- China

- /

- Electrical

- /

- SHSE:603366

Dawnrays Pharmaceutical (Holdings) And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

In a week marked by significant economic and earnings reports, global markets saw mixed performances with major indexes like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this backdrop, investors often look for opportunities in various market segments, including penny stocks—a term that may seem outdated but still highlights potential growth areas in smaller or newer companies. When these stocks are supported by solid financial health, they can offer unique opportunities for investors seeking to uncover hidden value.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$514.18M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.73 | MYR126.45M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.47 | £360.49M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £471.81M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.01 | MYR2.07B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

Click here to see the full list of 5,809 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Dawnrays Pharmaceutical (Holdings) (SEHK:2348)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dawnrays Pharmaceutical (Holdings) Limited is an investment holding company that develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally, with a market cap of HK$1.99 billion.

Operations: The company's revenue is primarily derived from its Finished Drugs segment, generating CN¥1.04 billion, and the Intermediates and Bulk Medicines segment, contributing CN¥130.31 million.

Market Cap: HK$2B

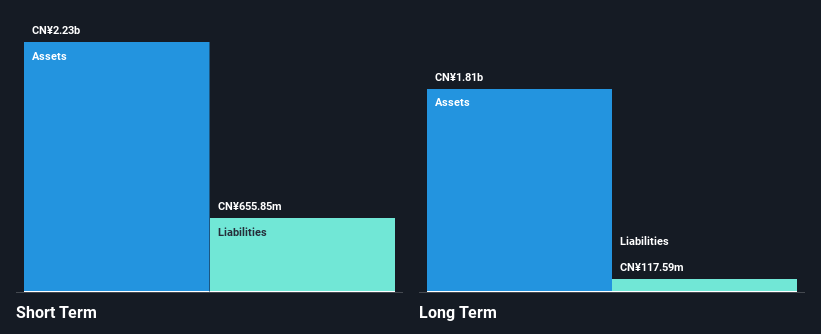

Dawnrays Pharmaceutical (Holdings) Limited demonstrates financial stability with CN¥2.2 billion in short-term assets, comfortably covering both its short and long-term liabilities. The company's earnings have shown robust growth, increasing by 27.3% over the past year, surpassing its five-year average of 13.1% annually and outpacing the industry growth rate of 6.4%. Despite a low Return on Equity at 17.1%, Dawnrays maintains a strong net profit margin of 52.2%, improved from last year's 33.9%. Recent executive changes include Ms. Yu Liwei's appointment as CEO, potentially influencing strategic direction moving forward.

- Take a closer look at Dawnrays Pharmaceutical (Holdings)'s potential here in our financial health report.

- Evaluate Dawnrays Pharmaceutical (Holdings)'s historical performance by accessing our past performance report.

China Brilliant Global (SEHK:8026)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Brilliant Global Limited is an investment holding company involved in the research and development, design, wholesale, and retail of gold and jewelry in Hong Kong and the People's Republic of China, with a market cap of HK$451.74 million.

Operations: The company's revenue is primarily derived from its Gold and Jewellery Business, which generated HK$71.81 million, followed by its Property Management Services Business at HK$16.98 million and Lending Business at HK$2.46 million.

Market Cap: HK$451.74M

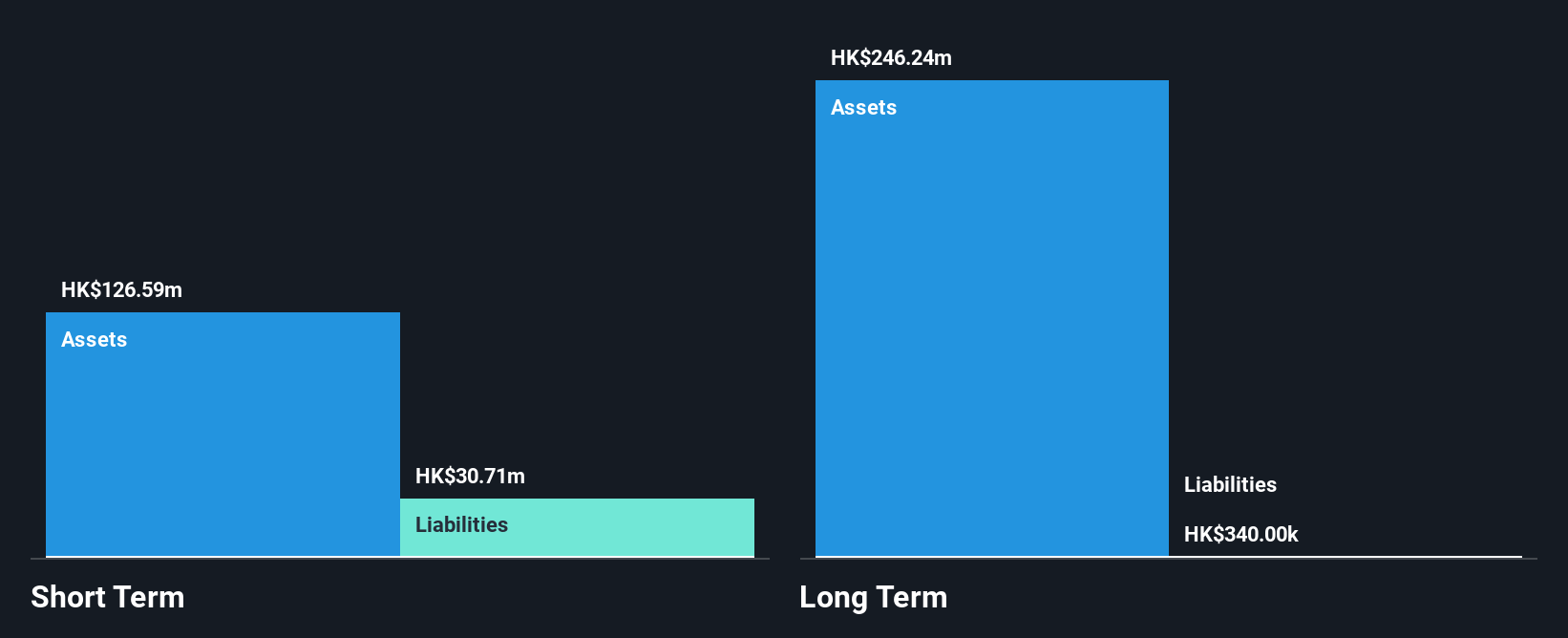

China Brilliant Global Limited, with a market cap of HK$451.74 million, primarily generates revenue from its Gold and Jewellery Business (HK$71.81 million). Despite being unprofitable, the company maintains a positive free cash flow and has a sufficient cash runway exceeding three years. Short-term assets of HK$122.7 million comfortably cover short-term liabilities of HK$41.1 million, while the net debt to equity ratio stands at a satisfactory 4.4%. Recent auditor changes saw Infinity CPA Limited appointed at the annual general meeting in September 2024, succeeding Elite Partners CPA Limited after their retirement decision earlier this year.

- Click to explore a detailed breakdown of our findings in China Brilliant Global's financial health report.

- Review our historical performance report to gain insights into China Brilliant Global's track record.

Solareast Holdings (SHSE:603366)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solareast Holdings Co., Ltd. is involved in the R&D, production, and sales of water heaters, kitchen appliances, clean energy heating, and water purification products both in China and internationally, with a market cap of CN¥3.88 billion.

Operations: No specific revenue segments are reported for Solareast Holdings, which engages in the development, manufacturing, and sale of various home appliances and clean energy products domestically and abroad.

Market Cap: CN¥3.88B

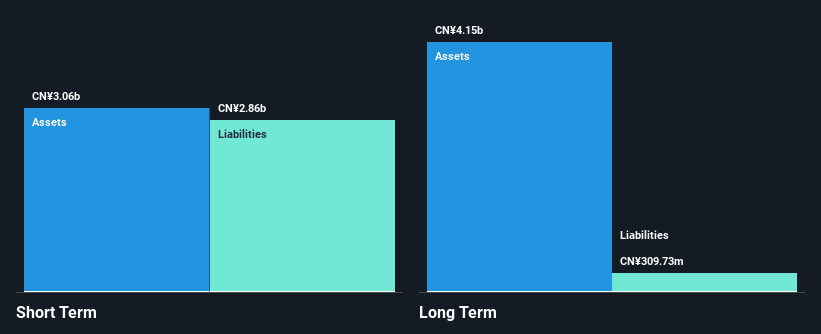

Solareast Holdings Co., Ltd., with a market cap of CN¥3.88 billion, demonstrates financial stability with short-term assets of CN¥3.1 billion exceeding both short and long-term liabilities. The company has reduced its debt to equity ratio significantly over five years, now at 6.4%, and maintains more cash than its total debt, indicating strong liquidity management. However, recent earnings show challenges; net income for the nine months ended September 2024 decreased to CN¥67.26 million from CN¥169.87 million a year ago, reflecting declining profit margins and negative earnings growth over the past year despite previously achieving profitability growth over five years.

- Click here to discover the nuances of Solareast Holdings with our detailed analytical financial health report.

- Understand Solareast Holdings' track record by examining our performance history report.

Where To Now?

- Reveal the 5,809 hidden gems among our Penny Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603366

Solareast Holdings

Engages in the research and development, production, and sales of water heaters, kitchen appliances, clean energy heating, water purification, and other businesses in China and internationally.

Excellent balance sheet low.