- China

- /

- Electrical

- /

- SHSE:603016

Undiscovered Gems In China To Explore This October 2024

Reviewed by Simply Wall St

As Chinese equities experience a lift from recent stimulus measures by the central bank, the Shanghai Composite Index and CSI 300 have shown positive momentum, contrasting with declines in other global markets. This environment presents an intriguing backdrop for investors seeking opportunities in underappreciated small-cap stocks, where potential growth may be found amidst broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zhejiang Kingland Pipeline and TechnologiesLtd | 1.99% | 3.49% | -8.00% | ★★★★★★ |

| Hangzhou Xili Intelligent TechnologyLtd | NA | 15.90% | 3.31% | ★★★★★★ |

| Guangdong Delian Group | 29.25% | 8.50% | -28.27% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| Jiangsu ChengXing Phosph-Chemicals | 74.90% | 2.41% | 20.41% | ★★★★★☆ |

| Ningbo Kangqiang Electronics | 50.87% | 5.32% | -0.38% | ★★★★★☆ |

| Wuxi Delinhai Environmental TechnologyLtd | 4.33% | -16.56% | -40.58% | ★★★★☆☆ |

| Shanghai Ace Investment&DevelopmentLtd | 43.95% | 10.89% | 23.28% | ★★★★☆☆ |

| Baoding Technology | 64.72% | 34.67% | 46.03% | ★★★★☆☆ |

| Beijing Sanfo Outdoor Products | 34.30% | 16.03% | 40.40% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Wuxi New Hongtai Electrical TechnologyLtd (SHSE:603016)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi New Hongtai Electrical Technology Co., Ltd is involved in the research, development, production, and sale of components for circuit breakers and switches in China, with a market cap of CN¥5.34 billion.

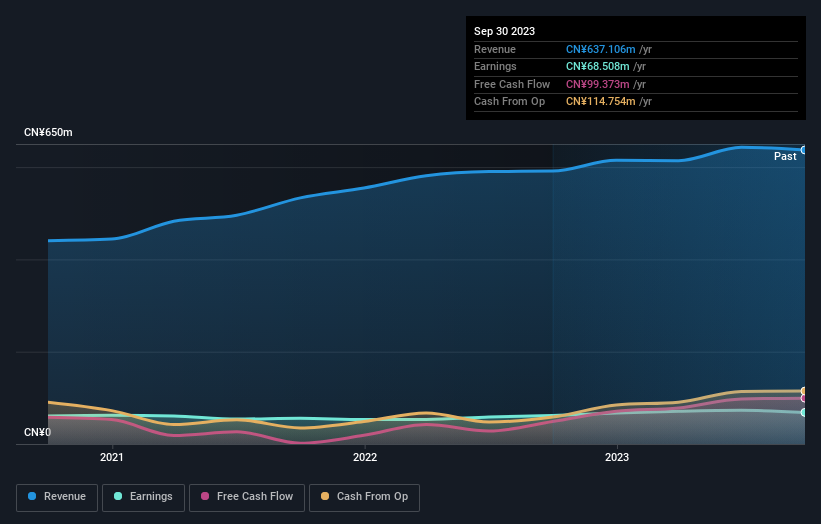

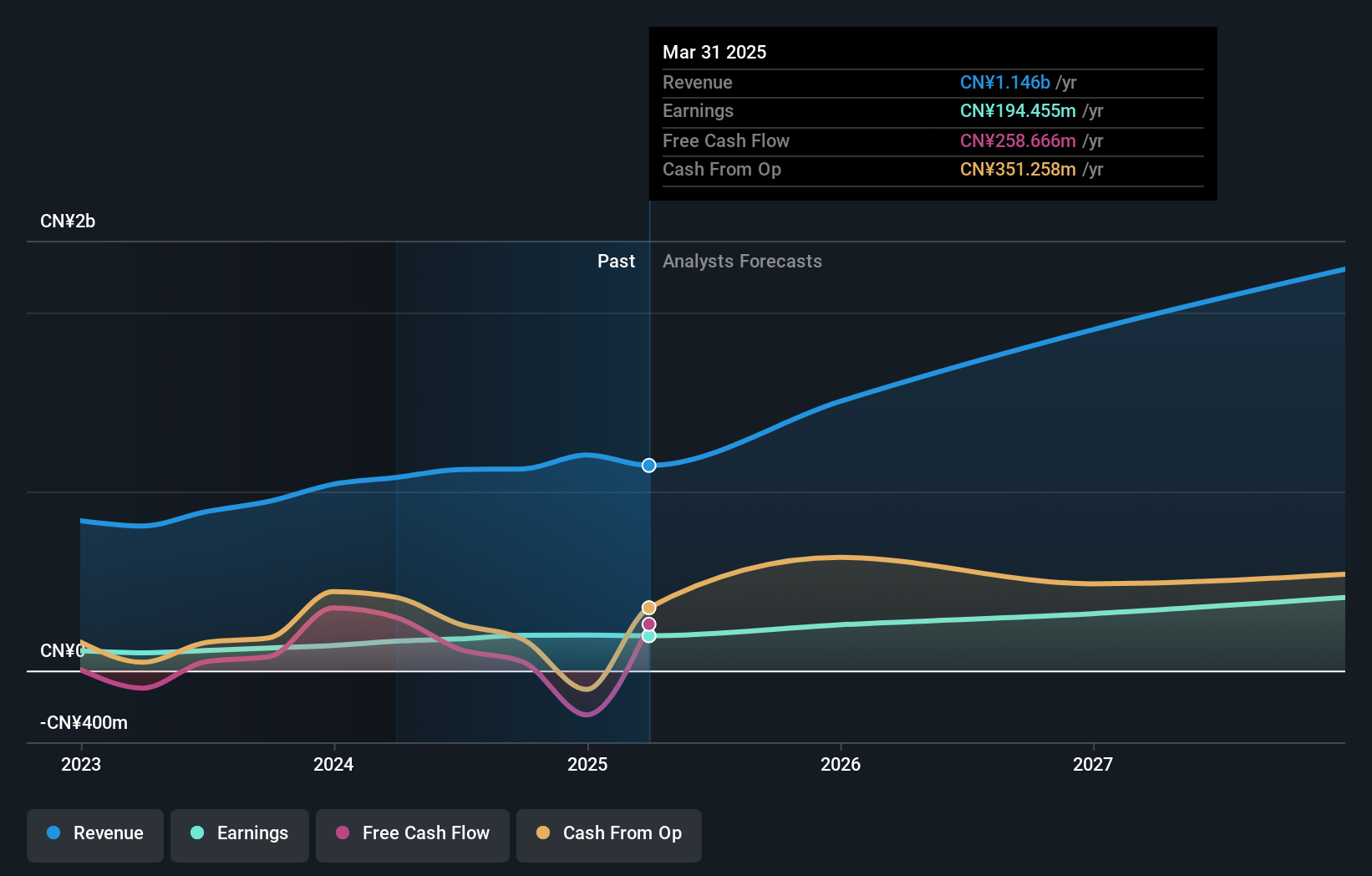

Operations: Wuxi New Hongtai Electrical Technology Co., Ltd generates revenue primarily from the Transmission and Distribution and Control Equipment Manufacturing segment, amounting to CN¥637.11 million. The company's financial performance is influenced by its cost structure within this segment, impacting its overall profitability metrics.

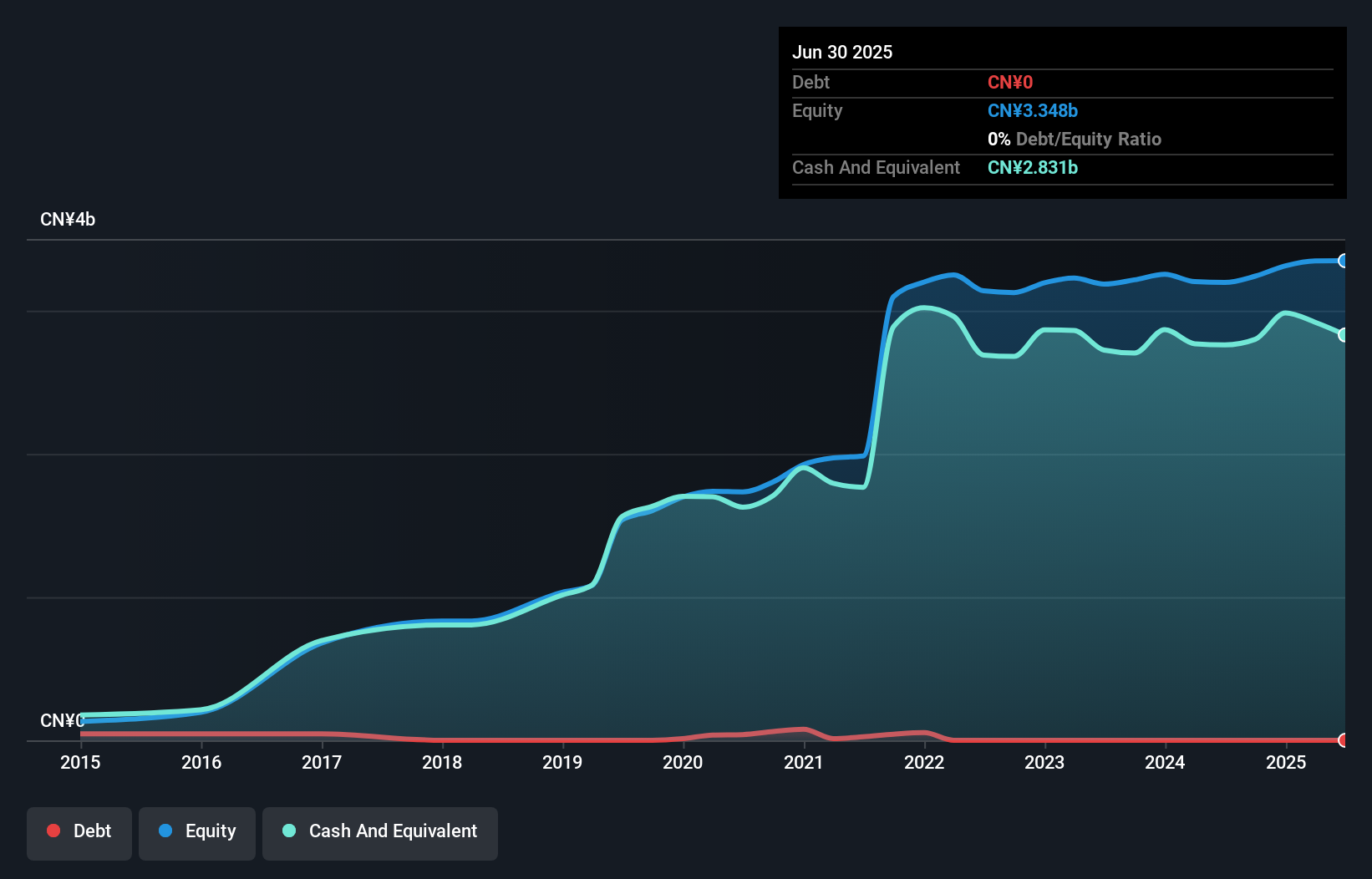

Wuxi New Hongtai Electrical Technology, a small player in the electrical industry, has shown promising growth with earnings rising by 10.8% over the past year, outpacing the industry's 2.7%. Trading at 20.4% below its estimated fair value suggests potential undervaluation. Despite a slight increase in its debt to equity ratio to 0.3%, it holds more cash than total debt, indicating strong financial footing. Recent half-year results reveal net income climbed to CNY 37.64 million from CNY 34.47 million last year, with basic earnings per share improving from CNY 0.23 to CNY 0.25, reflecting solid operational performance amidst market volatility.

- Unlock comprehensive insights into our analysis of Wuxi New Hongtai Electrical TechnologyLtd stock in this health report.

Understand Wuxi New Hongtai Electrical TechnologyLtd's track record by examining our Past report.

Jiangxi Guoke Defence GroupLtd (SHSE:688543)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Guoke Defence Group Co., Ltd. engages in the research, development, production, and sale of military products, with a market cap of CN¥10.28 billion.

Operations: The company's primary revenue streams are derived from the production and sale of military products. A notable financial trend is its gross profit margin, which has shown variability over recent periods.

Jiangxi Guoke Defence Group Ltd., a promising player in China's defense sector, has showcased impressive growth with earnings surging by 56% over the past year, outpacing the industry average. The company's debt to equity ratio has significantly improved from 91.7% to 2.7% over five years, indicating strengthened financial health. Recent earnings reports reveal net income for the first nine months of 2024 at CNY 149.24 million compared to CNY 92.58 million a year ago, reflecting robust performance and strategic execution. Additionally, Jiangxi Guoke's share repurchase program completed with buybacks totaling CNY 76.13 million further underscores its commitment to enhancing shareholder value.

Hangzhou DPtech TechnologiesLtd (SZSE:300768)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou DPtech Technologies Co., Ltd. focuses on the research, development, production, and sale of network security and application delivery products in China and internationally, with a market cap of CN¥12.45 billion.

Operations: DPtech generates revenue primarily from the sale of network security and application delivery products. The company's cost structure includes expenses related to research, development, and production.

DPtech, a nimble player in the tech landscape, showcases promising growth with recent earnings revealing a net income of CNY 92.38 million for the first nine months of 2024, up from CNY 67.08 million the previous year. The company's P/E ratio stands at 81.9x, which is below the industry average of 86.4x, indicating potential undervaluation within its sector. Despite experiencing share price volatility recently, DPtech remains debt-free and has demonstrated consistent earnings quality over time. With an anticipated annual earnings growth rate of over 29%, it holds potential for future expansion in its market segment.

Key Takeaways

- Investigate our full lineup of 881 Chinese Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi New Hongtai Electrical TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603016

Wuxi New Hongtai Electrical TechnologyLtd

Engages in the research, development, production, and sale of components of circuit breakers, low-voltage circuit breakers, and knife-melt switches in China.

Excellent balance sheet with acceptable track record.