- China

- /

- Electrical

- /

- SHSE:601311

A Piece Of The Puzzle Missing From Camel Group Co., Ltd.'s (SHSE:601311) Share Price

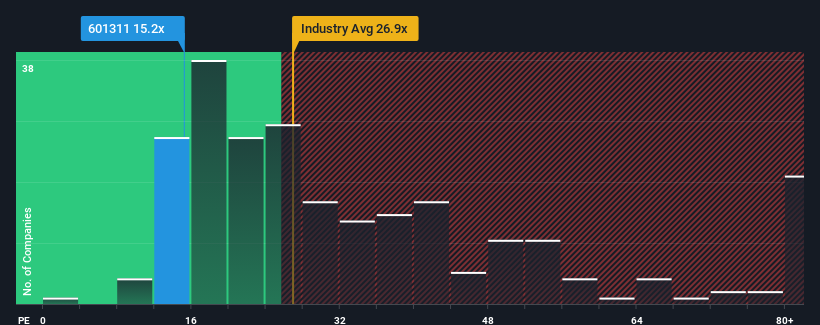

Camel Group Co., Ltd.'s (SHSE:601311) price-to-earnings (or "P/E") ratio of 15.2x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 53x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Camel Group has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Camel Group

Does Growth Match The Low P/E?

Camel Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a decent 10% gain to the company's bottom line. Still, lamentably EPS has fallen 41% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 19% each year growth forecast for the broader market.

In light of this, it's peculiar that Camel Group's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Camel Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Camel Group that you should be aware of.

You might be able to find a better investment than Camel Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601311

Camel Group

Manufactures and sells green lead-acid and new energy lithium-ion batteries in China and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives