As global markets experience fluctuations driven by economic data and trade negotiations, small-cap stocks are gaining attention for their potential to outperform larger indices. In this dynamic environment, discovering promising stocks requires a keen eye for companies with strong fundamentals and the ability to navigate the evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Otec | 9.34% | 5.51% | 13.05% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 45.53% | -12.49% | 10.72% | ★★★★★★ |

| Ascentech K.K | NA | 133.18% | 172.84% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.03% | -13.23% | -30.14% | ★★★★★★ |

| Anji Foodstuff | NA | 9.26% | -13.65% | ★★★★★★ |

| Sing Investments & Finance | 0.21% | 8.60% | 11.10% | ★★★★★☆ |

| Torigoe | 8.59% | 4.69% | 9.28% | ★★★★★☆ |

| Kondotec | 12.90% | 6.97% | 11.26% | ★★★★★☆ |

| Sunway | 26.60% | -2.70% | -27.94% | ★★★★★☆ |

| Huasi Holding | 16.28% | 5.13% | 20.61% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Elegant Home-Tech (SHSE:603221)

Simply Wall St Value Rating: ★★★★★☆

Overview: Elegant Home-Tech Co., Ltd. is involved in the research, development, production, and sales of polyvinyl chloride (PVC) elastic floorings both in China and internationally, with a market cap of CN¥4.12 billion.

Operations: Elegant Home-Tech generates revenue primarily through the sale of polyvinyl chloride (PVC) elastic floorings. The company focuses on both domestic and international markets, which diversifies its revenue streams. One key financial metric is its net profit margin, which provides insight into profitability trends over time.

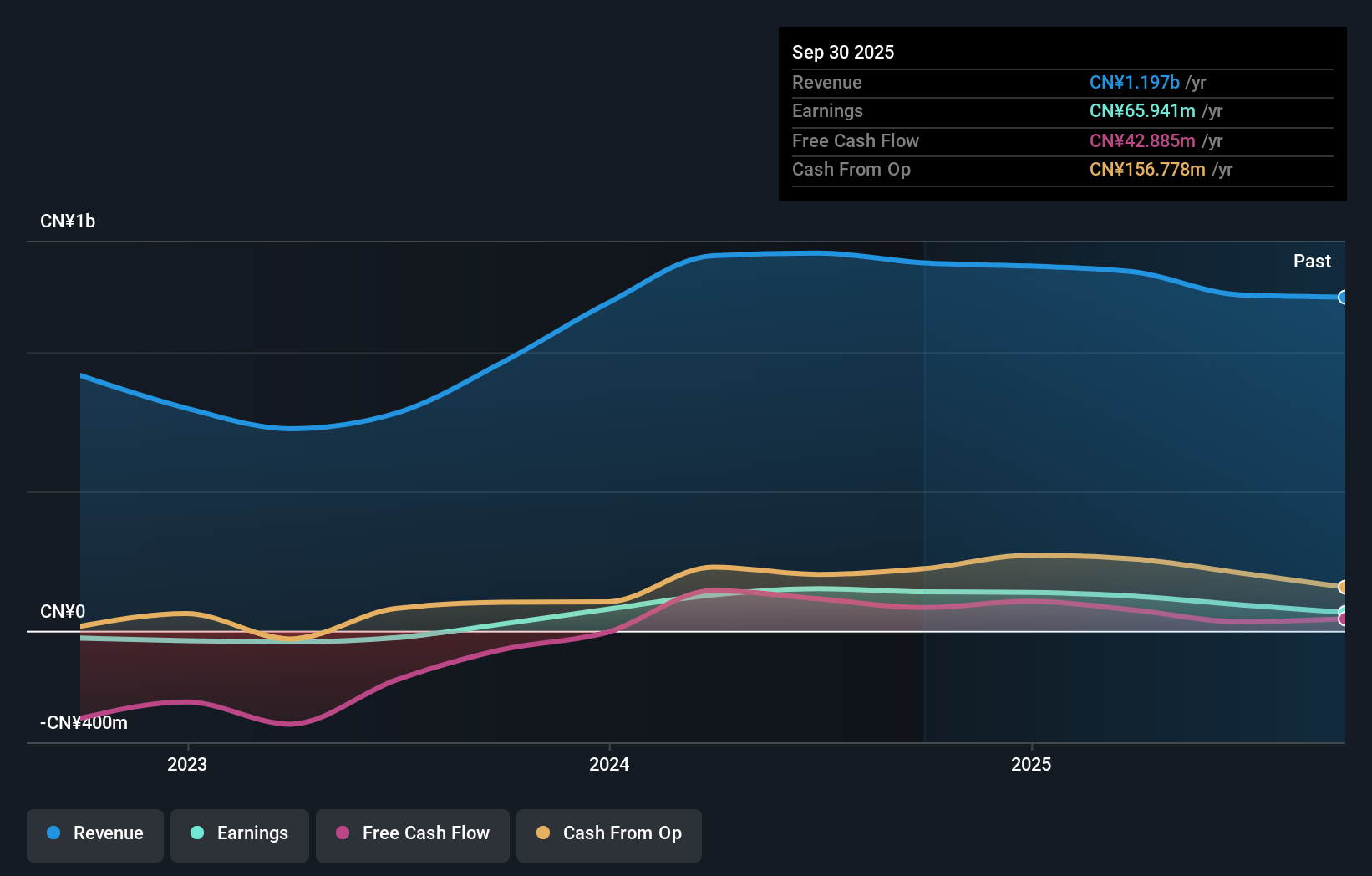

Elegant Home-Tech, a smaller player in the market, is intriguing due to its high-quality earnings and valuation trading at 41.8% below estimated fair value. Despite a negative earnings growth of 3.1%, which contrasts with the broader building industry's average of 21.9%, the company remains profitable, ensuring no immediate cash runway concerns. Its financial health appears solid with more cash than total debt and interest payments well-covered by EBIT at 15 times coverage. However, over five years, its debt-to-equity ratio has increased from 3% to 22.6%, indicating rising leverage that investors should monitor closely.

- Navigate through the intricacies of Elegant Home-Tech with our comprehensive health report here.

Examine Elegant Home-Tech's past performance report to understand how it has performed in the past.

Sichuan Huiyu Pharmaceutical (SHSE:688553)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sichuan Huiyu Pharmaceutical Co., Ltd. engages in the research, development, production, and sale of anti-tumor and injection drugs both in China and internationally, with a market cap of CN¥10.89 billion.

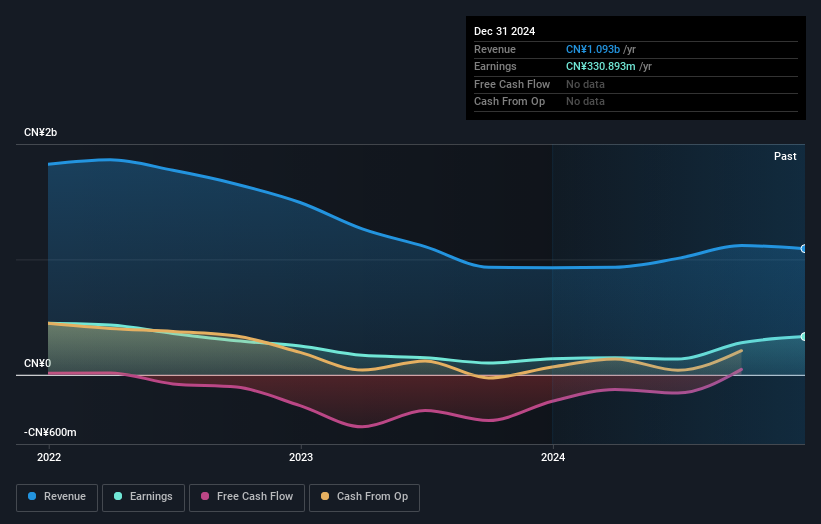

Operations: Huiyu Pharmaceutical generates revenue primarily from its medicine segment, totaling CN¥1.09 billion.

Sichuan Huiyu Pharmaceutical, a smaller player in the industry, shows a mixed financial landscape. Recent earnings growth of 71.4% outpaced the broader Pharmaceuticals sector's -3.4%, indicating strong performance despite past challenges. The price-to-earnings ratio stands at 43x, slightly below the CN market average of 44x, suggesting potential value for investors. However, with its debt to equity ratio climbing from 6.1% to 10.4% over five years and recent volatility in share prices, caution is advised. A notable one-off gain of CN¥166M impacted results for the year ending March 2025, hinting at some irregularities in earnings quality but also showcasing resilience amidst industry fluctuations.

- Delve into the full analysis health report here for a deeper understanding of Sichuan Huiyu Pharmaceutical.

Learn about Sichuan Huiyu Pharmaceutical's historical performance.

Ningbo Runhe High-Tech Materials (SZSE:300727)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Runhe High-Tech Materials Co., Ltd. operates in the silicone deep-processing and textile printing and dyeing additives sectors, with a market capitalization of CN¥7.85 billion.

Operations: Runhe High-Tech generates revenue primarily from silicone deep-processing products and textile printing and dyeing additives, contributing CN¥852.51 million and CN¥500.56 million, respectively.

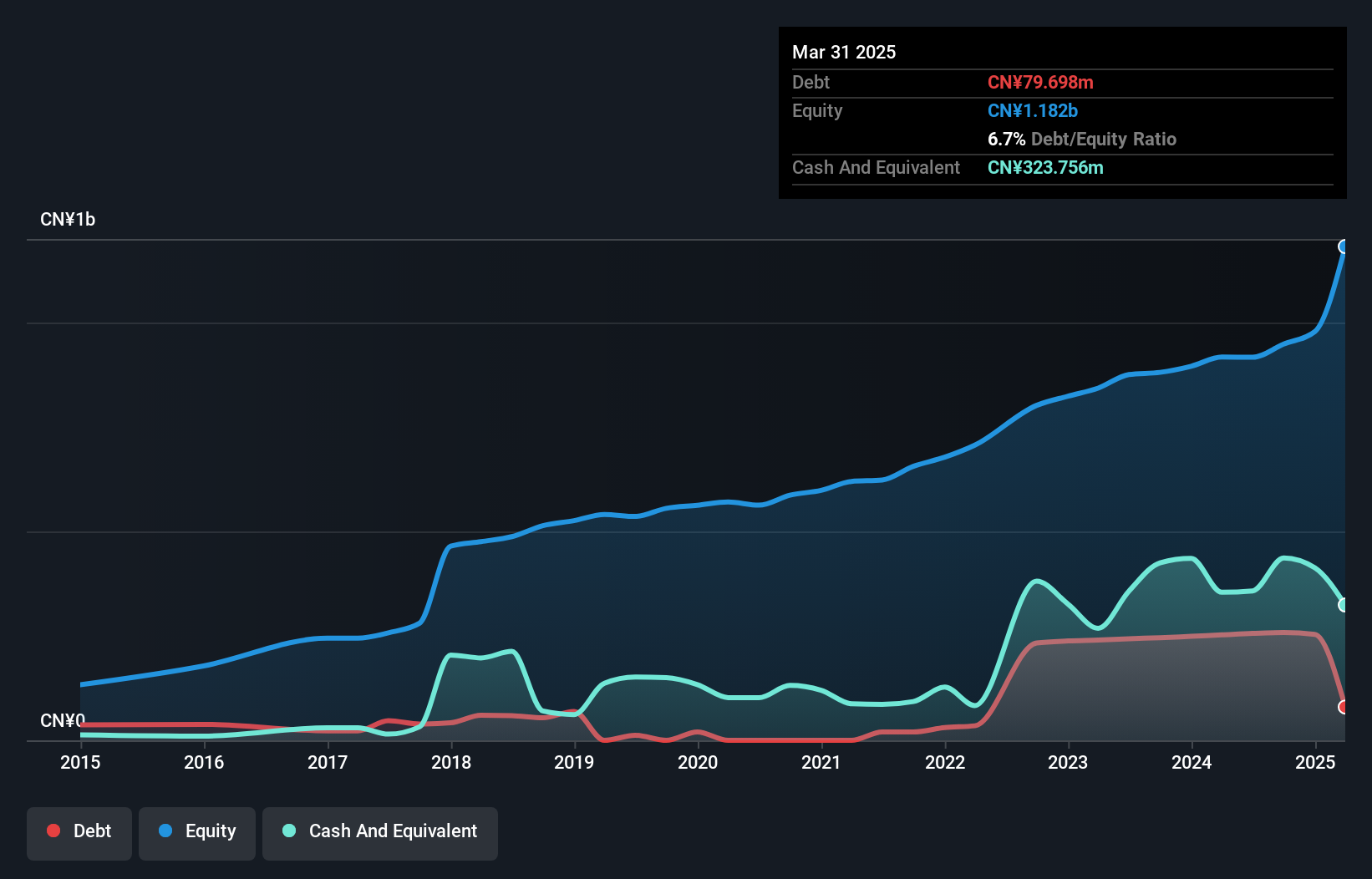

Ningbo Runhe High-Tech Materials, known for its robust performance in the chemicals sector, has shown impressive earnings growth of 30.5% over the past year, outpacing the industry's 1.8%. The company is debt-free and continues to operate without concerns over interest payments. Recent earnings results for the first half of 2025 revealed sales of CNY 677.81 million and a net income increase to CNY 57.75 million from CNY 41.66 million a year ago, highlighting its profitability strength despite volatile share prices recently observed in the market.

Taking Advantage

- Click here to access our complete index of 2443 Asian Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elegant Home-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603221

Elegant Home-Tech

Engages in the research and development, production, and sales of polyvinyl chloride (PVC) elastic floorings in China and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives