- China

- /

- Semiconductors

- /

- SHSE:605358

3 High-Growth Insider-Owned Stocks With Earnings Up To 75%

Reviewed by Simply Wall St

Global markets have been buoyant recently, with U.S. stocks reaching record highs on the back of China's new stimulus measures and optimism surrounding artificial intelligence. Meanwhile, mixed economic signals from the housing sector and consumer confidence indices suggest a cautious but hopeful outlook for sustained growth. In this environment, identifying high-growth companies with significant insider ownership can be particularly rewarding. Insider ownership often indicates confidence in the company's future prospects, making these stocks attractive in today's market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 29.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

Let's dive into some prime choices out of the screener.

Hangzhou Lion ElectronicsLtd (SHSE:605358)

Simply Wall St Growth Rating: ★★★★★☆

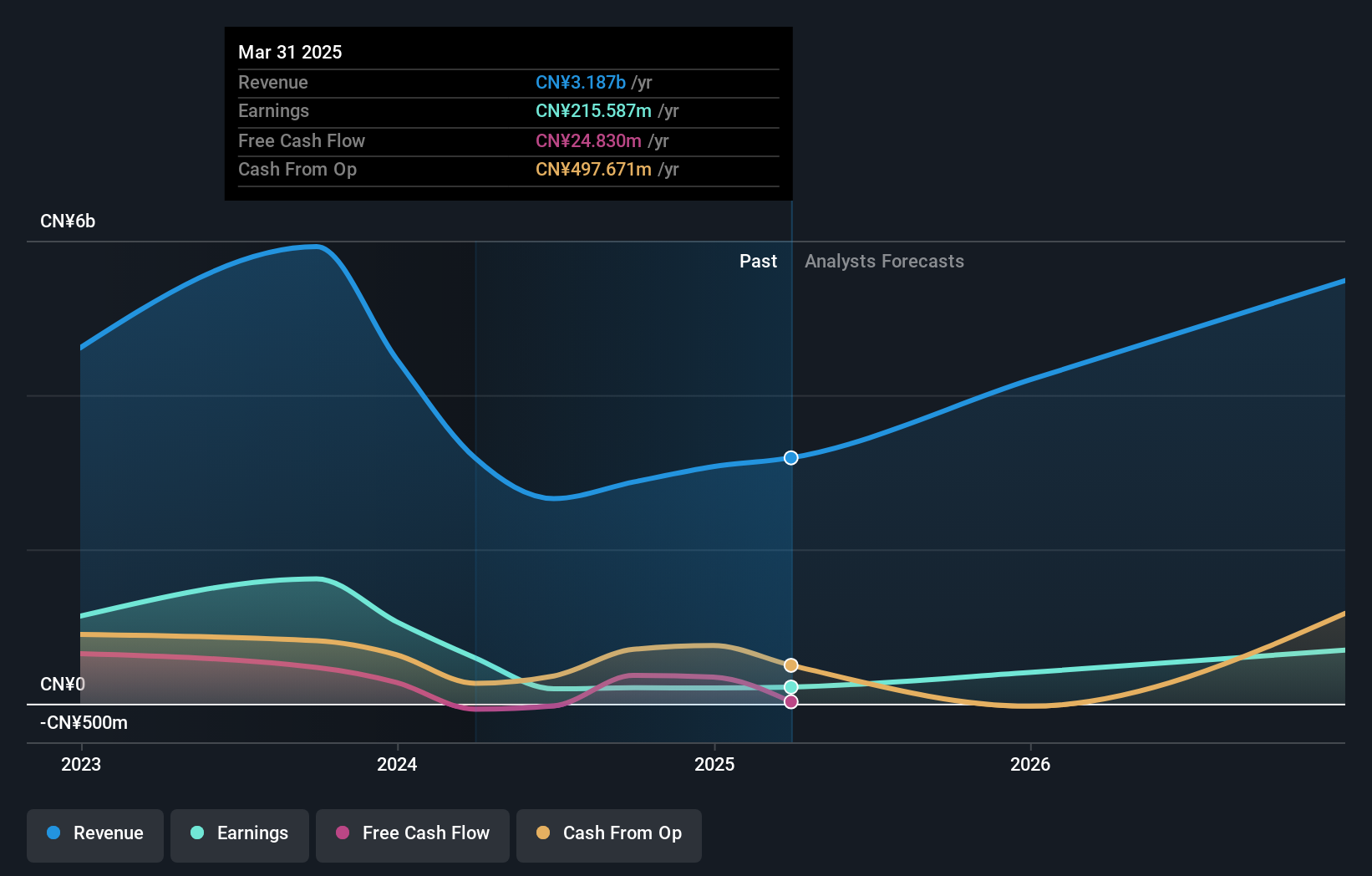

Overview: Hangzhou Lion Electronics Co., Ltd specializes in the R&D, production, and sale of semiconductor silicon wafers, power devices, and compound semiconductor RF chips in China with a market cap of CN¥16.24 billion.

Operations: The company's revenue is derived from semiconductor wafers (CN¥1.62 billion), semiconductor power devices (CN¥939.92 million), and compound semiconductor radio frequency chips (CN¥227.27 million).

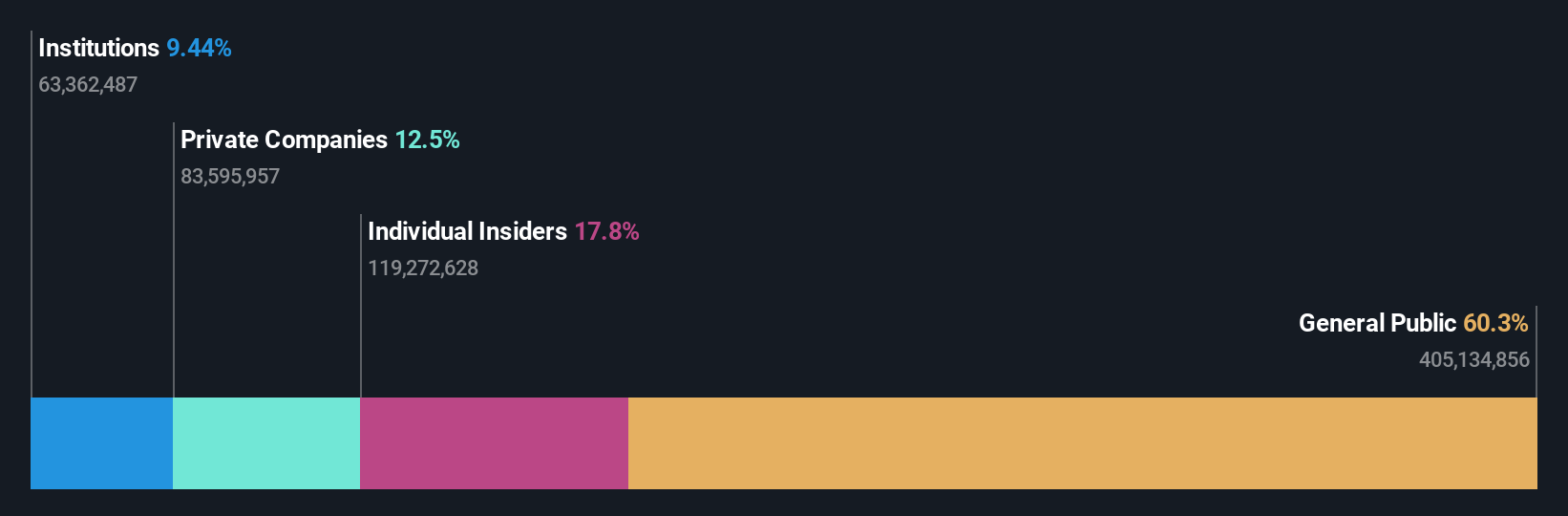

Insider Ownership: 18.8%

Earnings Growth Forecast: 76% p.a.

Hangzhou Lion Electronics Ltd. is poised for growth with a forecasted annual revenue increase of 23.7%, outpacing the Chinese market's 13.2% growth rate. Despite a recent net loss of CNY 66.86 million, the company is expected to achieve profitability within three years, surpassing average market profit growth expectations. A recent share buyback program worth CNY 50 million reflects confidence in its future prospects, though its return on equity is projected to be low at 4.9%.

- Click to explore a detailed breakdown of our findings in Hangzhou Lion ElectronicsLtd's earnings growth report.

- Our valuation report unveils the possibility Hangzhou Lion ElectronicsLtd's shares may be trading at a premium.

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Growth Rating: ★★★★★☆

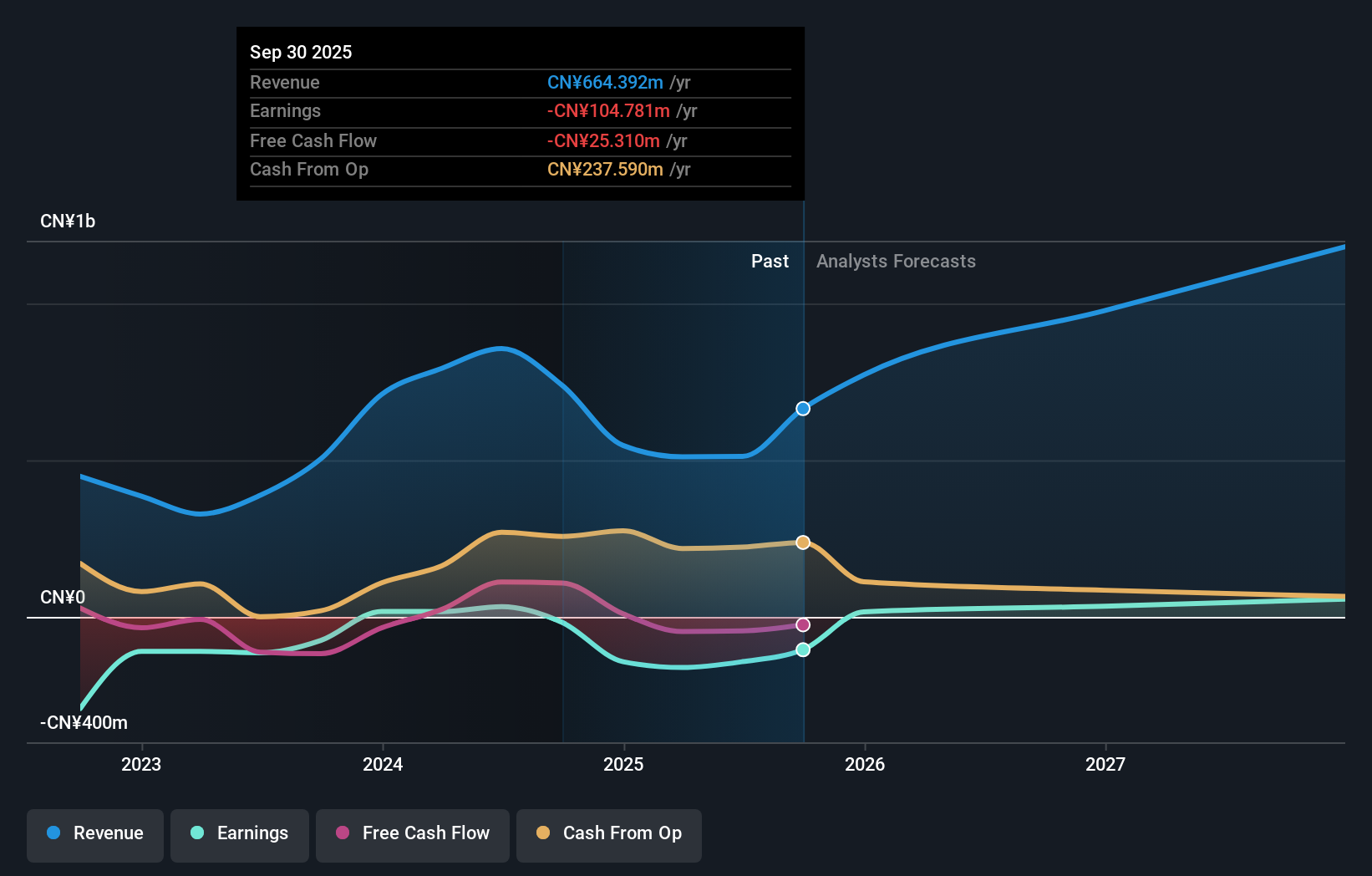

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (SHSE:688717) operates in the renewable energy sector, focusing on the development and production of solar power inverters, with a market cap of CN¥11.79 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥2.66 billion.

Insider Ownership: 35.1%

Earnings Growth Forecast: 50.9% p.a.

SolaX Power Network Technology (Zhejiang) faces challenges with a significant drop in net income to CNY 103.01 million for the half year, yet it is set for robust growth with earnings projected to increase by over 50% annually. Revenue is expected to grow at 33.6% per year, outpacing the Chinese market average. Despite high volatility in share price and lower profit margins, insider ownership remains stable without substantial recent trades.

- Take a closer look at SolaX Power Network Technology (Zhejiang)'s potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that SolaX Power Network Technology (Zhejiang) is priced higher than what may be justified by its financials.

Hwa Create (SZSE:300045)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hwa Create Corporation researches, develops, manufactures, and sells satellite navigation, radar, and communication products and technologies with a market cap of CN¥14.31 billion.

Operations: The company generates revenue from satellite navigation, radar, and communication products and technologies.

Insider Ownership: 35.6%

Earnings Growth Forecast: 50.6% p.a.

Hwa Create Corporation's earnings are forecast to grow 50.61% annually, with revenue expected to increase by 28.6% per year, outpacing the Chinese market. The company became profitable this year, reporting CNY 2.83 million net income for the half-year ended June 30, 2024, compared to a net loss of CNY 12.25 million a year ago. Despite high share price volatility and no substantial recent insider trades, its growth prospects remain strong with significant insider ownership.

- Get an in-depth perspective on Hwa Create's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Hwa Create implies its share price may be too high.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1516 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Lion ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605358

Hangzhou Lion ElectronicsLtd

Engages in the research and development, production, and sale of semiconductor silicon wafers and power devices, and compound semiconductor radio frequency chips in China.

High growth potential and slightly overvalued.