Asian Value Stocks Trading Below Estimated Worth In June 2025

Reviewed by Simply Wall St

As global trade tensions remain a focal point, Asian markets are navigating a complex landscape influenced by fluctuating tariffs and economic policies. Despite these challenges, investors are keenly searching for opportunities in undervalued stocks that promise potential growth relative to their current market prices. Identifying such stocks requires careful analysis of fundamentals and market conditions, particularly in an environment where consumer confidence and inflation expectations are pivotal factors.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Livero (TSE:9245) | ¥1701.00 | ¥3374.76 | 49.6% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥43.52 | CN¥85.48 | 49.1% |

| Fuji (TSE:6134) | ¥2268.50 | ¥4455.15 | 49.1% |

| StemCell Institute (TSE:7096) | ¥1060.00 | ¥2118.09 | 50% |

| cottaLTD (TSE:3359) | ¥431.00 | ¥858.54 | 49.8% |

| Kanto Denka Kogyo (TSE:4047) | ¥843.00 | ¥1679.86 | 49.8% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.44 | CN¥26.41 | 49.1% |

| GEM (SZSE:002340) | CN¥6.14 | CN¥12.27 | 49.9% |

| Dive (TSE:151A) | ¥921.00 | ¥1817.84 | 49.3% |

| BalnibarbiLtd (TSE:3418) | ¥1166.00 | ¥2297.01 | 49.2% |

We're going to check out a few of the best picks from our screener tool.

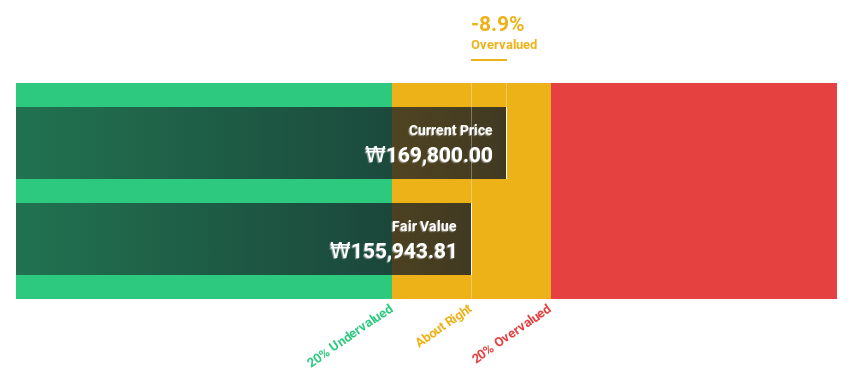

HD HYUNDAI Marine SolutionLTD (KOSE:A443060)

Overview: HD Hyundai Marine Solution Co., Ltd. offers integrated engineering services for Hyundai brand ships and has a market cap of ₩8.22 trillion.

Operations: HD Hyundai Marine Solution Co., Ltd. generates its revenue through the provision of engineering-based services specifically tailored for ships under the Hyundai brand.

Estimated Discount To Fair Value: 20.7%

HD HYUNDAI Marine Solution LTD. is trading at ₩183,300, which is 20.7% below its estimated fair value of ₩231,287.92, making it an undervalued stock based on cash flows. The company exhibits strong growth potential with earnings expected to grow significantly at 21.9% annually over the next three years and revenue projected to increase by 16.1% per year, outpacing the Korean market's average growth rate of 7.1%.

- Our comprehensive growth report raises the possibility that HD HYUNDAI Marine SolutionLTD is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of HD HYUNDAI Marine SolutionLTD.

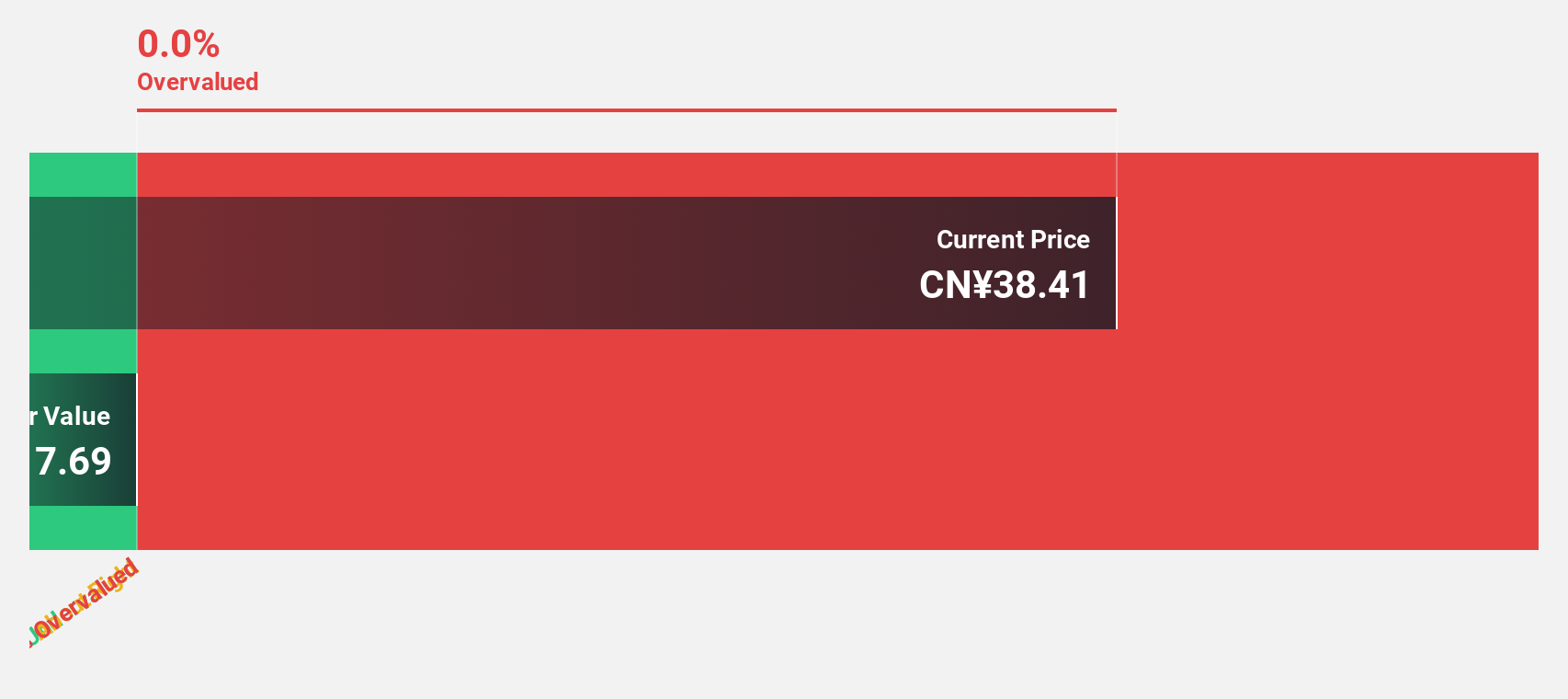

Qi An Xin Technology Group (SHSE:688561)

Overview: Qi An Xin Technology Group Inc. is a cybersecurity company offering products and services to government, enterprises, and institutions in China and internationally, with a market cap of CN¥21.57 billion.

Operations: The company generates revenue primarily from the Information Security Industry segment, amounting to CN¥4.33 billion.

Estimated Discount To Fair Value: 41%

Qi An Xin Technology Group is trading at CN¥31.62, significantly below its estimated fair value of CN¥53.58, suggesting it is undervalued based on cash flows. Despite a net loss in Q1 2025, the company shows potential with earnings forecasted to grow 67.8% annually and expected profitability within three years. Revenue growth of 19.3% per year surpasses the Chinese market average, although return on equity remains low at an anticipated 0.3%.

- The analysis detailed in our Qi An Xin Technology Group growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Qi An Xin Technology Group's balance sheet health report.

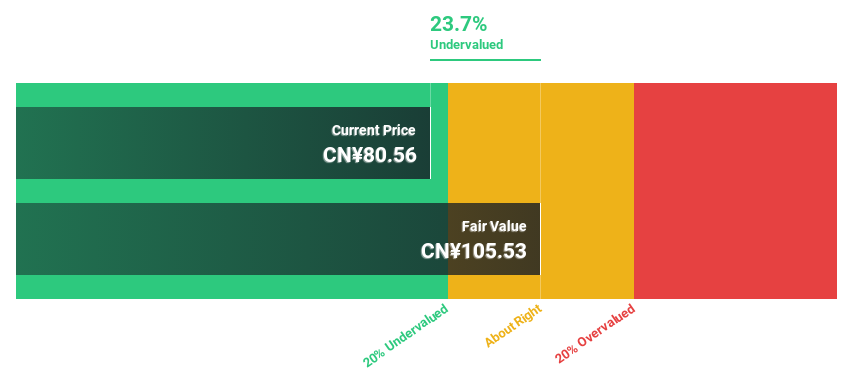

Nanjing LES Information Technology (SHSE:688631)

Overview: Nanjing LES Information Technology Co., Ltd. operates in the technology sector, focusing on providing information technology solutions, and has a market cap of CN¥13.78 billion.

Operations: I'm unable to provide a summary of the company's revenue segments as the information appears to be missing or incomplete in the provided text.

Estimated Discount To Fair Value: 16.6%

Nanjing LES Information Technology, trading at CN¥84.27, is undervalued relative to its fair value estimate of CN¥101.08. Despite reporting a net loss of CN¥14.93 million in Q1 2025 with decreased sales, the company is projected to achieve significant earnings growth of 26% annually and revenue growth surpassing the Chinese market average at 36.7% per year. However, anticipated return on equity remains modest at 11.3%, and recent share price volatility persists.

- In light of our recent growth report, it seems possible that Nanjing LES Information Technology's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Nanjing LES Information Technology.

Seize The Opportunity

- Access the full spectrum of 302 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qi An Xin Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688561

Qi An Xin Technology Group

A cyber-security company, provides cybersecurity products and services for government, enterprises, and other institutions in China and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives