- Hong Kong

- /

- Hospitality

- /

- SEHK:1405

3 Asian Growth Companies With High Insider Ownership Expecting Up To 30% Revenue Growth

Reviewed by Simply Wall St

As geopolitical tensions rise and trade negotiations between major economies continue to evolve, Asia's markets have shown resilience amidst global uncertainties. In this environment, growth companies with high insider ownership can be particularly appealing, as they often indicate strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 43% |

Let's dive into some prime choices out of the screener.

DPC Dash (SEHK:1405)

Simply Wall St Growth Rating: ★★★★★☆

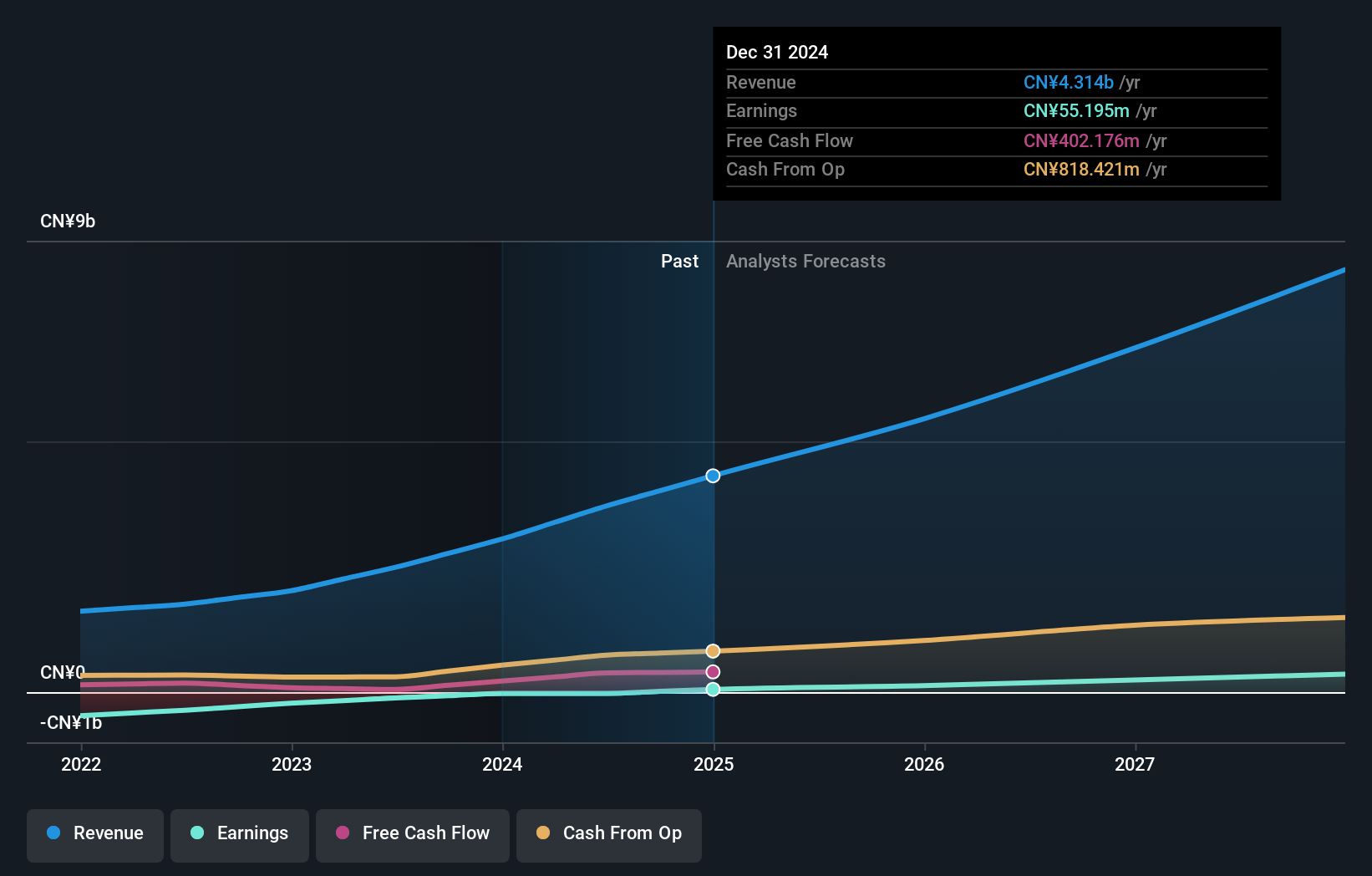

Overview: DPC Dash Ltd, along with its subsidiaries, operates a chain of fast-food restaurants in the People's Republic of China and has a market cap of HK$12.92 billion.

Operations: The company's revenue primarily comes from its fast-food restaurant operations in the People’s Republic of China, generating CN¥4.31 billion.

Insider Ownership: 37.7%

Revenue Growth Forecast: 21.9% p.a.

DPC Dash's insider ownership is noteworthy, with more shares bought than sold recently. The company has turned profitable, reporting a net income of CNY 55.2 million for 2024, and earnings are expected to grow significantly over the next three years. Revenue growth is forecast at 21.9% annually, outpacing the Hong Kong market. Despite recent executive changes, including Mr. Weiking Ng's appointment as a non-executive director, analysts expect the stock price to rise by 25.4%.

- Click here and access our complete growth analysis report to understand the dynamics of DPC Dash.

- The analysis detailed in our DPC Dash valuation report hints at an inflated share price compared to its estimated value.

Smoore International Holdings (SEHK:6969)

Simply Wall St Growth Rating: ★★★★☆☆

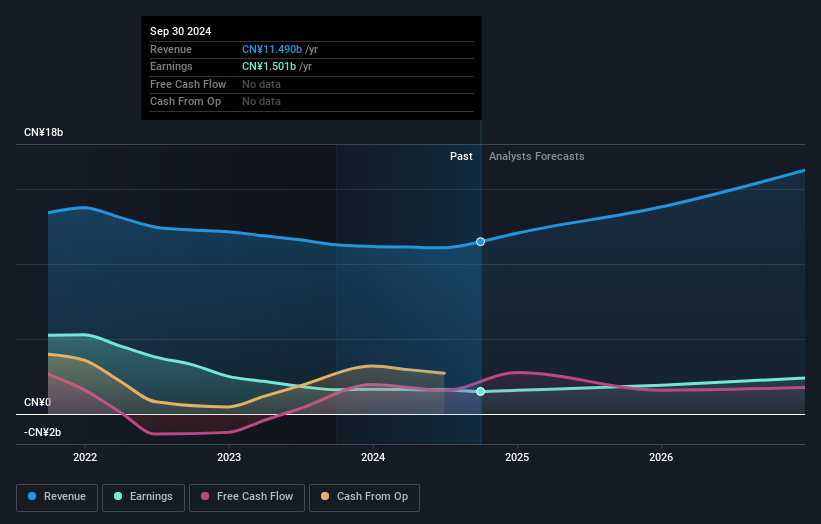

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions, with a market cap of HK$122.49 billion.

Operations: The company's revenue primarily comes from the sale of APV and vaping devices and components, totaling CN¥11.80 billion.

Insider Ownership: 39.7%

Revenue Growth Forecast: 11.7% p.a.

Smoore International Holdings has seen significant insider buying recently, reflecting confidence in its growth prospects. Earnings are expected to grow at 23.4% annually, outpacing the Hong Kong market's growth rate of 10.6%. However, revenue growth is forecasted at a slower pace of 11.7% per year. The company declared a final dividend of HK$0.05 per share for 2024 despite reporting lower net income (CNY1.30 billion) compared to the previous year (CNY1.65 billion).

- Click here to discover the nuances of Smoore International Holdings with our detailed analytical future growth report.

- According our valuation report, there's an indication that Smoore International Holdings' share price might be on the expensive side.

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Growth Rating: ★★★★★☆

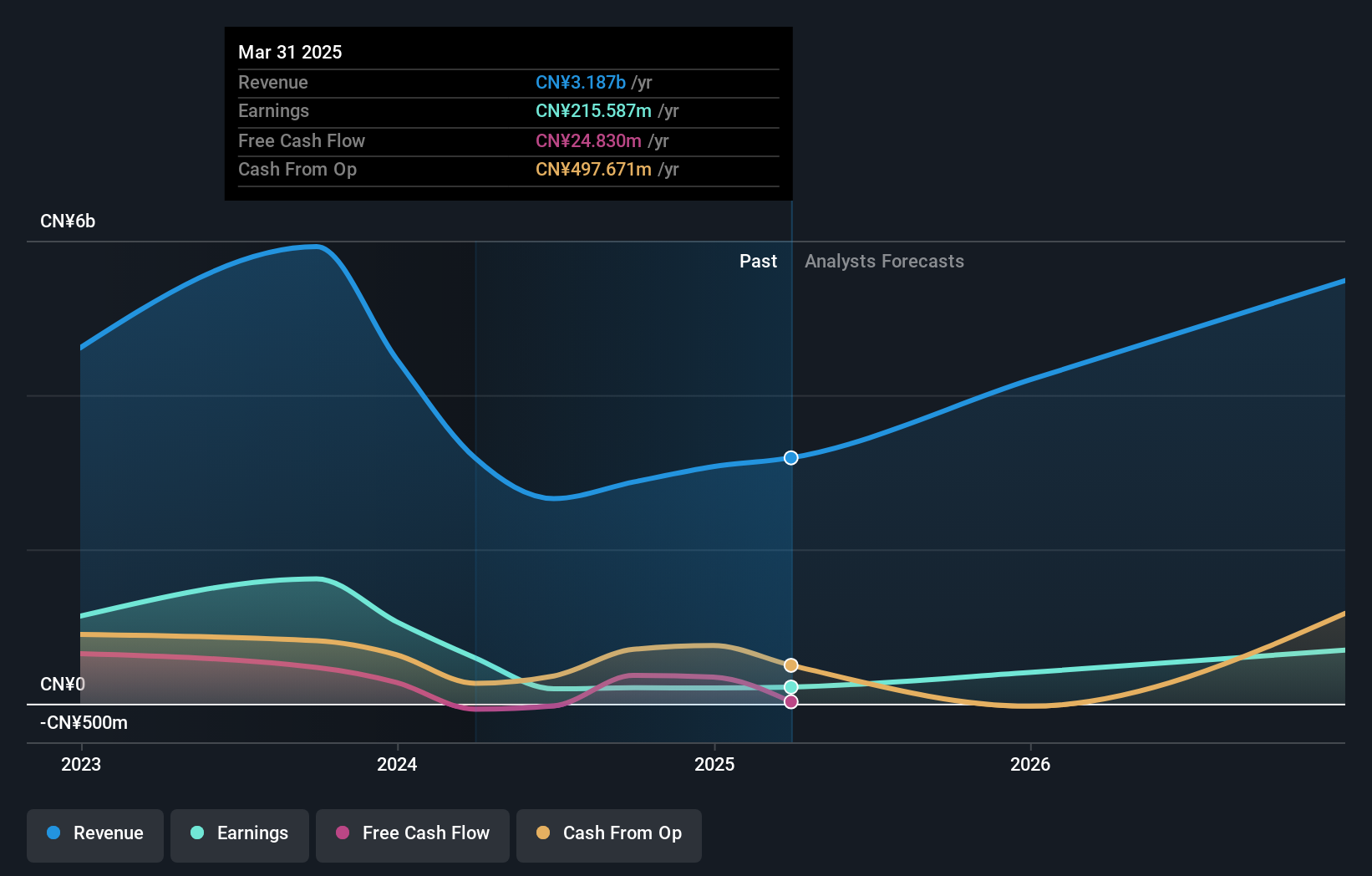

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (ticker: SHSE:688717) is a company engaged in the development and production of solar energy products, with a market cap of CN¥9.12 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, which generated CN¥3.19 billion.

Insider Ownership: 35.1%

Revenue Growth Forecast: 30.6% p.a.

SolaX Power Network Technology (Zhejiang) demonstrates strong growth potential with expected annual earnings growth of 62.5%, significantly outpacing the Chinese market. Revenue is also forecasted to increase by 30.6% annually, surpassing market averages. Recent product innovations, such as the SolaXCloud Security Strategy, align with stringent cybersecurity standards and enhance its competitive edge in energy management solutions. Despite these positives, profit margins have decreased from last year, and insider trading data is unavailable for recent months.

- Take a closer look at SolaX Power Network Technology (Zhejiang)'s potential here in our earnings growth report.

- Our valuation report unveils the possibility SolaX Power Network Technology (Zhejiang)'s shares may be trading at a discount.

Turning Ideas Into Actions

- Gain an insight into the universe of 611 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1405

DPC Dash

Operates a chain of fast-food restaurants in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives