- China

- /

- Electrical

- /

- SHSE:688006

Capital Allocation Trends At Zhejiang HangKe Technology (SHSE:688006) Aren't Ideal

There are a few key trends to look for if we want to identify the next multi-bagger. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Having said that, from a first glance at Zhejiang HangKe Technology (SHSE:688006) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Zhejiang HangKe Technology, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.067 = CN¥359m ÷ (CN¥9.6b - CN¥4.3b) (Based on the trailing twelve months to September 2024).

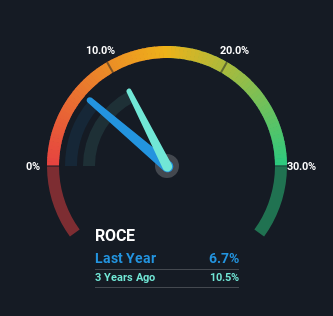

Therefore, Zhejiang HangKe Technology has an ROCE of 6.7%. On its own, that's a low figure but it's around the 5.8% average generated by the Electrical industry.

Check out our latest analysis for Zhejiang HangKe Technology

In the above chart we have measured Zhejiang HangKe Technology's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Zhejiang HangKe Technology .

How Are Returns Trending?

In terms of Zhejiang HangKe Technology's historical ROCE movements, the trend isn't fantastic. Around five years ago the returns on capital were 14%, but since then they've fallen to 6.7%. Given the business is employing more capital while revenue has slipped, this is a bit concerning. This could mean that the business is losing its competitive advantage or market share, because while more money is being put into ventures, it's actually producing a lower return - "less bang for their buck" per se.

On a side note, Zhejiang HangKe Technology's current liabilities are still rather high at 45% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

What We Can Learn From Zhejiang HangKe Technology's ROCE

In summary, we're somewhat concerned by Zhejiang HangKe Technology's diminishing returns on increasing amounts of capital. Long term shareholders who've owned the stock over the last five years have experienced a 38% depreciation in their investment, so it appears the market might not like these trends either. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

Zhejiang HangKe Technology does have some risks, we noticed 3 warning signs (and 1 which is significant) we think you should know about.

While Zhejiang HangKe Technology may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang HangKe Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688006

Zhejiang HangKe Technology

Designs, develops, produces, and sells lithium-ion (Li-ion) battery post-processing systems for the rechargeable batteries in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives