- China

- /

- Electrical

- /

- SHSE:688629

Investors Appear Satisfied With Sichuan Huafeng Technology Co., LTD.'s (SHSE:688629) Prospects As Shares Rocket 25%

Sichuan Huafeng Technology Co., LTD. (SHSE:688629) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 43%.

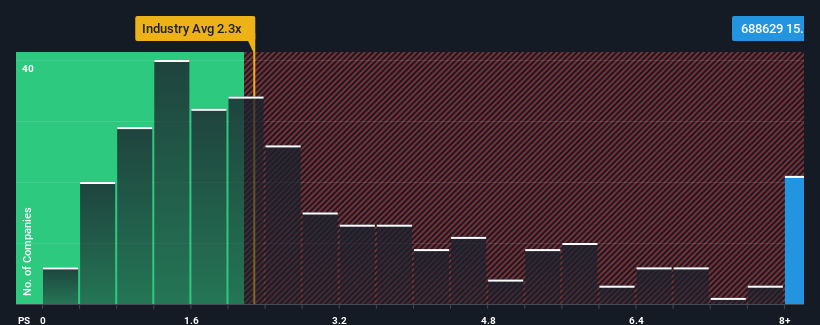

Since its price has surged higher, you could be forgiven for thinking Sichuan Huafeng Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 15.4x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Sichuan Huafeng Technology

How Sichuan Huafeng Technology Has Been Performing

With revenue growth that's superior to most other companies of late, Sichuan Huafeng Technology has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Sichuan Huafeng Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Sichuan Huafeng Technology's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Sichuan Huafeng Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. Revenue has also lifted 24% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 88% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 27% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Sichuan Huafeng Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Sichuan Huafeng Technology's P/S

Shares in Sichuan Huafeng Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Sichuan Huafeng Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Sichuan Huafeng Technology that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688629

Sichuan Huafeng Technology

Engages in the research, development, manufacture, and sale of optical and electrical connectors and cable assemblies in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives