As global markets navigate a complex landscape, Asia's economic resilience continues to capture investor attention, with notable gains in China's stock indices and strategic shifts in Japan amidst political changes. In this dynamic environment, identifying promising stocks often involves looking for companies that demonstrate strong fundamentals and the ability to adapt to evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 34.20% | 17.05% | 40.91% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 16.31% | 7.95% | -9.56% | ★★★★★★ |

| Qingdao Eastsoft Communication TechnologyLtd | NA | 5.88% | -20.71% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 1.77% | 31.72% | ★★★★★★ |

| AJIS | 0.68% | 3.20% | -12.98% | ★★★★★☆ |

| Hyakugo Bank | 161.58% | 6.23% | 7.74% | ★★★★★☆ |

| Guangdong Delian Group | 28.18% | 5.07% | -36.51% | ★★★★★☆ |

| Huang Hsiang Construction | 268.99% | 13.29% | 10.70% | ★★★★☆☆ |

| Mechema Chemicals International | 55.74% | -4.23% | -5.72% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.30% | -23.01% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Lonking Holdings (SEHK:3339)

Simply Wall St Value Rating: ★★★★★★

Overview: Lonking Holdings Limited is an investment holding company that manufactures and distributes construction machinery such as wheel loaders, road rollers, excavators, and forklifts in Mainland China and internationally, with a market cap of HK$11.90 billion.

Operations: The primary revenue stream for Lonking Holdings comes from the sale of construction machinery, amounting to CN¥10.21 billion.

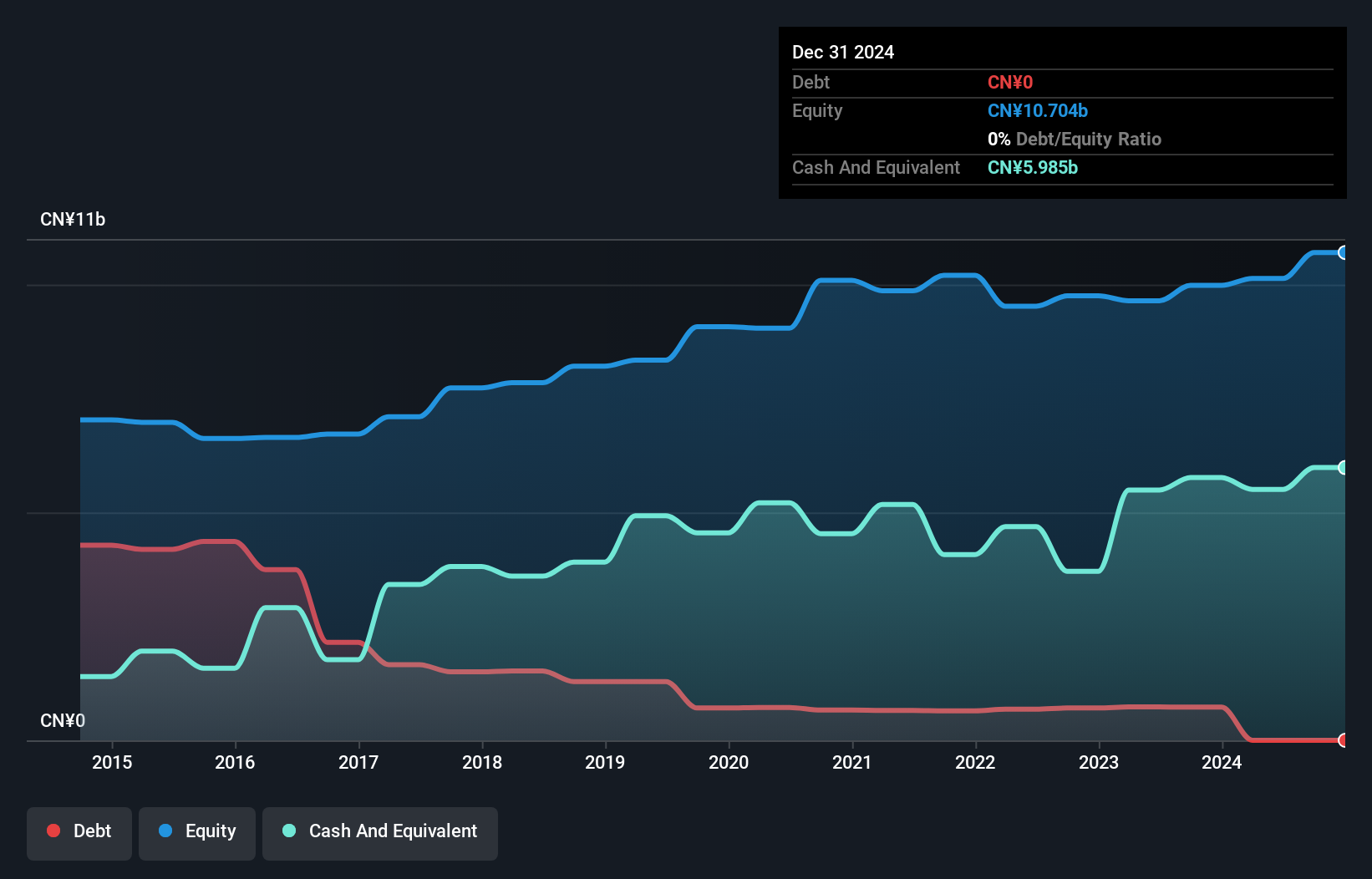

Lonking Holdings, a nimble player in the machinery sector, has shown impressive financial health with no debt compared to five years ago when its debt-to-equity ratio was 7.8%. The company is trading at 30.1% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings surged by 57.8%, outpacing the industry's growth of 12.5%. With high-quality earnings and positive free cash flow, Lonking seems well-positioned for future growth. Recently, it approved a dividend increase to HKD 0.13 per share for 2024, reflecting confidence in its financial stability and shareholder returns strategy.

- Click here and access our complete health analysis report to understand the dynamics of Lonking Holdings.

Assess Lonking Holdings' past performance with our detailed historical performance reports.

Mongolian Mining (SEHK:975)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mongolian Mining Corporation is involved in the mining, processing, transporting, and selling of coking coal products primarily in China, with a market capitalization of HK$8.78 billion.

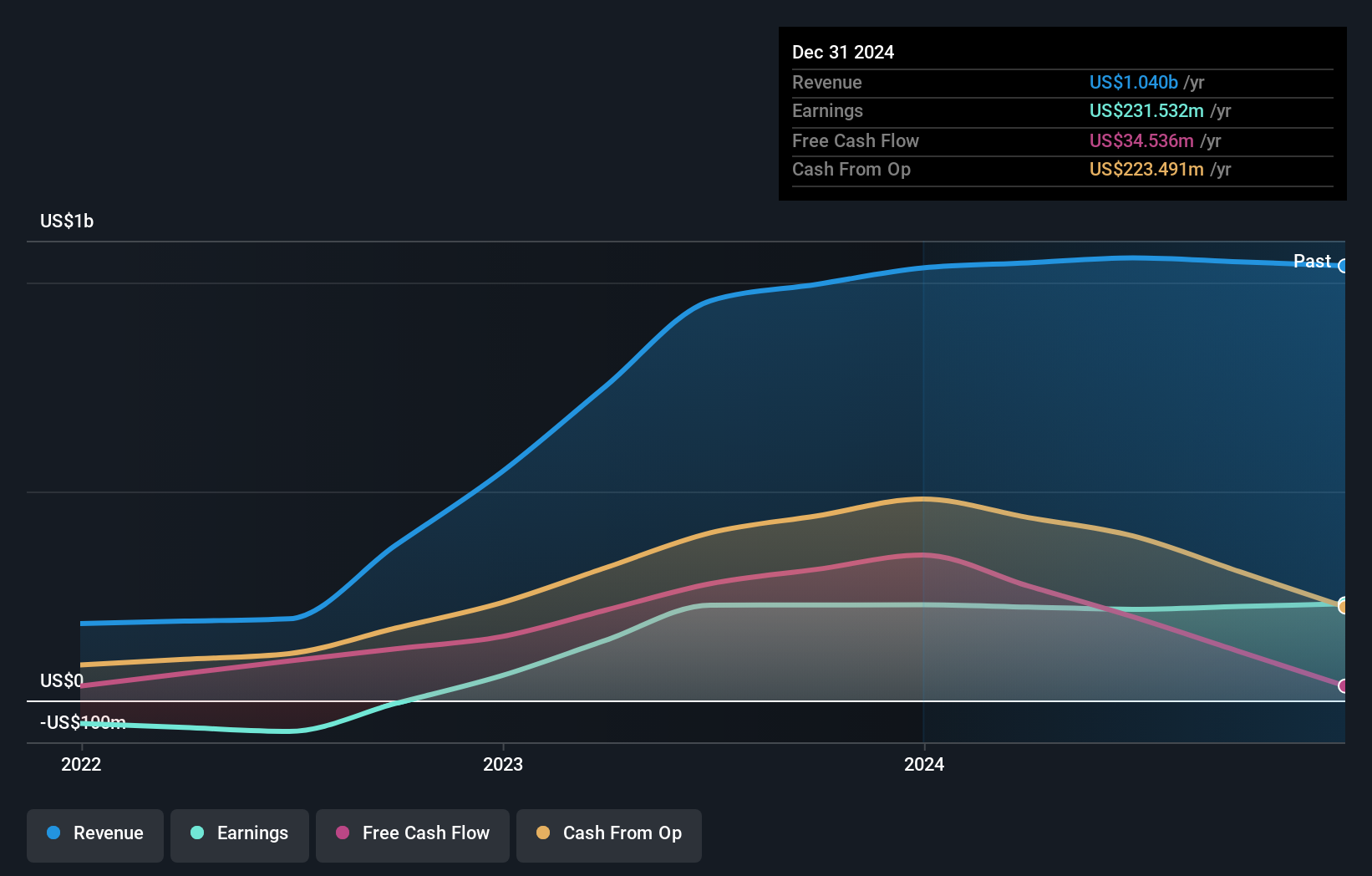

Operations: The company's primary revenue stream is from coal mining, generating $1.04 billion. With a focus on coking coal products sold in China, financial performance is influenced by market demand and operational efficiency.

Mongolian Mining, a relatively small player in the industry, offers an intriguing profile with its price-to-earnings ratio at 4.8x, significantly lower than the Hong Kong market's average of 12x. Despite a modest earnings growth of 1.2% last year compared to the industry's robust 40.2%, it boasts high-quality past earnings and strong interest coverage at 13.4 times EBIT over debt payments. Over five years, its net debt to equity ratio impressively dropped from 51.7% to a satisfactory 17.1%. While not outpacing industry growth, these financial metrics suggest potential stability and value within this niche sector.

Shareate Tools (SHSE:688257)

Simply Wall St Value Rating: ★★★★★★

Overview: Shareate Tools Ltd. is a Chinese company that manufactures and sells cemented carbide products and drilling tools, with a market capitalization of CN¥4.83 billion.

Operations: The company generates revenue primarily from the sale of cemented carbide products and drilling tools. With a market capitalization of CN¥4.83 billion, Shareate Tools Ltd.'s financial performance includes a net profit margin trend worth noting, reflecting its operational efficiency in the manufacturing sector.

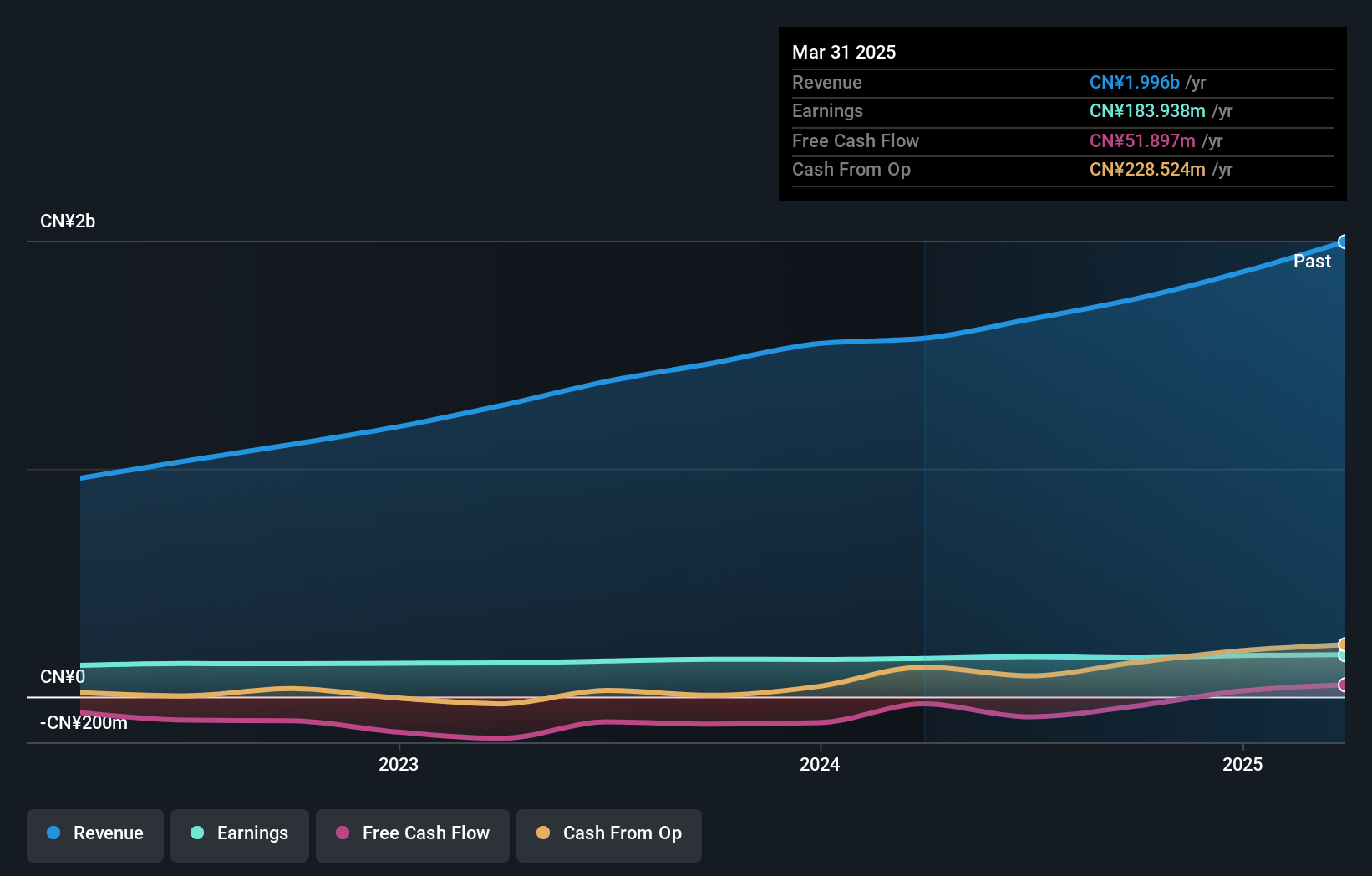

Shareate Tools, a smaller player in the machinery sector, reported impressive earnings growth of 9.6% over the past year, outpacing the industry's 1%. Its recent Q1 2025 results showed sales climbing to CNY 528.31 million from CNY 394.42 million a year prior, with net income rising to CNY 46.19 million. The company boasts high-quality earnings and a satisfactory net debt to equity ratio of just 1.9%, indicating financial stability despite market volatility in recent months. With its price-to-earnings ratio at an attractive level of 26.3x compared to the CN market's average of 41.5x, it presents potential value for investors seeking growth opportunities in Asia's dynamic landscape.

- Navigate through the intricacies of Shareate Tools with our comprehensive health report here.

Explore historical data to track Shareate Tools' performance over time in our Past section.

Summing It All Up

- Discover the full array of 2605 Asian Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688257

Shareate Tools

Manufactures and sells cemented carbide products and drilling tools in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives