- China

- /

- Electrical

- /

- SHSE:600516

Three Companies That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, major indices like the Nasdaq Composite and S&P 500 have experienced volatility, with growth stocks underperforming compared to value shares. In such an environment, identifying stocks that may be priced below their estimated value can offer investors potential opportunities for long-term gains, especially when focusing on companies with strong fundamentals and resilient business models.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.27 | 49.9% |

| IMAGICA GROUP (TSE:6879) | ¥476.00 | ¥947.55 | 49.8% |

| Nordic Waterproofing Holding (OM:NWG) | SEK175.60 | SEK349.53 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.63 | US$168.45 | 49.8% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| On the Beach Group (LSE:OTB) | £1.534 | £3.07 | 50% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.45 | CN¥22.90 | 50% |

| KeePer Technical Laboratory (TSE:6036) | ¥3935.00 | ¥7851.33 | 49.9% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.67 | 49.8% |

| Energy One (ASX:EOL) | A$5.60 | A$10.94 | 48.8% |

We're going to check out a few of the best picks from our screener tool.

FangDa Carbon New MaterialLtd (SHSE:600516)

Overview: FangDa Carbon New Material Co., Ltd specializes in the research, development, production, and sale of carbon products both in China and internationally, with a market cap of CN¥21.53 billion.

Operations: FangDa Carbon New Material Co., Ltd's revenue is primarily derived from its activities in research, development, production, and sales of carbon products both domestically and internationally.

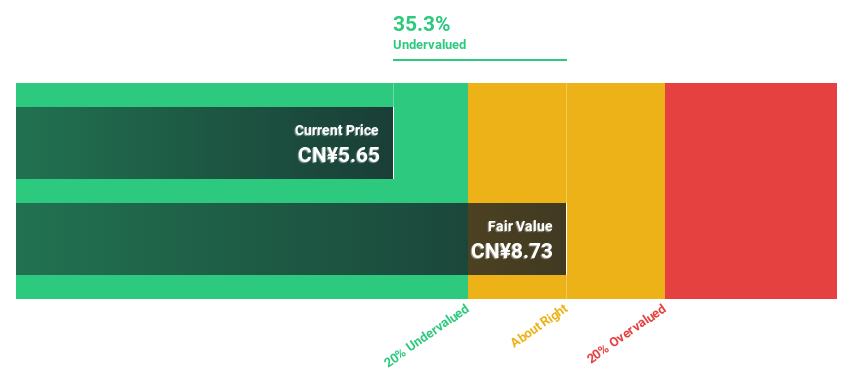

Estimated Discount To Fair Value: 36.4%

FangDa Carbon New Material Ltd. is trading at CN¥5.57, significantly below its estimated fair value of CN¥8.76, indicating potential undervaluation based on cash flows. Despite a drop in revenue and net income for the nine months ending September 2024, earnings are forecast to grow significantly over the next three years at 32.9% annually, outpacing the market's growth rate of 25.9%. A share buyback program may support shareholder value amidst these dynamics.

- Our growth report here indicates FangDa Carbon New MaterialLtd may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in FangDa Carbon New MaterialLtd's balance sheet health report.

Ningbo Haitian Precision MachineryLtd (SHSE:601882)

Overview: Ningbo Haitian Precision Machinery Co., Ltd. operates in the machinery industry and has a market capitalization of approximately CN¥12.29 billion.

Operations: Ningbo Haitian Precision Machinery Co., Ltd. generates its revenue from various segments within the machinery industry, contributing to its market capitalization of approximately CN¥12.29 billion.

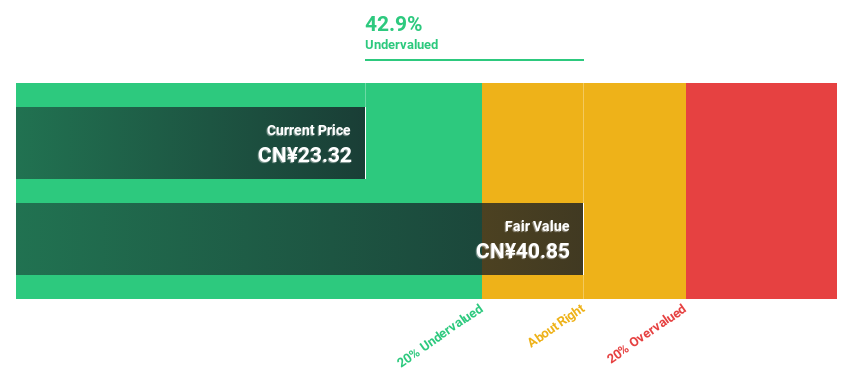

Estimated Discount To Fair Value: 42.5%

Ningbo Haitian Precision Machinery Ltd. is trading at CN¥23.54, well below its estimated fair value of CN¥40.91, highlighting potential undervaluation based on cash flows. Despite a decline in sales and net income for the nine months ending September 2024, earnings are expected to grow by 22.2% annually over the next three years, although this lags behind the broader market's growth rate of 25.9%. The company's return on equity is projected to reach a strong 20.8%.

- Our comprehensive growth report raises the possibility that Ningbo Haitian Precision MachineryLtd is poised for substantial financial growth.

- Dive into the specifics of Ningbo Haitian Precision MachineryLtd here with our thorough financial health report.

Zhejiang HangKe Technology (SHSE:688006)

Overview: Zhejiang HangKe Technology Incorporated Company specializes in the design, development, production, and sale of lithium-ion battery post-processing systems for the charging and discharging industry globally, with a market cap of approximately CN¥11.62 billion.

Operations: Revenue Segments (in millions of CN¥): Zhejiang HangKe Technology generates revenue through its lithium-ion battery post-processing systems for the charging and discharging sector both domestically and internationally.

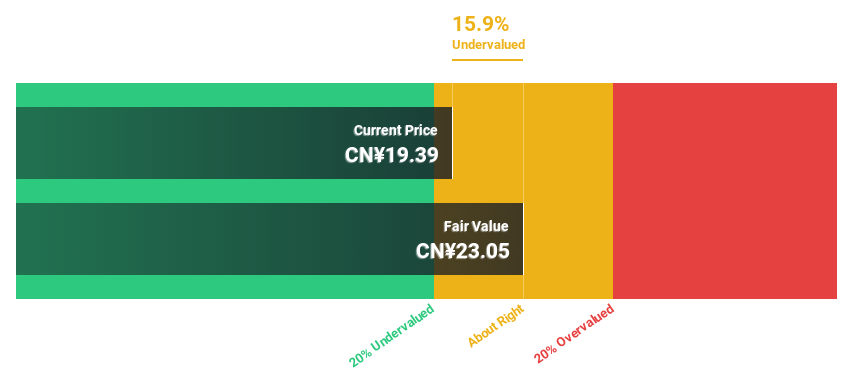

Estimated Discount To Fair Value: 16.7%

Zhejiang HangKe Technology is trading at CN¥19.25, approximately 16.7% below its estimated fair value of CN¥23.11, suggesting potential undervaluation based on cash flows. Despite a decrease in sales and net income for the first nine months of 2024, earnings are projected to grow significantly at 36.7% annually over the next three years, outpacing the Chinese market average growth rate of 25.9%. However, profit margins have declined from last year’s figures.

- The analysis detailed in our Zhejiang HangKe Technology growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang HangKe Technology.

Seize The Opportunity

- Embark on your investment journey to our 963 Undervalued Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600516

FangDa Carbon New MaterialLtd

Engages in the research and development, production, and sale of carbon products in China and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.