- China

- /

- Electrical

- /

- SHSE:688517

3 Dividend Stocks To Enhance Your Portfolio With Yields Up To 7.1%

Reviewed by Simply Wall St

As global markets show resilience with U.S. stock indexes nearing record highs and inflation concerns influencing monetary policy, investors are keenly observing opportunities that can provide both stability and income in their portfolios. In this environment, dividend stocks stand out as a compelling choice for those seeking to enhance their portfolio with reliable yields, potentially offering a buffer against market volatility while delivering consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.95% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.01% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1991 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

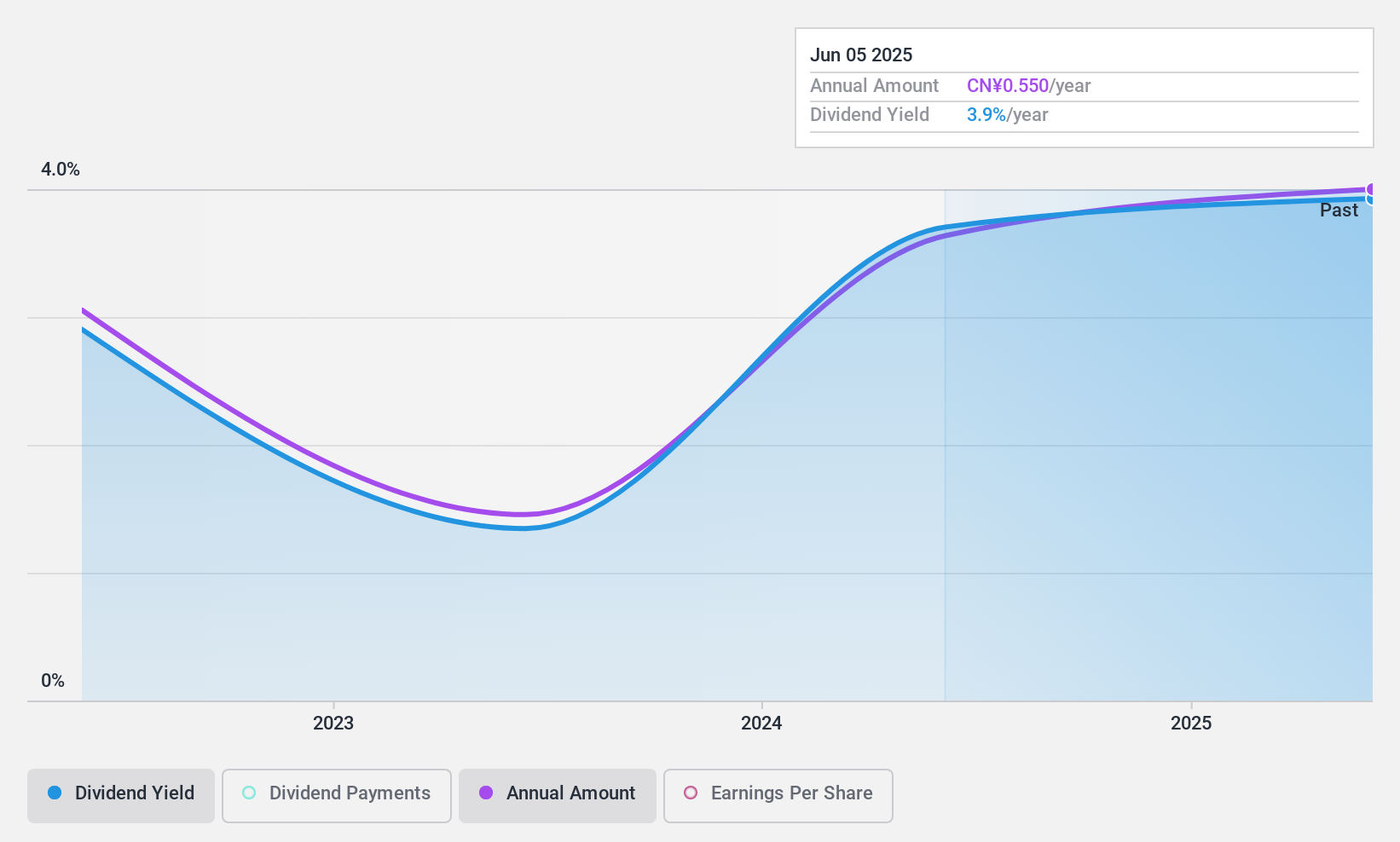

Warom Technology (SHSE:603855)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Warom Technology Incorporated Company researches, develops, manufactures, and supplies explosion-proof electric apparatus and professional lighting equipment in China and internationally, with a market cap of CN¥6.84 billion.

Operations: Warom Technology's revenue primarily comes from its development, manufacturing, and supply of explosion-proof electric apparatus and professional lighting equipment in both domestic and international markets.

Dividend Yield: 4.8%

Warom Technology offers a compelling dividend profile with payments that have been stable and growing over its 7-year history, despite being relatively new to dividends. The company maintains a payout ratio of 68.9%, ensuring dividends are covered by earnings, while the cash payout ratio stands at 75.3%. Trading at good value and below estimated fair value, Warom’s dividend yield is among the top quartile in China at 4.84%.

- Unlock comprehensive insights into our analysis of Warom Technology stock in this dividend report.

- The analysis detailed in our Warom Technology valuation report hints at an deflated share price compared to its estimated value.

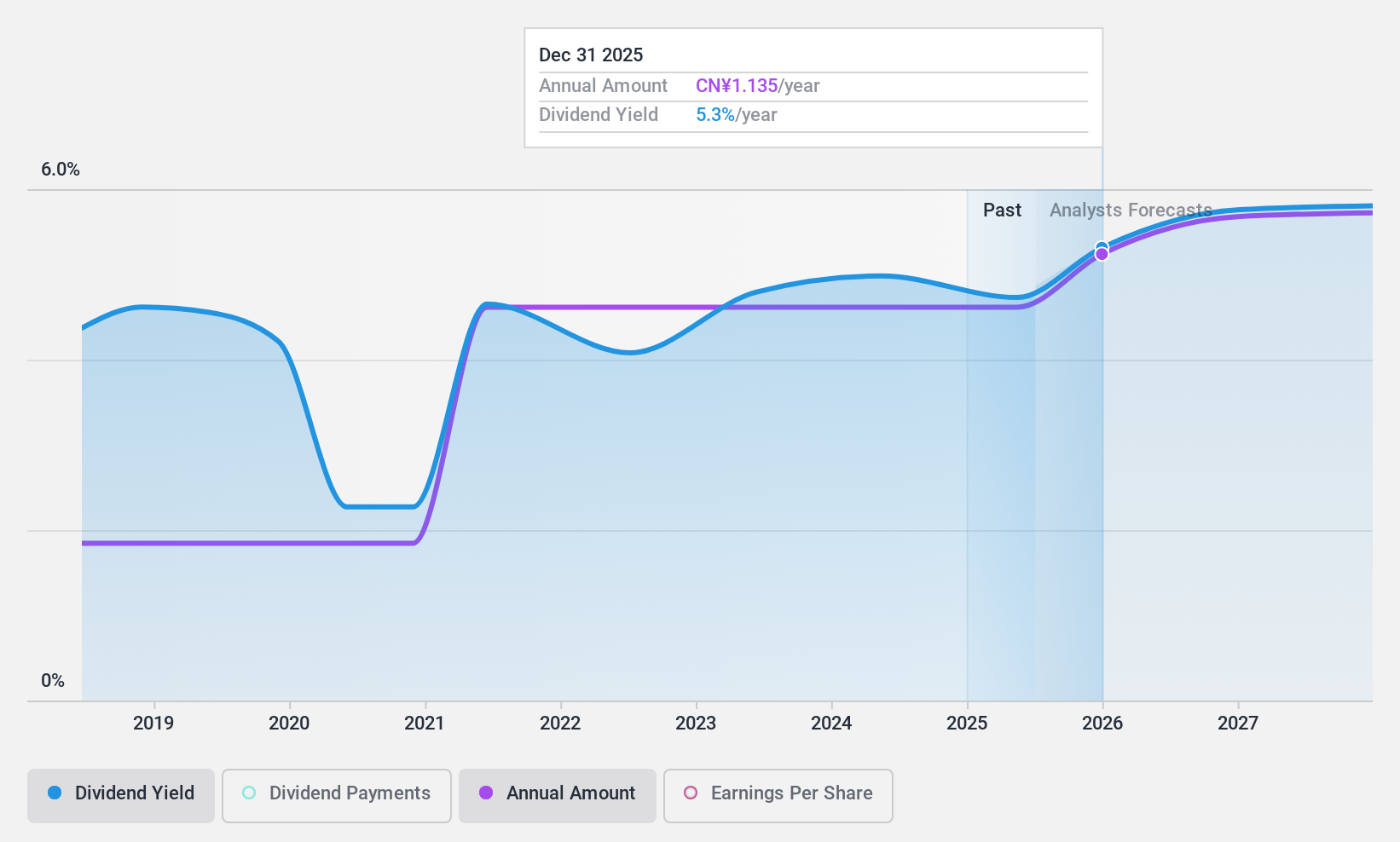

JinGuan Electric (SHSE:688517)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JinGuan Electric Co., Ltd. specializes in the research, development, and manufacture of lightning arresters in China and has a market cap of CN¥1.89 billion.

Operations: JinGuan Electric Co., Ltd. generates revenue primarily from its Electric Equipment segment, amounting to CN¥681.61 million.

Dividend Yield: 3.6%

JinGuan Electric's dividend payments have increased over the past three years, supported by a payout ratio of 68.3% and a cash payout ratio of 51.9%, indicating coverage by both earnings and cash flows. Despite being in the top 25% for dividend yield in China at 3.57%, its dividends have been volatile and unreliable, with less than ten years of payment history. The stock trades significantly below its estimated fair value.

- Click to explore a detailed breakdown of our findings in JinGuan Electric's dividend report.

- Our valuation report unveils the possibility JinGuan Electric's shares may be trading at a discount.

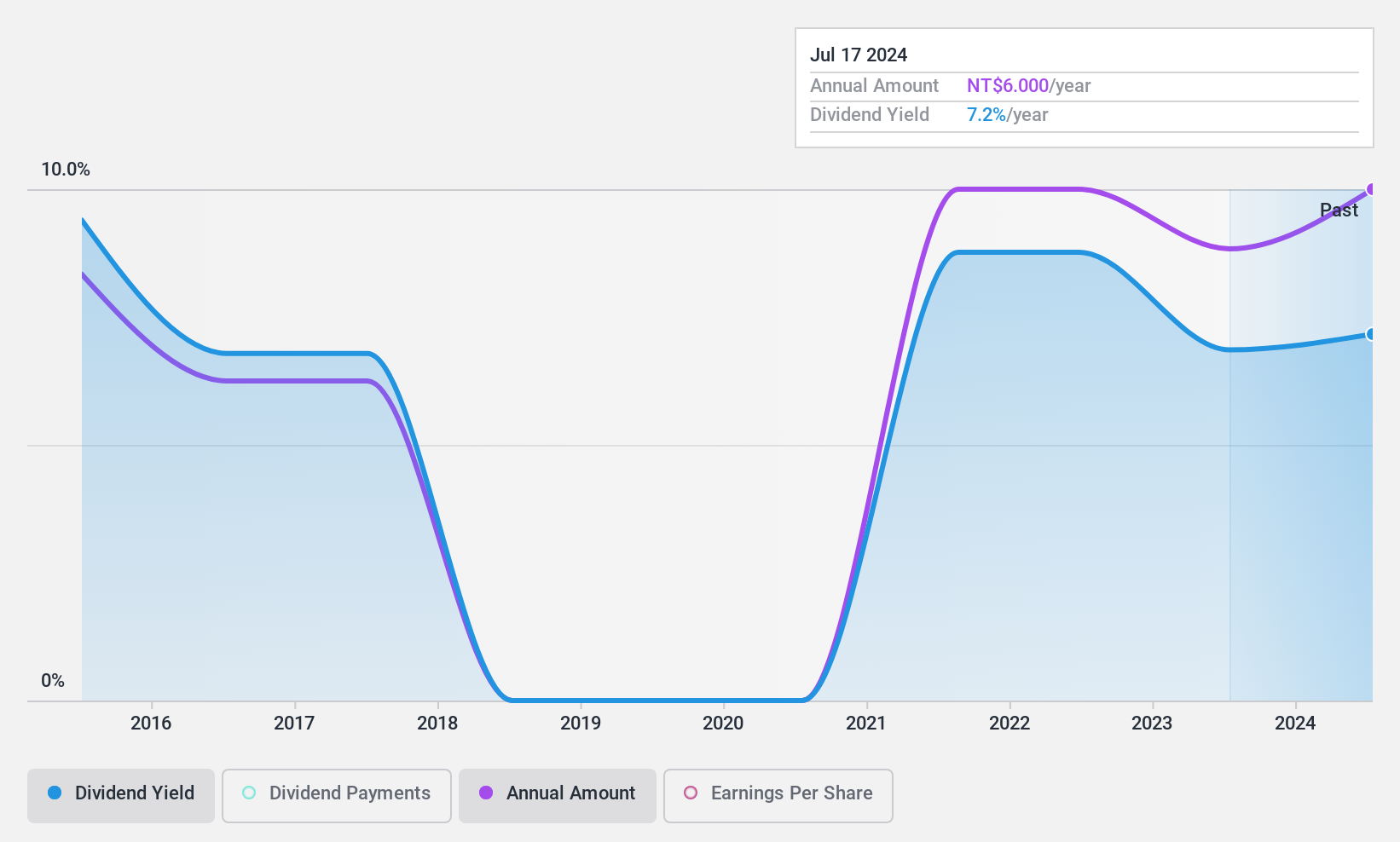

Interactive Digital Technologies (TPEX:6486)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Interactive Digital Technologies Inc. offers professional consulting and implementation services in telecom, media, IT and cloud, and geographical information systems in Taiwan, with a market cap of NT$4.27 billion.

Operations: Interactive Digital Technologies Inc. generates revenue from its Internet Telephone segment, which amounts to NT$2.70 billion.

Dividend Yield: 7.2%

Interactive Digital Technologies offers a high dividend yield of 7.15%, placing it in the top 25% within the TW market. However, its dividends have been volatile and unreliable over the past decade, with payments not fully covered by earnings due to a high payout ratio of 91.6%. Despite recent earnings growth of 30.4%, shareholder dilution and dividend volatility raise concerns about sustainability, though cash flows do cover dividends with a cash payout ratio of 67.1%.

- Click here to discover the nuances of Interactive Digital Technologies with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Interactive Digital Technologies shares in the market.

Where To Now?

- Discover the full array of 1991 Top Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688517

JinGuan Electric

Jinguan Electric Co., Ltd. engages in the research and development, and manufacture of lightning arresters in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives