- China

- /

- Electrical

- /

- SHSE:688005

Improved Revenues Required Before Ningbo Ronbay New Energy Technology Co.,Ltd. (SHSE:688005) Shares Find Their Feet

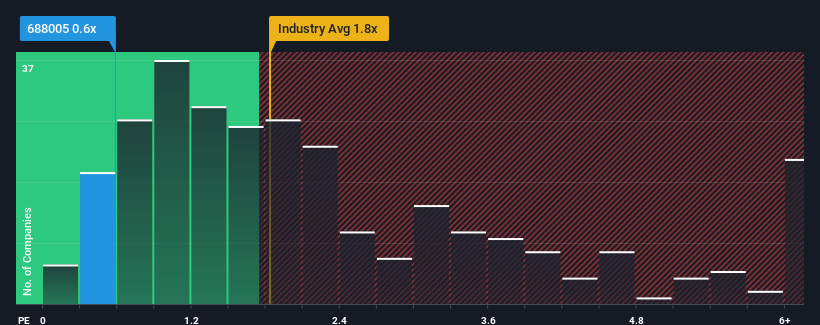

You may think that with a price-to-sales (or "P/S") ratio of 0.6x Ningbo Ronbay New Energy Technology Co.,Ltd. (SHSE:688005) is a stock worth checking out, seeing as almost half of all the Electrical companies in China have P/S ratios greater than 1.8x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ningbo Ronbay New Energy TechnologyLtd

How Has Ningbo Ronbay New Energy TechnologyLtd Performed Recently?

While the industry has experienced revenue growth lately, Ningbo Ronbay New Energy TechnologyLtd's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ningbo Ronbay New Energy TechnologyLtd.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Ningbo Ronbay New Energy TechnologyLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 47% decrease to the company's top line. Even so, admirably revenue has lifted 171% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 15% over the next year. That's shaping up to be materially lower than the 24% growth forecast for the broader industry.

In light of this, it's understandable that Ningbo Ronbay New Energy TechnologyLtd's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Ningbo Ronbay New Energy TechnologyLtd's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Ningbo Ronbay New Energy TechnologyLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Ningbo Ronbay New Energy TechnologyLtd, and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Ronbay New Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688005

Ningbo Ronbay New Energy TechnologyLtd

Ningbo Ronbay New Energy Technology Co.,Ltd.

High growth potential slight.