- China

- /

- Metals and Mining

- /

- SZSE:000933

Top Dividend Stocks In Global For October 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by unexpected inflation rates and geopolitical tensions, investors are keenly observing the performance of major indices, with U.S. stocks showing resilience amid volatility. In this environment, dividend stocks can offer a measure of stability and potential income, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.33% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.68% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.05% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.76% | ★★★★★★ |

| NCD (TSE:4783) | 4.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.47% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.70% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.63% | ★★★★★★ |

Click here to see the full list of 1376 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

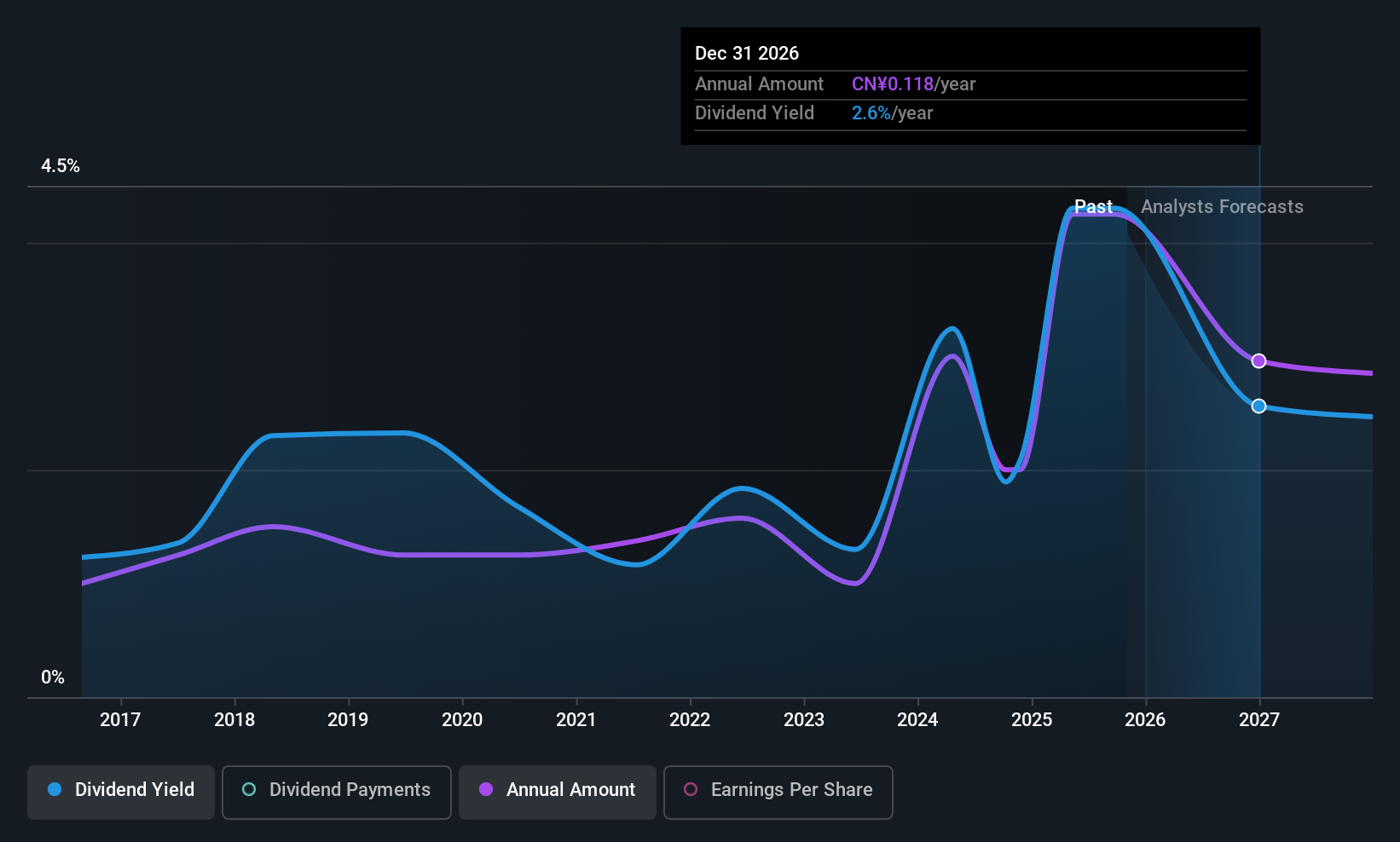

Shandong Nanshan AluminiumLtd (SHSE:600219)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shandong Nanshan Aluminium Co., Ltd. is engaged in aluminum processing operations globally and has a market capitalization of approximately CN¥47.93 billion.

Operations: Shandong Nanshan Aluminium Co., Ltd. generates revenue from several segments, including Cold Rolled Coil / Plate (CN¥18.28 billion), Alumina Powder (CN¥9.49 billion), Aluminum Profile (CN¥3.71 billion), Aluminum Foil (CN¥1.47 billion), Hot Rolled Coil / Plate (CN¥856.17 million), Alloy Ingot (CN¥739.31 million), Natural Gas (CN¥133.47 million) and Electricity, Gas (CN¥25.08 million).

Dividend Yield: 3.7%

Shandong Nanshan Aluminium Ltd. offers a dividend yield of 3.72%, placing it in the top quartile of CN market dividend payers, with dividends well-covered by earnings and cash flows (payout ratios at 37.9% and 35.3%, respectively). Despite trading at a significant discount to its estimated fair value, the company has a volatile and unreliable dividend history over the past decade. Recent share buybacks totaling CNY 311.45 million may impact future distributions positively or negatively depending on strategic allocation decisions.

- Click here and access our complete dividend analysis report to understand the dynamics of Shandong Nanshan AluminiumLtd.

- Insights from our recent valuation report point to the potential undervaluation of Shandong Nanshan AluminiumLtd shares in the market.

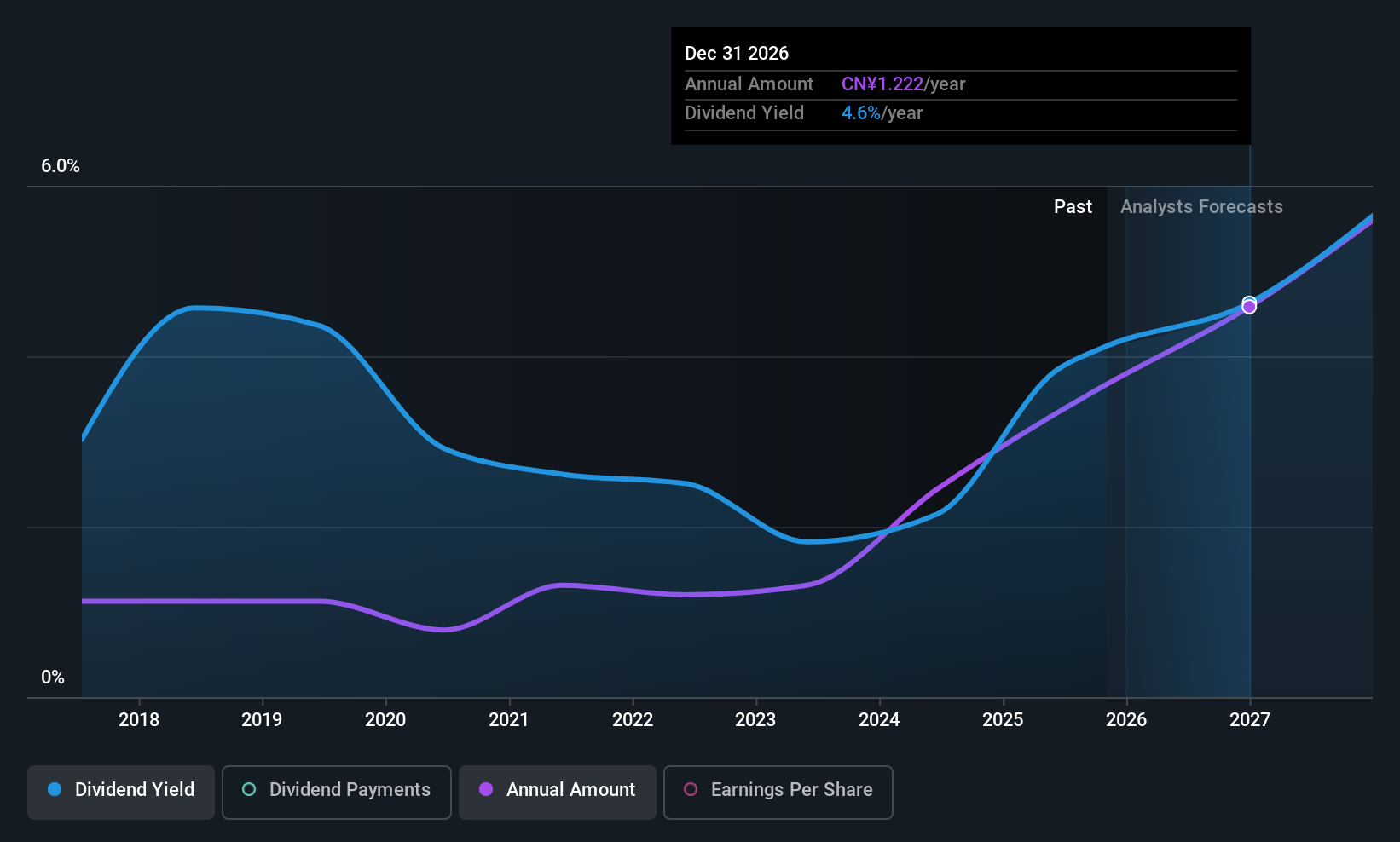

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution products in China and internationally, with a market cap of CN¥34.32 billion.

Operations: Ningbo Sanxing Medical Electric Co., Ltd.'s revenue is primarily derived from Smart Power Usage Transmission at CN¥12.41 billion and Medical Service at CN¥3.27 billion, with additional income from Financial Leasing, Factoring, and Consulting Inquiry Service amounting to CN¥1.68 million.

Dividend Yield: 3.8%

Ningbo Sanxing Medical Electric Ltd. provides a dividend yield of 3.84%, ranking it among the top 25% of dividend payers in the CN market, although its dividends have been volatile and unreliable over the past decade. The company's payout ratio stands at 82.8%, indicating coverage by earnings, but high cash payout ratios suggest dividends are not well-supported by cash flows. Despite this, Ningbo Sanxing trades at a favorable price-to-earnings ratio of 15.2x compared to the CN market average of 45x, with analysts forecasting further stock price appreciation and earnings growth.

- Navigate through the intricacies of Ningbo Sanxing Medical ElectricLtd with our comprehensive dividend report here.

- The analysis detailed in our Ningbo Sanxing Medical ElectricLtd valuation report hints at an deflated share price compared to its estimated value.

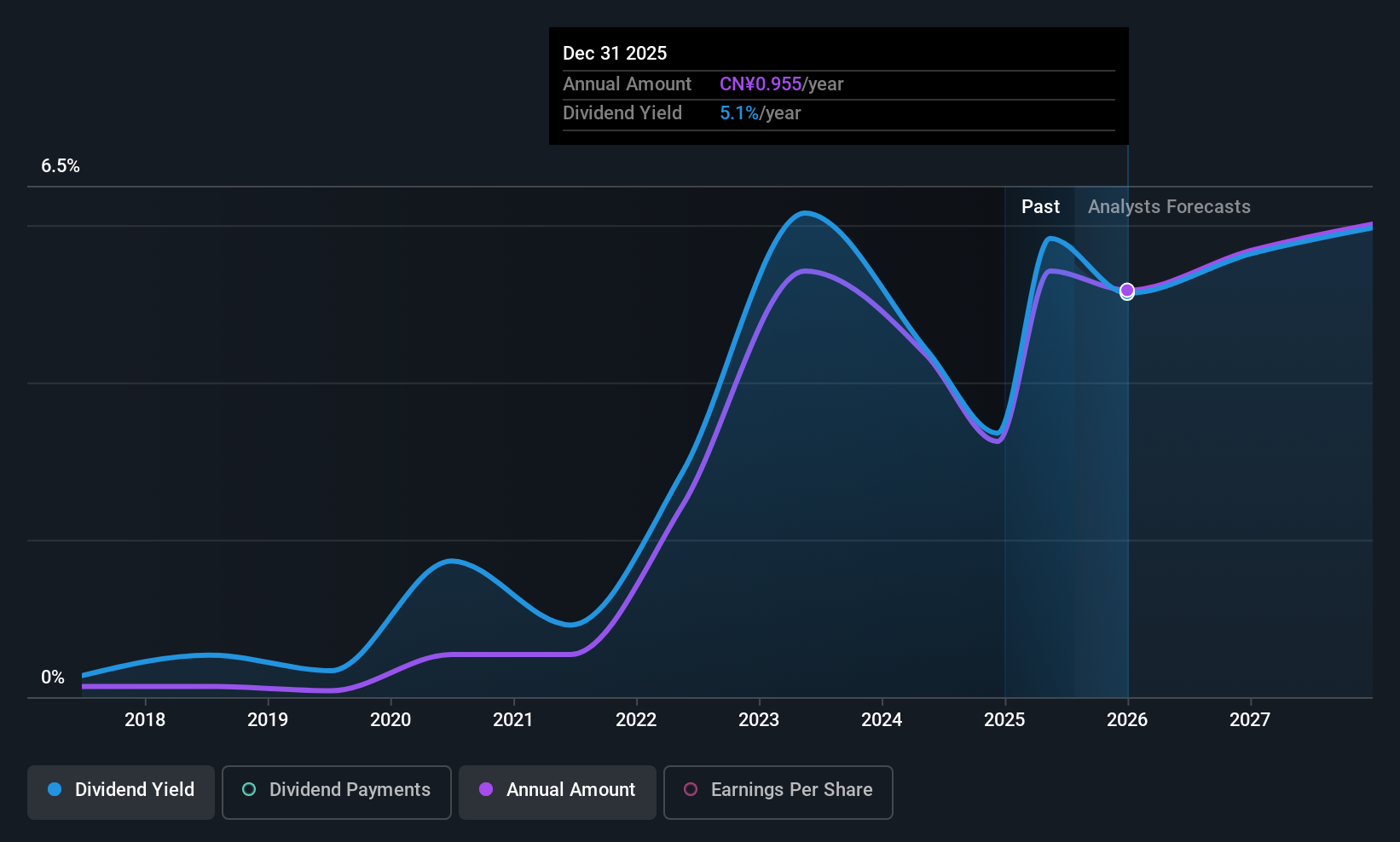

Henan Shenhuo Coal Industry and Electricity Power (SZSE:000933)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Henan Shenhuo Coal Industry and Electricity Power Co. operates in the coal mining and electricity generation sectors, with a market cap of CN¥52.36 billion.

Operations: Henan Shenhuo Coal Industry and Electricity Power Co.'s revenue segments include coal mining and electricity generation.

Dividend Yield: 4%

Henan Shenhuo Coal Industry and Electricity Power's dividend yield of 3.97% places it in the top 25% of CN market payers, though its eight-year track record shows volatility. The dividends are well-covered by earnings and cash flows, with payout ratios at 25.9% and 30.8%, respectively. Recent earnings show stable revenue growth but slight net income decline, while company bylaws have been amended to potentially support future strategic shifts impacting dividend reliability.

- Unlock comprehensive insights into our analysis of Henan Shenhuo Coal Industry and Electricity Power stock in this dividend report.

- Our valuation report here indicates Henan Shenhuo Coal Industry and Electricity Power may be undervalued.

Make It Happen

- Access the full spectrum of 1376 Top Global Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henan Shenhuo Coal Industry and Electricity Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000933

Henan Shenhuo Coal Industry and Electricity Power

Henan Shenhuo Coal Industry and Electricity Power Co.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives