Hymson Laser Technology Group Co.,Ltd.'s (SHSE:688559) 46% Jump Shows Its Popularity With Investors

Hymson Laser Technology Group Co.,Ltd. (SHSE:688559) shareholders would be excited to see that the share price has had a great month, posting a 46% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.8% in the last twelve months.

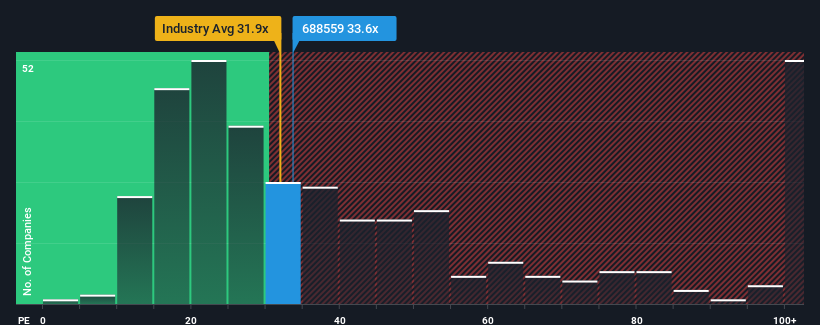

Even after such a large jump in price, there still wouldn't be many who think Hymson Laser Technology GroupLtd's price-to-earnings (or "P/E") ratio of 33.6x is worth a mention when the median P/E in China is similar at about 34x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Hymson Laser Technology GroupLtd has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Hymson Laser Technology GroupLtd

Is There Some Growth For Hymson Laser Technology GroupLtd?

The only time you'd be comfortable seeing a P/E like Hymson Laser Technology GroupLtd's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 39%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 154% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 20% per annum over the next three years. With the market predicted to deliver 19% growth per year, the company is positioned for a comparable earnings result.

With this information, we can see why Hymson Laser Technology GroupLtd is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Hymson Laser Technology GroupLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Hymson Laser Technology GroupLtd's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 5 warning signs for Hymson Laser Technology GroupLtd you should be aware of, and 2 of them can't be ignored.

Of course, you might also be able to find a better stock than Hymson Laser Technology GroupLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hymson Laser Technology GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688559

Hymson Laser Technology GroupLtd

Manufactures and sells lasers and automation equipment in China and internationally.

High growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026