- China

- /

- Electronic Equipment and Components

- /

- SZSE:301051

High Growth Tech Stocks To Explore This November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, small-cap stocks have demonstrated resilience amidst broader market volatility, with the Russell 2000 Index showing modest gains even as major indices like the Nasdaq Composite and S&P MidCap 400 experienced fluctuations. In this dynamic environment, identifying high growth tech stocks involves looking for companies that not only show strong fundamentals but also possess the agility to adapt to rapidly changing market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Bluebik Group (SET:BBIK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bluebik Group Public Company Limited, with a market cap of THB8.70 billion, offers strategic and digital technology consulting services in Thailand through its subsidiaries.

Operations: The company generates revenue primarily from Digital Excellence and Delivery, contributing THB1.31 billion, followed by Management Consulting at THB72.95 million and Strategic Project Management Office at THB25.72 million. The Big Data segment adds THB114.52 million to the revenue stream but is offset by eliminations of THB103.61 million.

Bluebik Group's recent performance and strategic decisions underscore its potential in the tech sector, despite mixed financial results. In the last year, earnings surged by 37.2%, outpacing the IT industry's growth of 4.3%. Looking ahead, earnings are projected to climb at an impressive rate of 22.9% annually, significantly above Thailand's market average of 15.3%. However, a recent dip in net income—from THB 67.02 million to THB 41.27 million in Q2—alongside leadership changes could signal challenges needing careful navigation. This backdrop of robust growth forecasts juxtaposed with operational hurdles presents a dynamic landscape for Bluebik Group as it moves forward.

- Unlock comprehensive insights into our analysis of Bluebik Group stock in this health report.

Review our historical performance report to gain insights into Bluebik Group's's past performance.

UniTTECLtd (SZSE:000925)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: UniTTEC Co., Ltd offers integrated solutions for rail transit and energy saving and environmental protection in China, with a market cap of CN¥4.79 billion.

Operations: UniTTEC Co., Ltd focuses on providing integrated solutions for rail transit and energy-saving initiatives in China. The company's business model leverages its expertise in these sectors to generate revenue, though specific financial data regarding revenue streams or cost breakdowns is not detailed.

UniTTECLtd's recent financials reflect a challenging landscape, with a notable revenue dip to CNY 1.1 billion from last year's CNY 1.35 billion and an increased net loss of CNY 87.21 million, up from CNY 27.44 million. Despite these hurdles, the company is poised for recovery, projecting an aggressive earnings growth of 70.4% annually. This optimism is underpinned by a robust commitment to innovation, as evidenced by R&D expenses maintaining a significant portion of revenue at 16.4%. These figures suggest that UniTTECLtd is strategically investing in future capabilities while navigating current financial pressures—an approach that could reshape its market standing as it moves towards profitability.

- Take a closer look at UniTTECLtd's potential here in our health report.

Gain insights into UniTTECLtd's past trends and performance with our Past report.

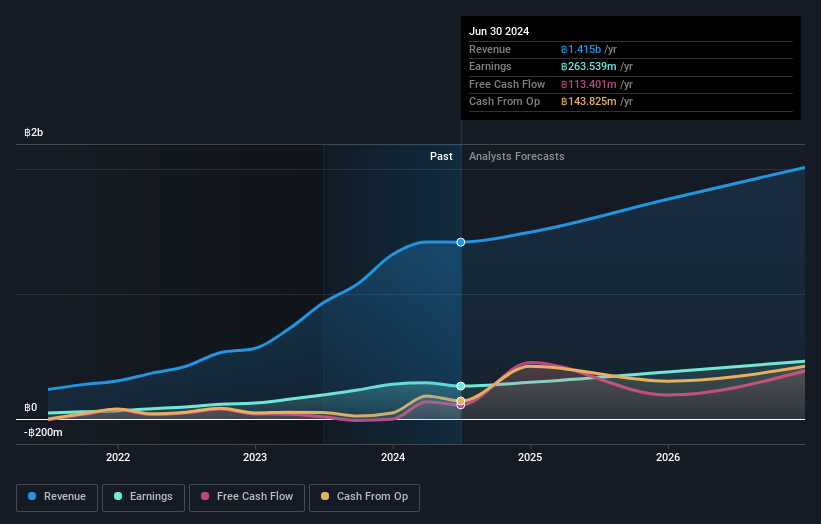

Shenzhen Xinhao Photoelectricity Technology (SZSE:301051)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Xinhao Photoelectricity Technology Co., Ltd specializes in the research, development, manufacture, and sale of precision optical components with a market capitalization of CN¥4.82 billion.

Operations: Xinhao Photoelectricity focuses on producing precision optical components, leveraging its expertise in research and development to drive sales. The company's operations are underpinned by its manufacturing capabilities, contributing significantly to its revenue streams.

Shenzhen Xinhao Photoelectricity Technology has demonstrated resilience despite a challenging financial year, with recent reports showing a slight increase in revenue to CNY 1.23 billion from CNY 1.22 billion year-over-year, though it shifted from a net profit to a substantial net loss of CNY 206.71 million. This downturn reflects broader market challenges but is juxtaposed against an aggressive forecast for revenue growth at an annual rate of 86.8% and earnings expected to surge by 146.07%. The company's commitment to innovation remains robust, evidenced by its strategic allocation towards R&D, crucial for sustaining long-term competitiveness in the high-tech industry. These investments are pivotal as Shenzhen Xinhao aims to pivot from current losses to anticipated profitability within three years, aligning with market expectations for significant growth above the industry standard.

- Click here to discover the nuances of Shenzhen Xinhao Photoelectricity Technology with our detailed analytical health report.

Understand Shenzhen Xinhao Photoelectricity Technology's track record by examining our Past report.

Make It Happen

- Discover the full array of 1288 High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301051

Shenzhen Xinhao Photoelectricity Technology

Engages in the research and development, manufacture, and sale of precision optical components.

High growth potential with mediocre balance sheet.