Aofu Environmental Technology Co.,Ltd. (SHSE:688021) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Aofu Environmental Technology Co.,Ltd. (SHSE:688021) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

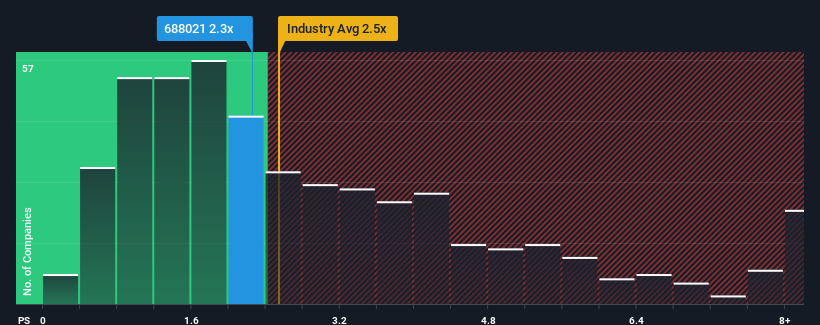

Although its price has dipped substantially, it's still not a stretch to say that Aofu Environmental TechnologyLtd's price-to-sales (or "P/S") ratio of 2.3x right now seems quite "middle-of-the-road" compared to the Machinery industry in China, where the median P/S ratio is around 2.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Aofu Environmental TechnologyLtd

How Aofu Environmental TechnologyLtd Has Been Performing

Recent times have been advantageous for Aofu Environmental TechnologyLtd as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Aofu Environmental TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Aofu Environmental TechnologyLtd would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 8.6% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 104% during the coming year according to the two analysts following the company. That's shaping up to be materially higher than the 24% growth forecast for the broader industry.

With this information, we find it interesting that Aofu Environmental TechnologyLtd is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Aofu Environmental TechnologyLtd's P/S

Aofu Environmental TechnologyLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Aofu Environmental TechnologyLtd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about these 2 warning signs we've spotted with Aofu Environmental TechnologyLtd.

If you're unsure about the strength of Aofu Environmental TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688021

Aofu Environmental TechnologyLtd

Engages in the manufacture and sale of ceramic products in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives