Discover None Exchange's Hidden Opportunities With These 3 Undiscovered Gems

Reviewed by Simply Wall St

As global markets continue to navigate economic uncertainties, with U.S. inflation accelerating and small-cap stocks lagging behind their larger counterparts, investors are increasingly seeking opportunities in less-explored areas of the market. In this environment, identifying stocks that demonstrate resilience and potential for growth amid volatility can be crucial for uncovering hidden gems within the market's overlooked corners.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Konya Kagit Sanayi ve Ticaret | 0.67% | 24.97% | 7.82% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Shanghai Sheng Jian Environment Technology (SHSE:603324)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Sheng Jian Environment Technology Co., Ltd. operates in the environmental technology sector, with a market capitalization of CN¥4.08 billion.

Operations: Shanghai Sheng Jian Environment Technology generates revenue primarily through its environmental technology services. The company reported a market capitalization of CN¥4.08 billion.

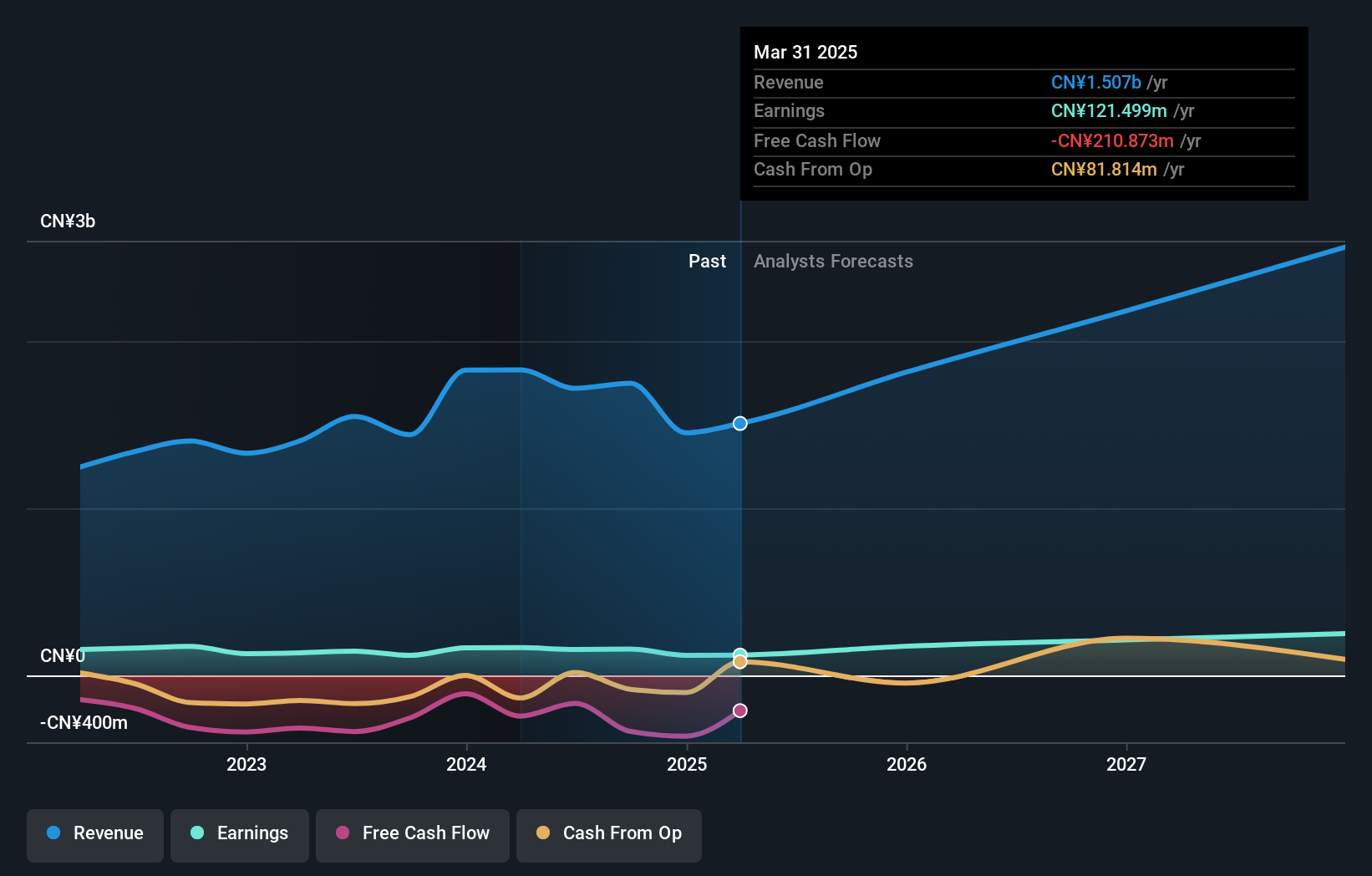

Shanghai Sheng Jian Environment Technology shows impressive growth with earnings up 31.9% over the past year, outpacing the Machinery industry's -0.06%. The company's net debt to equity ratio stands at a satisfactory 24.1%, and its interest payments are well covered by EBIT at 16.2 times, indicating solid financial health. Despite not being free cash flow positive, it has completed significant share repurchases totaling CNY 30.24 million recently, reflecting confidence in its valuation with a price-to-earnings ratio of 26.6x, which is attractive compared to the broader CN market's 37.9x average.

Henan Thinker Automatic EquipmentLtd (SHSE:603508)

Simply Wall St Value Rating: ★★★★★☆

Overview: Henan Thinker Automatic Equipment Co., Ltd. engages in the development and manufacturing of automatic equipment and software solutions, with a market capitalization of approximately CN¥9.01 billion.

Operations: Henan Thinker generates revenue primarily from its software and information technology services segment, which accounts for CN¥1.35 billion. The company's financial performance can be analyzed through its net profit margin, reflecting the profitability of its operations.

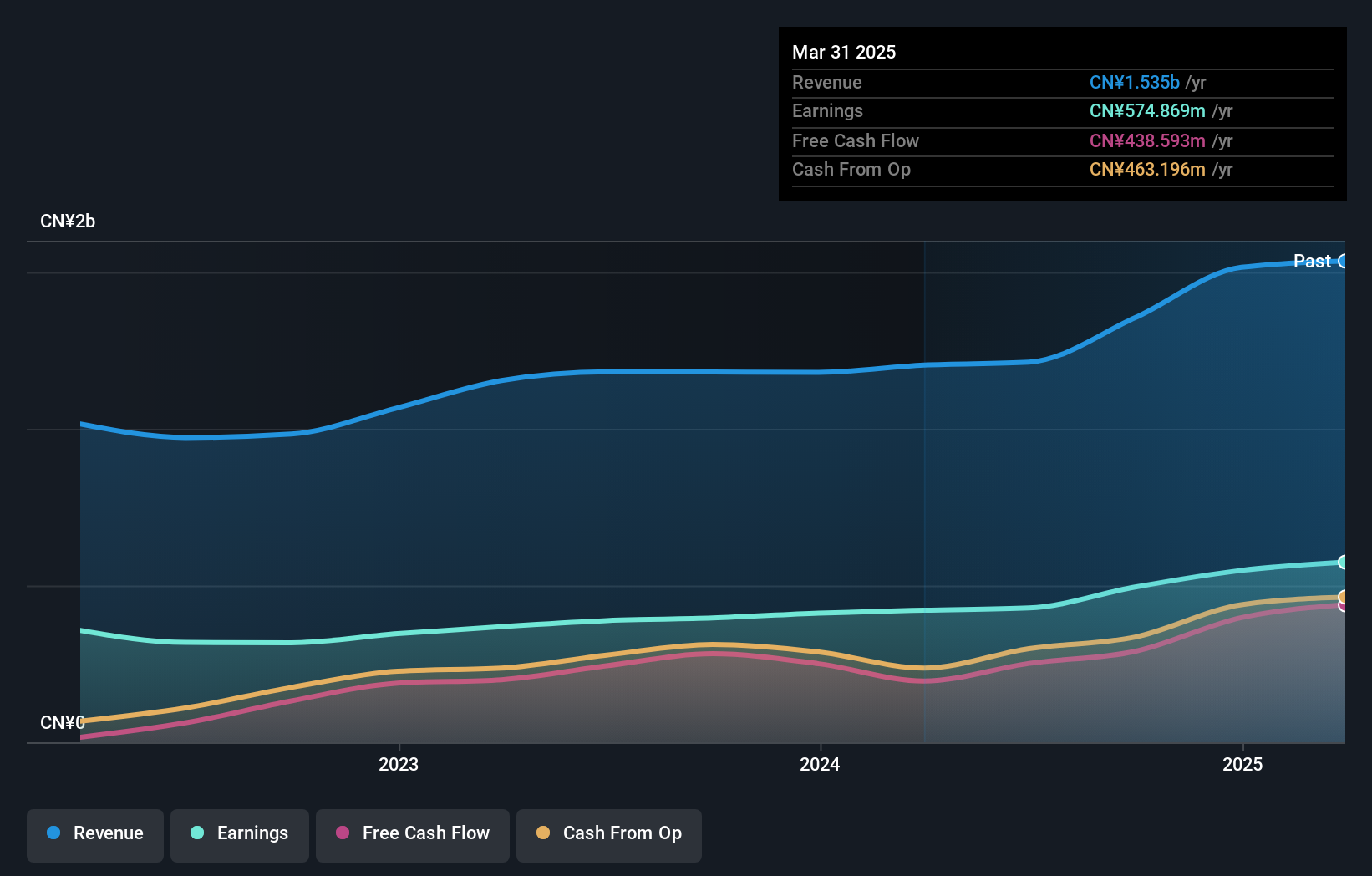

Henan Thinker Automatic Equipment Ltd., a nimble player in the machinery sector, has shown impressive growth with earnings rising 24.8% over the past year, outpacing the industry average of -0.06%. The debt to equity ratio increased slightly to 0.07% over five years, yet remains low and manageable given their cash position surpasses total debt. With a price-to-earnings ratio of 18.9x, it offers better value compared to the broader CN market at 37.9x. The company's ability to cover interest payments comfortably and its positive free cash flow further enhance its financial stability and attractiveness for potential investors looking for promising opportunities in this space.

Ferrotec (An Hui) Technology DevelopmentLTD (SZSE:301297)

Simply Wall St Value Rating: ★★★★★★

Overview: Ferrotec (An Hui) Technology Development Co., LTD specializes in providing semiconductor equipment precision cleaning services and has a market cap of CN¥14.28 billion.

Operations: The company generates revenue primarily from semiconductor equipment precision cleaning services. It recorded a gross profit margin of 45.6%, indicating efficient cost management in its operations.

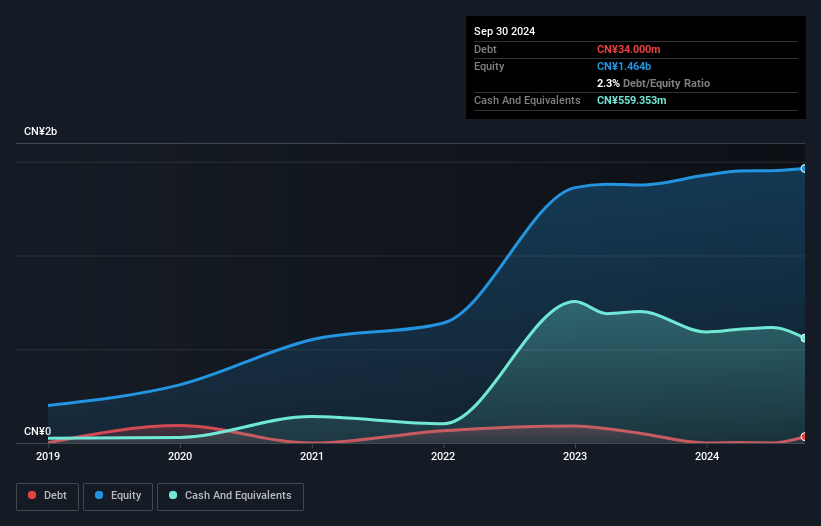

Ferrotec (An Hui) Technology Development Co., Ltd. has shown a promising trajectory with its debt to equity ratio dropping from 24.8% to 2.3% over five years, indicating improved financial health. Earnings have grown by 11%, outpacing the Commercial Services industry average of 1.7%. Despite a significant one-off gain of CN¥25M affecting recent results, the company remains profitable with free cash flow turning positive at CN¥52.8M as of September 2024, suggesting operational efficiency improvements. A special meeting in December discussed potential asset purchases via share offerings and convertible bonds, hinting at strategic growth plans ahead.

Summing It All Up

- Get an in-depth perspective on all 4747 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603324

Shanghai Shengjian Technology

Provides green technology services for manufacturing industry in the People’s Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives