- China

- /

- Electrical

- /

- SHSE:688349

Even With A 39% Surge, Cautious Investors Are Not Rewarding Sany Renewable Energy Co.,Ltd.'s (SHSE:688349) Performance Completely

Sany Renewable Energy Co.,Ltd. (SHSE:688349) shares have had a really impressive month, gaining 39% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 6.2% isn't as attractive.

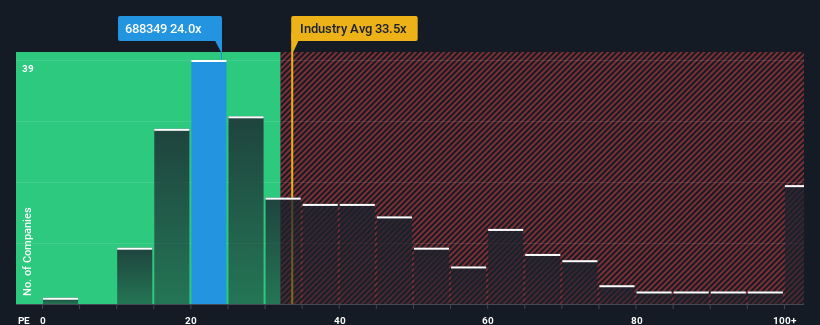

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Sany Renewable EnergyLtd as an attractive investment with its 24x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times haven't been advantageous for Sany Renewable EnergyLtd as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Sany Renewable EnergyLtd

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Sany Renewable EnergyLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 4.1%. The last three years don't look nice either as the company has shrunk EPS by 31% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 26% per year as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 18% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Sany Renewable EnergyLtd's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Despite Sany Renewable EnergyLtd's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sany Renewable EnergyLtd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Sany Renewable EnergyLtd (1 doesn't sit too well with us) you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688349

Sany Renewable EnergyLtd

Engages in the research and development, manufacture, and sale of wind turbines and generators in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives