- China

- /

- Aerospace & Defense

- /

- SHSE:603261

Chengdu Lihang Technology Co,Ltd.'s (SHSE:603261) Popularity With Investors Under Threat As Stock Sinks 27%

The Chengdu Lihang Technology Co,Ltd. (SHSE:603261) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The last month has meant the stock is now only up 4.8% during the last year.

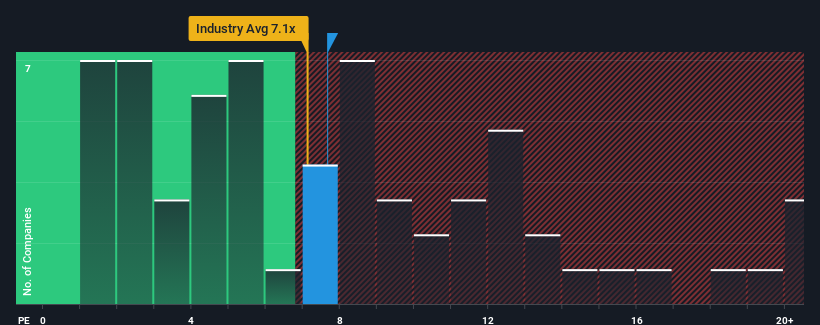

Even after such a large drop in price, there still wouldn't be many who think Chengdu Lihang Technology CoLtd's price-to-sales (or "P/S") ratio of 7.7x is worth a mention when the median P/S in China's Aerospace & Defense industry is similar at about 7.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Chengdu Lihang Technology CoLtd

How Has Chengdu Lihang Technology CoLtd Performed Recently?

Revenue has risen firmly for Chengdu Lihang Technology CoLtd recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chengdu Lihang Technology CoLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Chengdu Lihang Technology CoLtd would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Revenue has also lifted 24% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 26% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Chengdu Lihang Technology CoLtd is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Chengdu Lihang Technology CoLtd's P/S?

With its share price dropping off a cliff, the P/S for Chengdu Lihang Technology CoLtd looks to be in line with the rest of the Aerospace & Defense industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Chengdu Lihang Technology CoLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Chengdu Lihang Technology CoLtd (3 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Chengdu Lihang Technology CoLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603261

Chengdu Lihang Technology CoLtd

Chengdu Lihang Technology Co.,Ltd. engages in the production, maintenance, and support of aircraft in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives