Stock Analysis

High Insider Ownership Growth Companies On Chinese Exchanges In May 2024

Reviewed by Simply Wall St

As of May 2024, Chinese markets are experiencing a period of stabilization with significant government interventions aimed at reviving the property sector and alleviating deflationary pressures. Amid these broader economic maneuvers, high insider ownership in growth companies can be a signal of confidence from those most familiar with the company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

| Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.5% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Let's dive into some prime choices out of from the screener.

Xi'an Bright Laser TechnologiesLtd (SHSE:688333)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xi'an Bright Laser Technologies Co., Ltd. specializes in metal additive manufacturing and repairing solutions in the People's Republic of China, with a market capitalization of CN¥16.79 billion.

Operations: The company generates revenue primarily from metal additive manufacturing and repairing solutions.

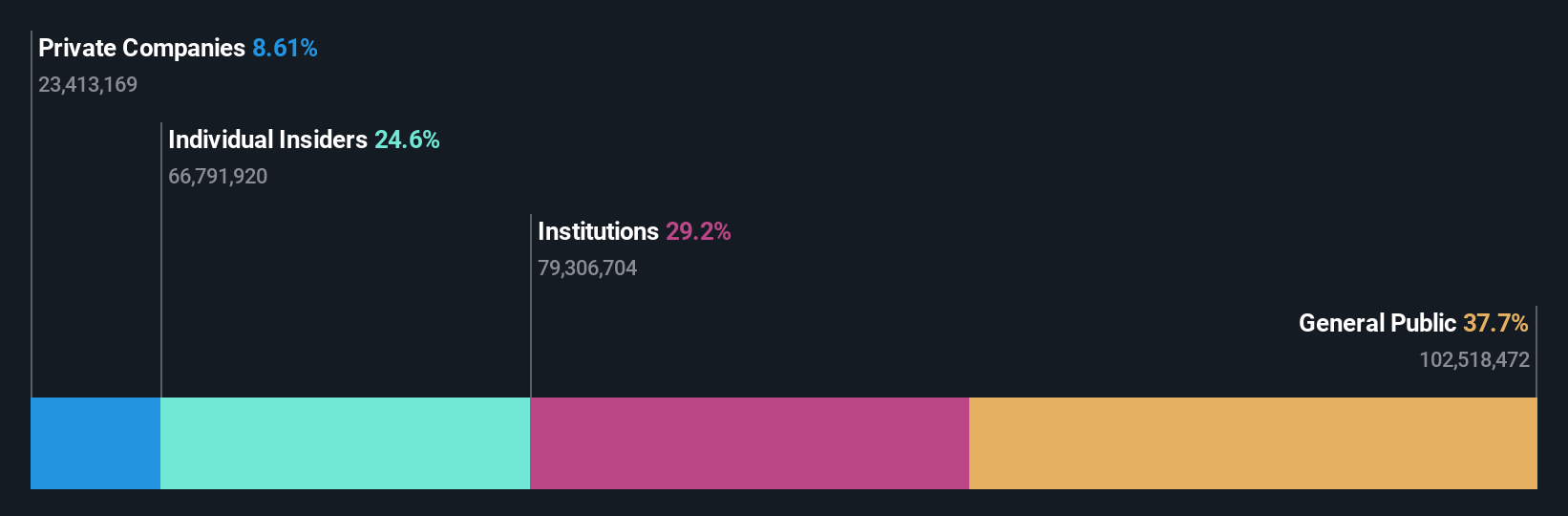

Insider Ownership: 29.8%

Earnings Growth Forecast: 45.1% p.a.

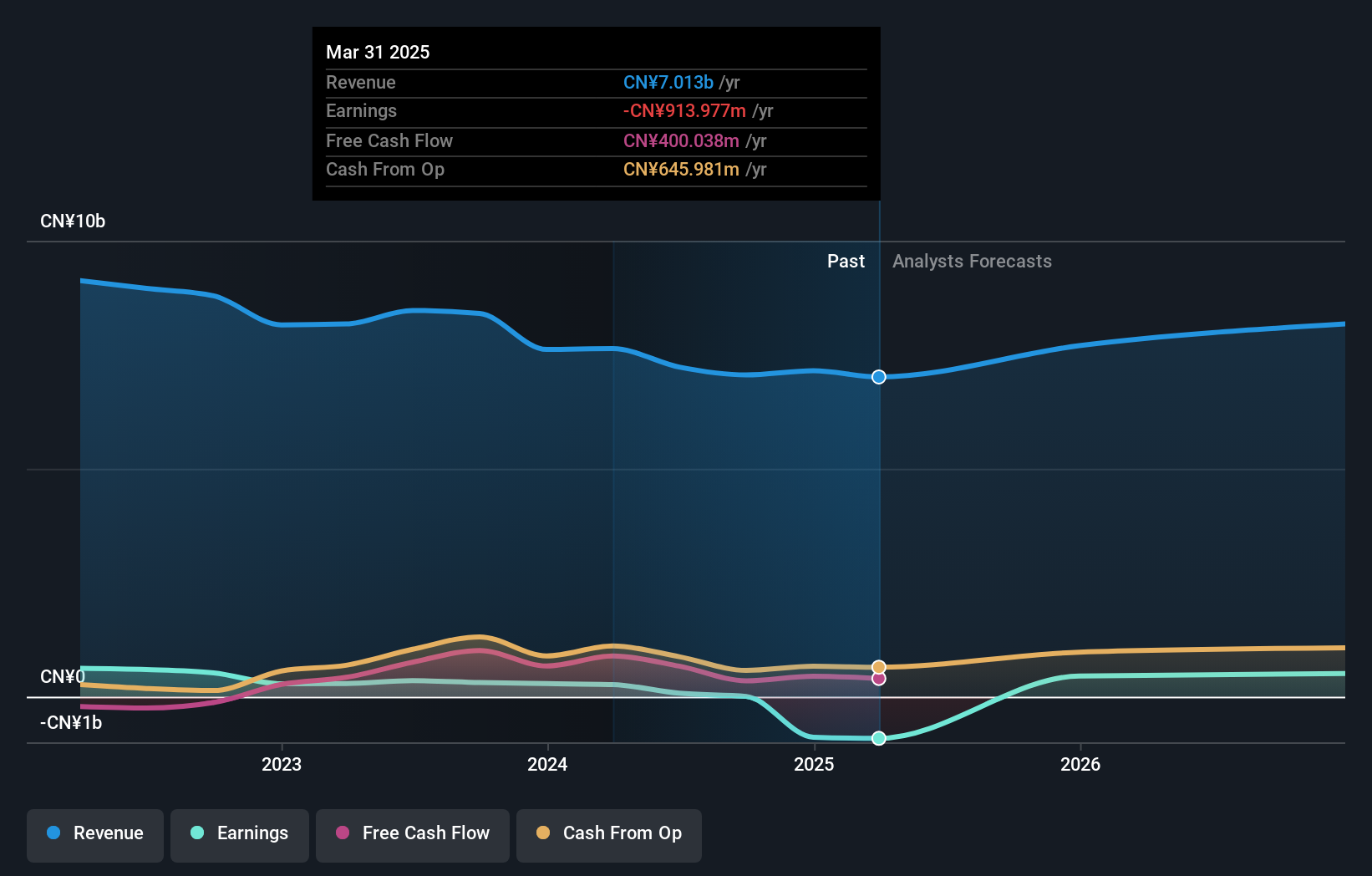

Xi'an Bright Laser Technologies Ltd. has demonstrated robust growth, with earnings increasing by 105.5% over the past year and projected annual growth of 45.1%, outpacing the Chinese market average. Despite a forecasted low return on equity of 16.7% in three years, the company's revenue is expected to grow by 34.6% annually, significantly above the market trend of 20%. Recent financial reports show a shift from a net loss to a profit in Q1 2024, indicating improving operational efficiency and potential for sustained growth despite no recent insider buying or selling activity reported.

- Take a closer look at Xi'an Bright Laser TechnologiesLtd's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Xi'an Bright Laser TechnologiesLtd's current price could be inflated.

Shenzhen Envicool Technology (SZSE:002837)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Envicool Technology Co., Ltd. is a company based in China that specializes in manufacturing and distributing temperature control solutions and products, with a market capitalization of approximately CN¥18.58 billion.

Operations: The company generates its revenue primarily through the production and sale of temperature control solutions and products in China.

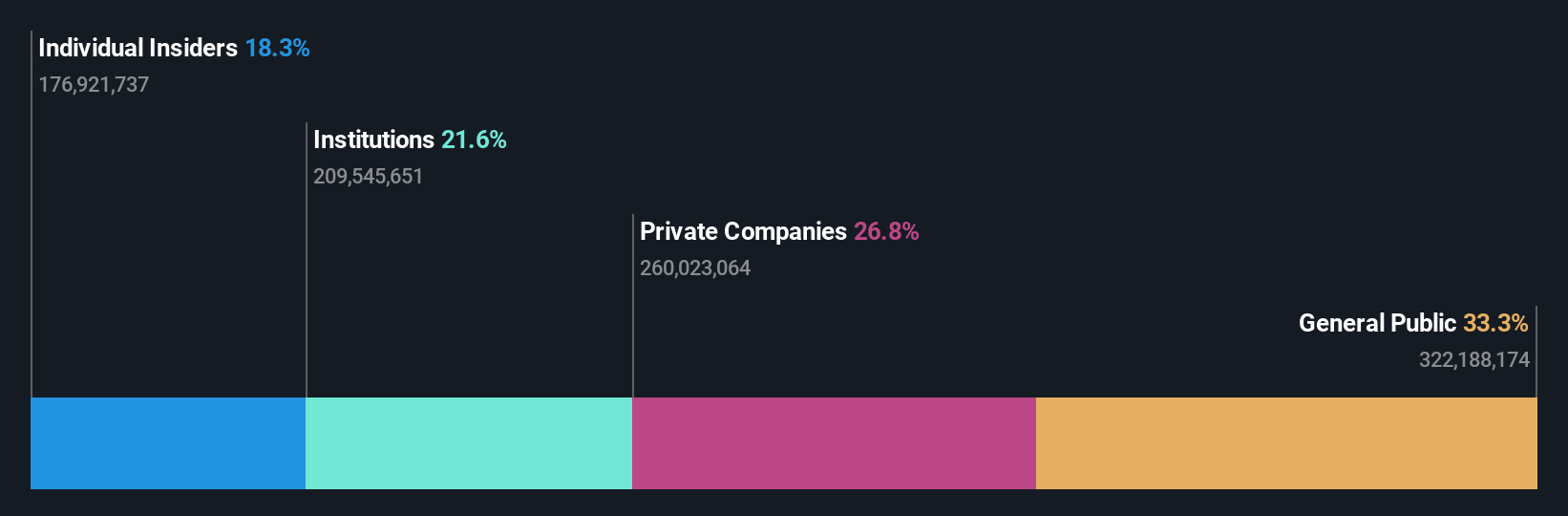

Insider Ownership: 21.2%

Earnings Growth Forecast: 31.5% p.a.

Shenzhen Envicool Technology Co., Ltd. is experiencing strong growth, with earnings and revenue increasing by 30.1% and 31.5% per year respectively, outperforming the Chinese market projections of 23.3%. The company's Return on Equity is expected to reach a high of 22.2% in three years, reflecting efficient management and promising profitability. Recent corporate activities include significant amendments to company bylaws and a notable dividend increase approved at the latest Annual General Meeting, underlining its stable financial health and commitment to shareholder returns.

- Get an in-depth perspective on Shenzhen Envicool Technology's performance by reading our analyst estimates report here.

- The analysis detailed in our Shenzhen Envicool Technology valuation report hints at an inflated share price compared to its estimated value.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company operating both in China and internationally, with a market capitalization of approximately CN¥12.89 billion.

Operations: The company generates its revenue from various audio-visual technology segments, primarily in China and other international markets.

Insider Ownership: 28.6%

Earnings Growth Forecast: 47.4% p.a.

Leyard Optoelectronic Co., Ltd. is poised for robust growth, with earnings anticipated to surge by 47.4% annually, significantly outpacing the Chinese market's average of 23.3%. Despite a lower forecasted return on equity at 10.4%, the company's revenue growth remains strong at 15.7% per year, slightly above the market norm of 14%. Recent adjustments in company bylaws and consistent dividend payouts highlight its stable governance structure and commitment to shareholder value amidst fluctuating net income figures in recent quarters.

- Click here to discover the nuances of Leyard Optoelectronic with our detailed analytical future growth report.

- Our expertly prepared valuation report Leyard Optoelectronic implies its share price may be too high.

Seize The Opportunity

- Navigate through the entire inventory of 412 Fast Growing Chinese Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Xi'an Bright Laser TechnologiesLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688333

Xi'an Bright Laser TechnologiesLtd

Offers metal additive manufacturing and repairing solutions in the People's Republic of China.

High growth potential with excellent balance sheet.