- China

- /

- Semiconductors

- /

- SHSE:603061

Asian Growth Leaders With Strong Insider Stakes September 2025

Reviewed by Simply Wall St

In September 2025, Asian markets have shown resilience amidst global economic uncertainties, with China's stock markets gaining traction due to strong domestic liquidity and innovative developments in technology sectors. In this environment, companies with robust growth potential and high insider ownership are particularly appealing as they often indicate confidence from those closest to the business, aligning well with investor interests seeking stability and long-term value.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Tongguan Gold Group (SEHK:340) | 30.1% | 32.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| M31 Technology (TPEX:6643) | 30.7% | 96.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's uncover some gems from our specialized screener.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Mainland China, and internationally, with a market cap of HK$13.83 billion.

Operations: The company's revenue from its software as a service offerings for digital content asset protection and transactions amounts to HK$2.68 billion.

Insider Ownership: 21.2%

Earnings Growth Forecast: 33.8% p.a.

Vobile Group's earnings are forecast to grow significantly at 33.8% annually, outpacing the Hong Kong market. Revenue is also expected to rise substantially at 22.9% per year. Recent results show strong financial performance, with sales reaching HK$1.46 billion and net income increasing to HK$102.34 million for the first half of 2025 compared to the previous year. Despite no recent insider trading activity, strategic collaborations could enhance its position in digital content markets.

- Take a closer look at Vobile Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Vobile Group shares in the market.

JHT DesignLtd (SHSE:603061)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JHT Design Co., Ltd. specializes in the research, development, production, and sale of semiconductor chip testing equipment in China and has a market capitalization of CN¥7.46 billion.

Operations: JHT Design Ltd. generates its revenue from the research, development, production, and sale of semiconductor chip testing equipment in China.

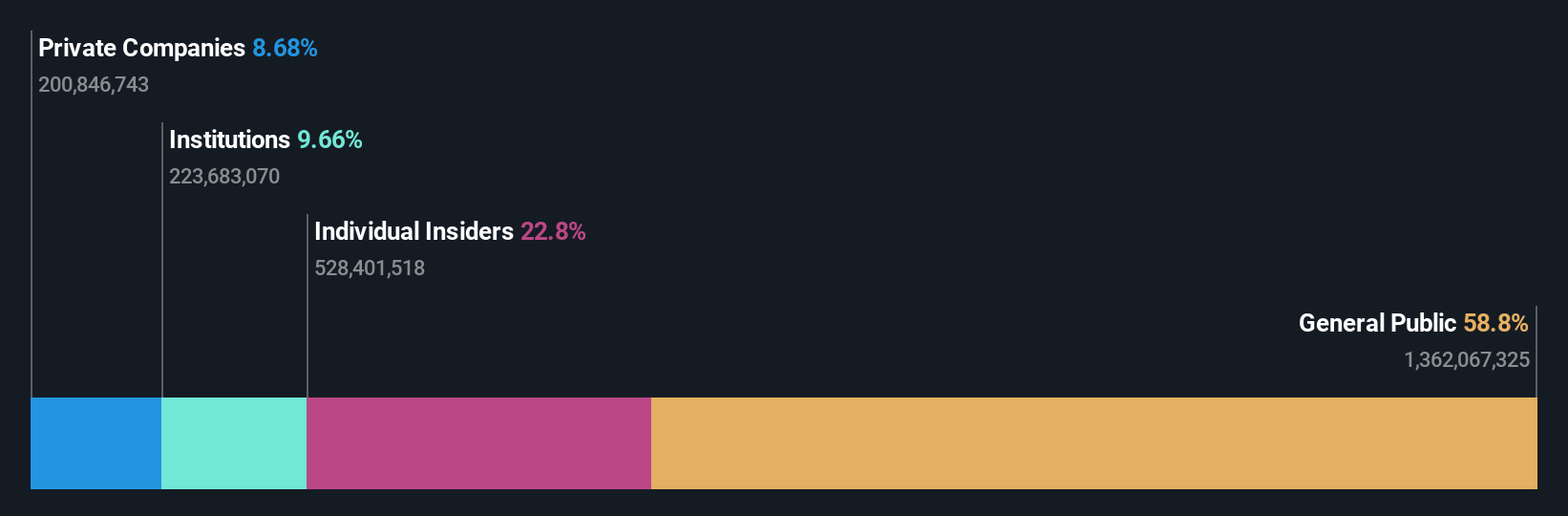

Insider Ownership: 23.8%

Earnings Growth Forecast: 41.2% p.a.

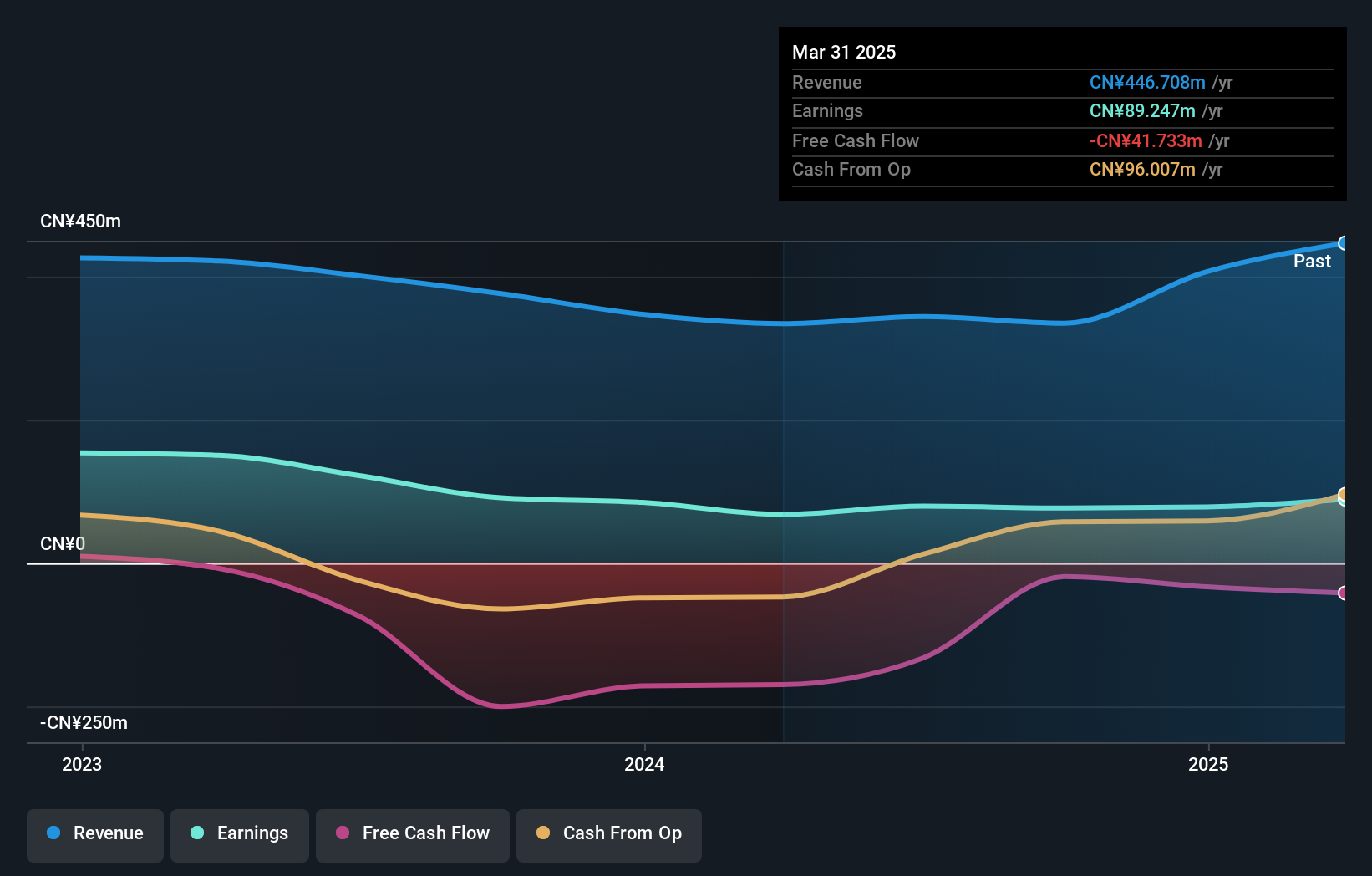

JHT Design Ltd. demonstrates robust growth prospects with earnings forecasted to increase by 41.21% annually, surpassing the broader Chinese market's growth rate. Revenue is expected to grow at 25.5% per year, outpacing both the industry and market averages. Recent financial results highlight a significant performance improvement, with sales reaching ¥307.22 million and net income rising to ¥76.01 million for H1 2025 compared to last year, though insider trading activity remains minimal recently.

- Unlock comprehensive insights into our analysis of JHT DesignLtd stock in this growth report.

- In light of our recent valuation report, it seems possible that JHT DesignLtd is trading beyond its estimated value.

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (SHSE:688717) specializes in the development and production of solar power products, with a market cap of CN¥13.26 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, totaling CN¥3.30 billion.

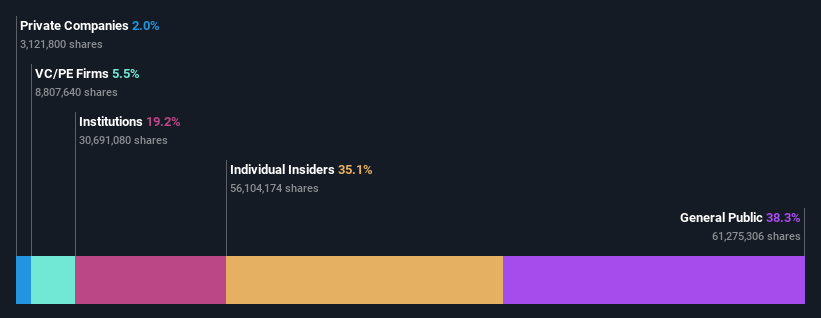

Insider Ownership: 35.9%

Earnings Growth Forecast: 67.2% p.a.

SolaX Power Network Technology (Zhejiang) shows strong growth potential, with earnings projected to rise 67.16% annually, significantly outpacing the Chinese market's average. Recent H1 2025 results reported revenue of CNY 1.81 billion and net income of CNY 141.78 million, reflecting solid year-over-year growth. Despite high insider ownership, recent insider trading activity is minimal. The company's addition to the S&P Global BMI Index further underscores its growing prominence in the industry.

- Click here to discover the nuances of SolaX Power Network Technology (Zhejiang) with our detailed analytical future growth report.

- Our valuation report unveils the possibility SolaX Power Network Technology (Zhejiang)'s shares may be trading at a premium.

Key Takeaways

- Embark on your investment journey to our 613 Fast Growing Asian Companies With High Insider Ownership selection here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603061

JHT DesignLtd

Engages in research, development, production, and sale of semiconductor chip testing equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives