We Think That There Are More Issues For Nanjing Canatal Data-Centre Environmental Tech (SHSE:603912) Than Just Sluggish Earnings

Nanjing Canatal Data-Centre Environmental Tech Co., Ltd's (SHSE:603912) stock wasn't much affected by its recent lackluster earnings numbers. We did some digging, and we believe that investors are missing some worrying factors underlying the profit figures.

Check out our latest analysis for Nanjing Canatal Data-Centre Environmental Tech

A Closer Look At Nanjing Canatal Data-Centre Environmental Tech's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

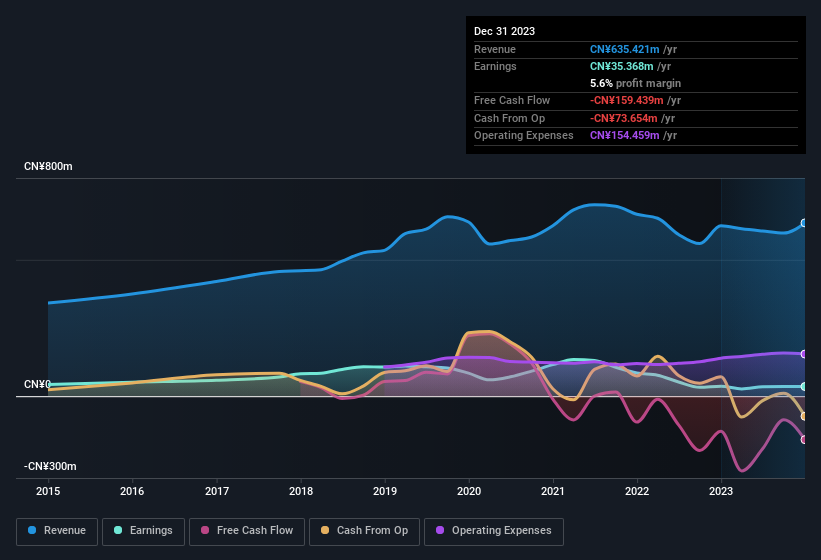

Over the twelve months to December 2023, Nanjing Canatal Data-Centre Environmental Tech recorded an accrual ratio of 0.22. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Even though it reported a profit of CN¥35.4m, a look at free cash flow indicates it actually burnt through CN¥159m in the last year. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of CN¥159m, this year, indicates high risk. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Nanjing Canatal Data-Centre Environmental Tech.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Nanjing Canatal Data-Centre Environmental Tech issued 27% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Nanjing Canatal Data-Centre Environmental Tech's EPS by clicking here.

A Look At The Impact Of Nanjing Canatal Data-Centre Environmental Tech's Dilution On Its Earnings Per Share (EPS)

Nanjing Canatal Data-Centre Environmental Tech's net profit dropped by 69% per year over the last three years. Even looking at the last year, profit was still down 3.1%. Sadly, earnings per share fell further, down a full 22% in that time. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, if Nanjing Canatal Data-Centre Environmental Tech's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that Nanjing Canatal Data-Centre Environmental Tech's profit was boosted by unusual items worth CN¥11m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Nanjing Canatal Data-Centre Environmental Tech had a rather significant contribution from unusual items relative to its profit to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Nanjing Canatal Data-Centre Environmental Tech's Profit Performance

In conclusion, Nanjing Canatal Data-Centre Environmental Tech's weak accrual ratio suggested its statutory earnings have been inflated by the unusual items. Meanwhile, the new shares issued mean that shareholders now own less of the company, unless they tipped in more cash themselves. For all the reasons mentioned above, we think that, at a glance, Nanjing Canatal Data-Centre Environmental Tech's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. To help with this, we've discovered 4 warning signs (3 are a bit unpleasant!) that you ought to be aware of before buying any shares in Nanjing Canatal Data-Centre Environmental Tech.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Canatal Data-Centre Environmental Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603912

Nanjing Canatal Data-Centre Environmental Tech

Engages in the research and development, and sale of integrated solutions for the computer room environment in China and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives