- China

- /

- Electrical

- /

- SHSE:688411

Global Growth Stocks With High Insider Confidence

Reviewed by Simply Wall St

As global markets navigate through interest rate expectations and the ongoing artificial intelligence boom, major indices such as the Dow Jones, S&P 500, and Nasdaq Composite have reached record highs. Amid this backdrop of optimism and economic shifts, growth companies with high insider ownership often signal strong internal confidence and alignment with shareholder interests, making them appealing to investors seeking stability in a fluctuating market environment.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We're going to check out a few of the best picks from our screener tool.

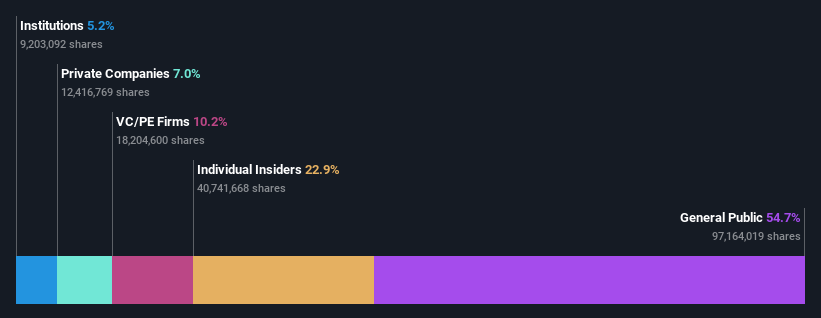

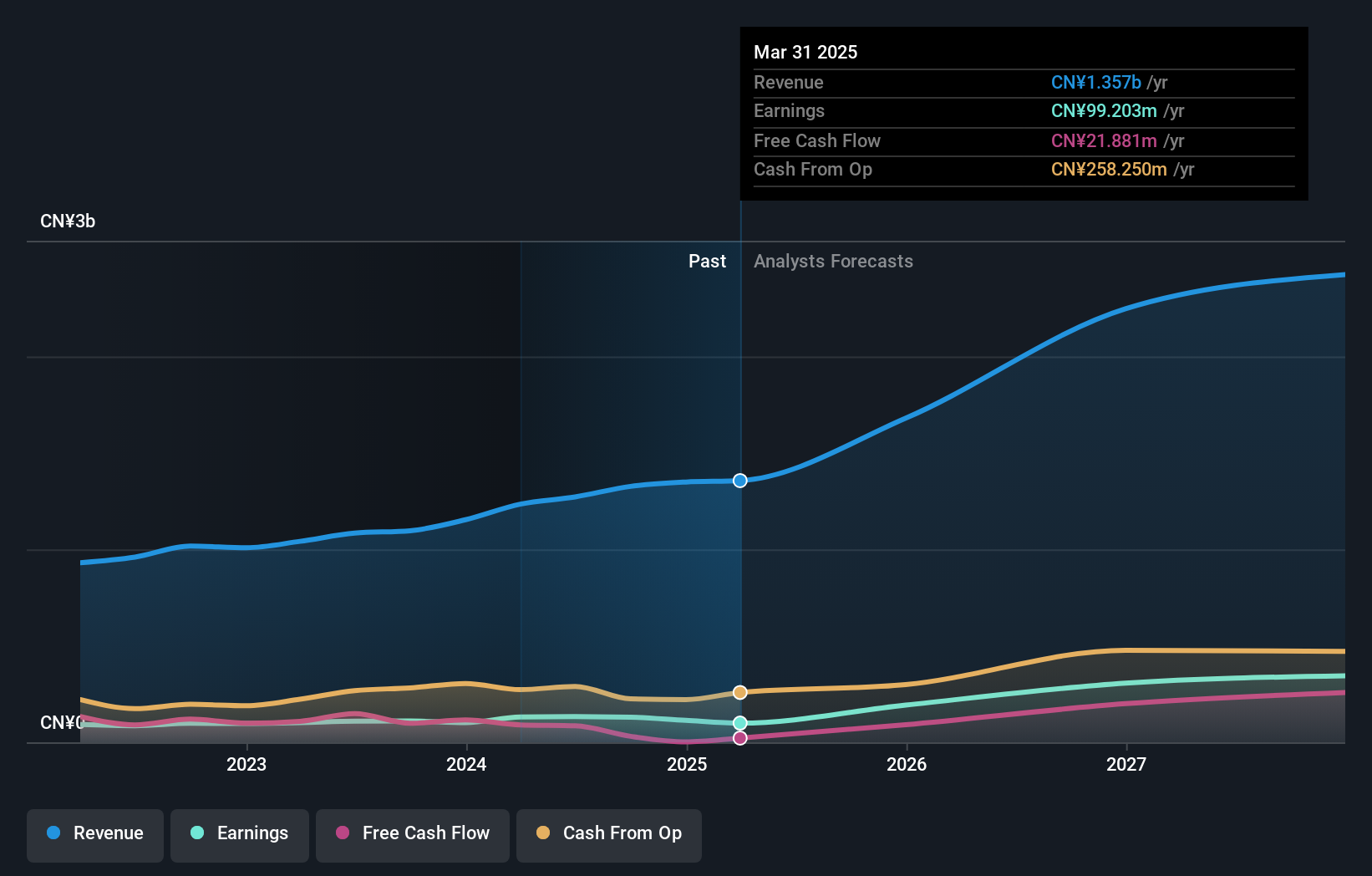

Beijing HyperStrong Technology (SHSE:688411)

Simply Wall St Growth Rating: ★★★★★★

Overview: Beijing HyperStrong Technology Co., Ltd. specializes in the design, development, integration, and operation of energy storage power stations across China, Europe, North America, and Australia with a market cap of CN¥32.87 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 22.6%

Earnings Growth Forecast: 26.9% p.a.

Beijing HyperStrong Technology is poised for robust growth, with revenue expected to increase by 29.4% annually, surpassing market averages. Earnings are also forecasted to grow significantly at 26.88% per year. The company's recent joint venture with Beijing Fourth Paradigm Technology aims to leverage AI in energy storage, enhancing its technological edge and market reach. Despite high volatility in share price, the strategic alliance could bolster long-term prospects without substantial insider trading activity noted recently.

- Get an in-depth perspective on Beijing HyperStrong Technology's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Beijing HyperStrong Technology implies its share price may be too high.

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. (ticker: SHSE:688498) operates in the semiconductor industry and has a market capitalization of CN¥31.95 billion.

Operations: Yuanjie Semiconductor Technology's revenue is derived from various segments within the semiconductor industry.

Insider Ownership: 28.0%

Earnings Growth Forecast: 68.2% p.a.

Yuanjie Semiconductor Technology is set for substantial growth, with earnings projected to rise by 68.16% annually, outpacing the Chinese market. Revenue is also expected to grow at a robust 42% per year. Recent earnings reports show significant improvements, with net income reaching CNY 46.26 million from CNY 10.75 million last year. Despite high share price volatility and low forecasted return on equity, no recent insider trading suggests confidence in future performance.

- Unlock comprehensive insights into our analysis of Yuanjie Semiconductor Technology stock in this growth report.

- Our valuation report here indicates Yuanjie Semiconductor Technology may be overvalued.

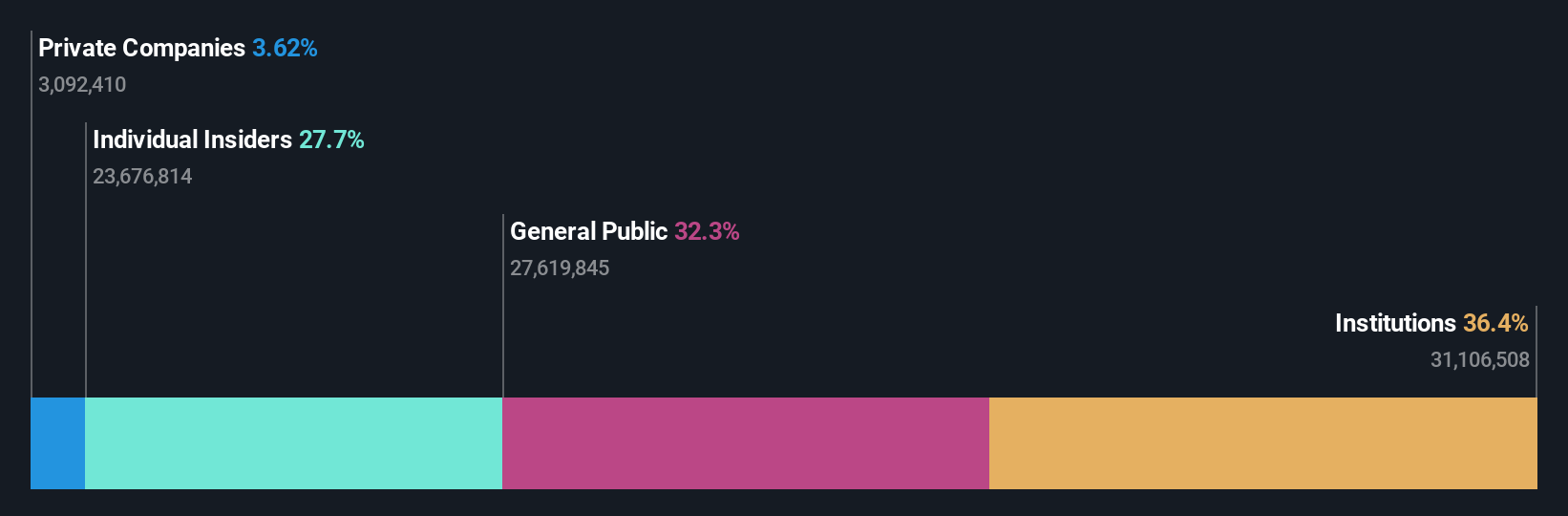

Inner Mongolia Furui Medical Science (SZSE:300049)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the medical science industry with a focus on developing and manufacturing medical products, and it has a market cap of CN¥18.16 billion.

Operations: Inner Mongolia Furui Medical Science Co., Ltd. generates revenue through its focus on developing and manufacturing medical products.

Insider Ownership: 16.1%

Earnings Growth Forecast: 45% p.a.

Inner Mongolia Furui Medical Science is poised for significant growth, with earnings expected to increase by 45% annually, surpassing the Chinese market's forecast. Revenue is projected to grow at 22.1% per year, though recent reports show a decline in net income from CNY 75.36 million to CNY 51.93 million compared to last year. Despite volatile share prices and a low future return on equity of 15.1%, no insider trading activity indicates stable internal confidence.

- Take a closer look at Inner Mongolia Furui Medical Science's potential here in our earnings growth report.

- According our valuation report, there's an indication that Inner Mongolia Furui Medical Science's share price might be on the expensive side.

Taking Advantage

- Unlock our comprehensive list of 844 Fast Growing Global Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? Uncover 8 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing HyperStrong Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688411

Beijing HyperStrong Technology

Engages in the design, development, integration, and operation of energy storage power stations in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives