As global markets navigate the challenges posed by rising U.S. Treasury yields and a cautious economic outlook, investors are increasingly focusing on growth stocks that have demonstrated resilience in this uncertain environment. Companies with high insider ownership often signal strong alignment between management and shareholder interests, making them attractive options for those seeking potential growth opportunities amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Saudi Automotive Services (SASE:4050)

Simply Wall St Growth Rating: ★★★★☆☆

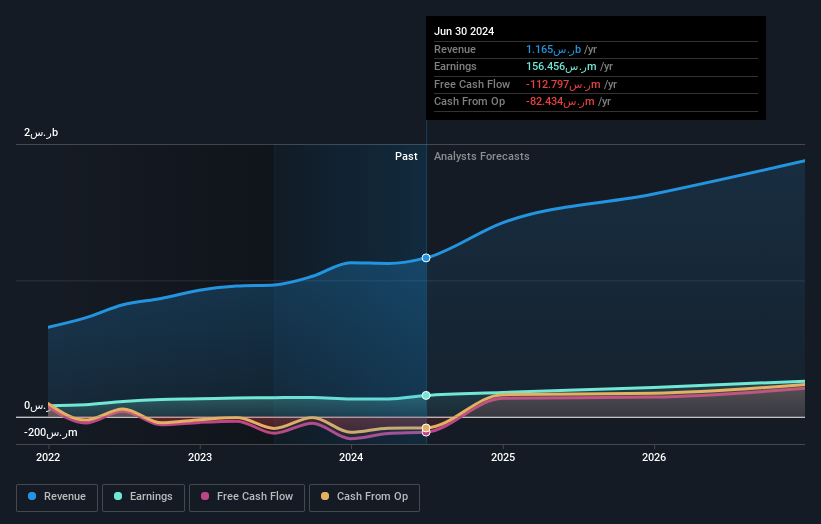

Overview: Saudi Automotive Services Company operates a network of vehicle service stations in Saudi Arabia and has a market cap of SAR5.56 billion.

Operations: The company's revenue is primarily derived from Retail and Operating (including Oil Company Petroleum Services) at SAR9.60 billion, with additional contributions from Fleet Transport at SAR55.84 million and Saudi Club at SAR29.15 million.

Insider Ownership: 10.6%

Earnings Growth Forecast: 29.8% p.a.

Saudi Automotive Services is poised for significant earnings growth, with forecasts indicating a 29.8% annual increase, outpacing the Saudi market's 6.8%. Despite recent volatility in its share price and large one-off items affecting financial results, the company reported SAR 2.49 billion in sales for Q2 2024 and a net income of SAR 12.85 million. Revenue growth is expected at 8.3% annually, surpassing the market's average of 1.3%.

- Unlock comprehensive insights into our analysis of Saudi Automotive Services stock in this growth report.

- According our valuation report, there's an indication that Saudi Automotive Services' share price might be on the expensive side.

Perfect Presentation for Commercial Services (SASE:7204)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Perfect Presentation for Commercial Services Company operates as an ICT services and technology solutions provider in the Kingdom of Saudi Arabia, with a market cap of SAR4.30 billion.

Operations: The company's revenue is derived from several segments, including Management Services (SAR70.60 million), Call Centre Services (SAR312.70 million), Operation and Maintenance Services (SAR376.09 million), and Software Licenses and Development Services (SWD) (SAR398.64 million).

Insider Ownership: 18.3%

Earnings Growth Forecast: 20.3% p.a.

Perfect Presentation for Commercial Services is positioned for substantial earnings growth, with a forecasted annual increase of 20.3%, surpassing the Saudi market's 6.8%. Despite revenue growth expectations of 17.7% annually, slightly below the high-growth threshold, it remains above the market average. Recent reports show Q2 sales at SAR 287.14 million and net income at SAR 58.77 million, reflecting strong year-over-year improvements in both metrics and indicating robust financial health despite debt concerns.

- Click here to discover the nuances of Perfect Presentation for Commercial Services with our detailed analytical future growth report.

- The analysis detailed in our Perfect Presentation for Commercial Services valuation report hints at an inflated share price compared to its estimated value.

Tianrun Industry Technology (SZSE:002283)

Simply Wall St Growth Rating: ★★★★☆☆

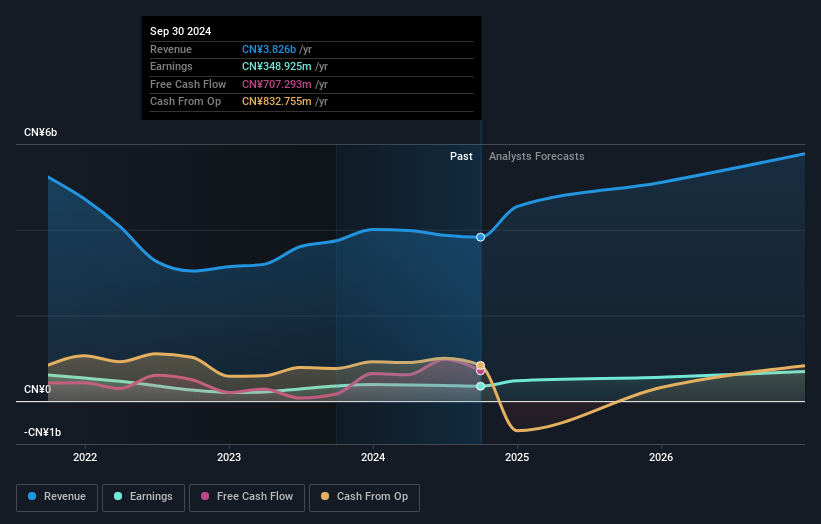

Overview: Tianrun Industry Technology Co., Ltd. manufactures and sells internal combustion engine crankshafts both in China and internationally, with a market cap of CN¥5.35 billion.

Operations: Tianrun Industry Technology generates its revenue from the manufacturing and sale of internal combustion engine crankshafts, serving both domestic and international markets.

Insider Ownership: 24%

Earnings Growth Forecast: 26.2% p.a.

Tianrun Industry Technology is forecasted to experience significant earnings growth of 26.25% annually, outpacing the Chinese market's average. The company's revenue, expected to grow at 16.6% per year, surpasses the market rate but remains below high-growth benchmarks. Recent earnings reports indicate a decline in sales and net income compared to last year, with nine-month sales at CNY 2.77 billion and net income at CNY 268.96 million, reflecting potential challenges despite favorable valuation metrics like a low price-to-earnings ratio of 15.3x.

- Delve into the full analysis future growth report here for a deeper understanding of Tianrun Industry Technology.

- Upon reviewing our latest valuation report, Tianrun Industry Technology's share price might be too pessimistic.

Next Steps

- Dive into all 1517 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tianrun Industry Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002283

Tianrun Industry Technology

Manufactures and sells internal combustion engine crankshafts in China and internationally.

Flawless balance sheet established dividend payer.