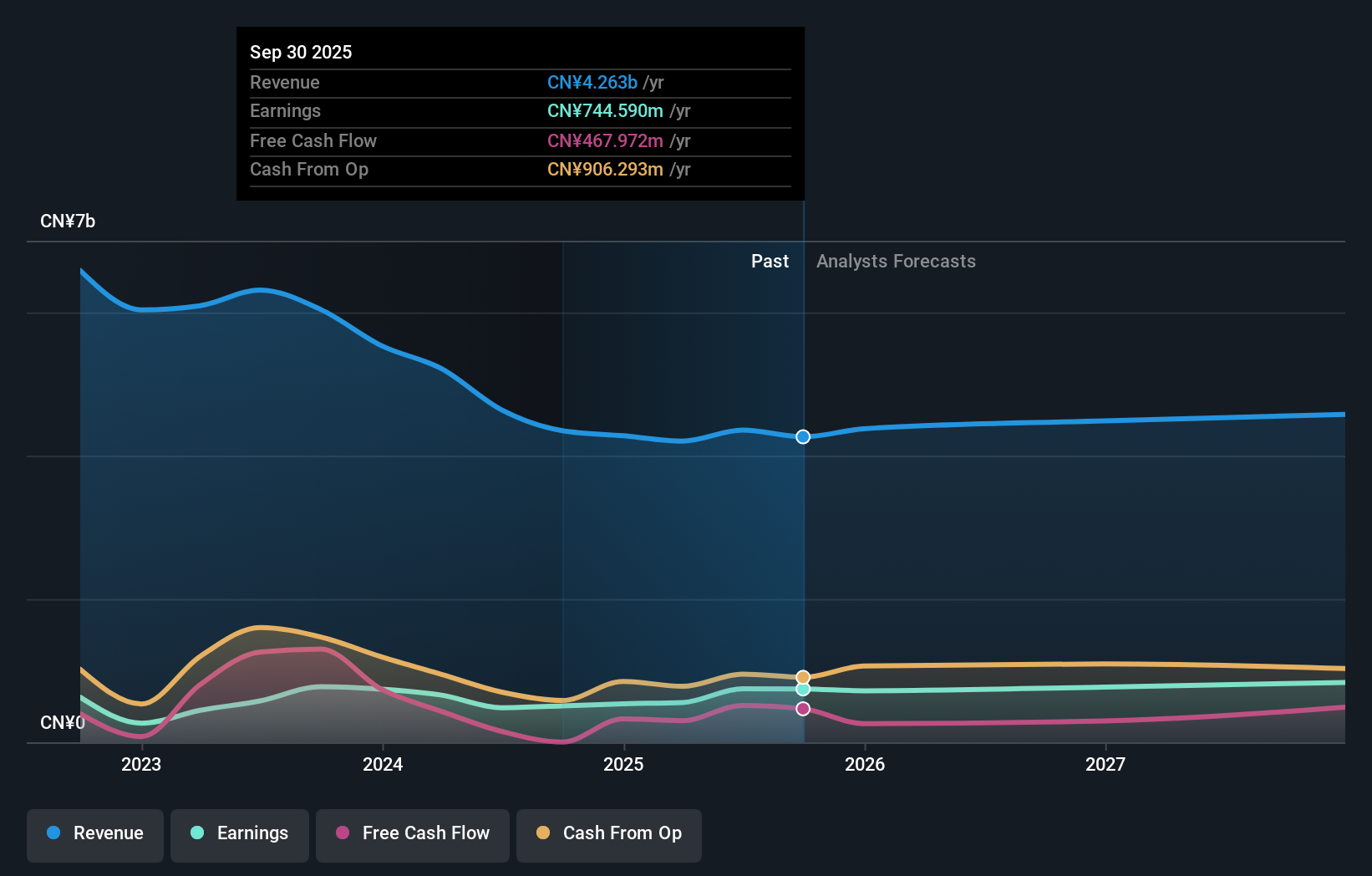

Guangdong Tapai Group, a notable player in the Basic Materials sector, showcases its potential with a net income surge to CN¥587.75 million for the nine months ending September 30, 2025, up from CN¥381.08 million last year. The company's earnings per share rose to CN¥0.5 from CN¥0.33, reflecting robust profitability despite stable revenue of around CN¥2.92 billion year-on-year. With no debt on its books and a price-to-earnings ratio of 14x significantly lower than the market average of 44x, it stands out as an attractive value proposition in its industry context while maintaining positive free cash flow and completing a share buyback worth CN¥54 million recently.

Where To Now?

- Delve into our full catalog of 2498 Asian Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bingshan Refrigeration & Heat Transfer Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000530

Bingshan Refrigeration & Heat Transfer Technologies

Bingshan Refrigeration & Heat Transfer Technologies Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026