- China

- /

- Electrical

- /

- SHSE:688800

A Piece Of The Puzzle Missing From Suzhou Recodeal Interconnect System Co.,Ltd's (SHSE:688800) 35% Share Price Climb

Suzhou Recodeal Interconnect System Co.,Ltd (SHSE:688800) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

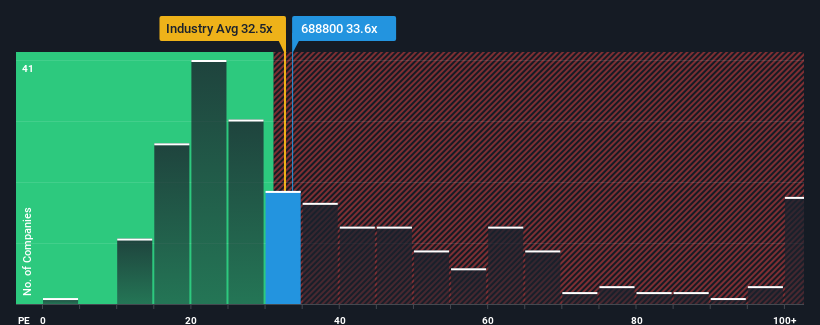

Even after such a large jump in price, there still wouldn't be many who think Suzhou Recodeal Interconnect SystemLtd's price-to-earnings (or "P/E") ratio of 33.6x is worth a mention when the median P/E in China is similar at about 34x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Suzhou Recodeal Interconnect SystemLtd has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Suzhou Recodeal Interconnect SystemLtd

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Suzhou Recodeal Interconnect SystemLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 46%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 46% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 41% each year during the coming three years according to the six analysts following the company. With the market only predicted to deliver 19% per year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Suzhou Recodeal Interconnect SystemLtd is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Suzhou Recodeal Interconnect SystemLtd's P/E?

Its shares have lifted substantially and now Suzhou Recodeal Interconnect SystemLtd's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Suzhou Recodeal Interconnect SystemLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Suzhou Recodeal Interconnect SystemLtd (1 is significant!) that you should be aware of.

Of course, you might also be able to find a better stock than Suzhou Recodeal Interconnect SystemLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688800

Suzhou Recodeal Interconnect SystemLtd

Develops, produces, and sells connection systems, microwave components and other products in China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives