Stock Analysis

- China

- /

- Trade Distributors

- /

- SHSE:600822

The past one-year earnings decline for Shanghai Material Trading (SHSE:600822) likely explains shareholders long-term losses

Shanghai Material Trading Co., Ltd. (SHSE:600822) shareholders should be happy to see the share price up 20% in the last week. But that doesn't change the fact that the returns over the last year have been less than pleasing. After all, the share price is down 33% in the last year, significantly under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Shanghai Material Trading

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

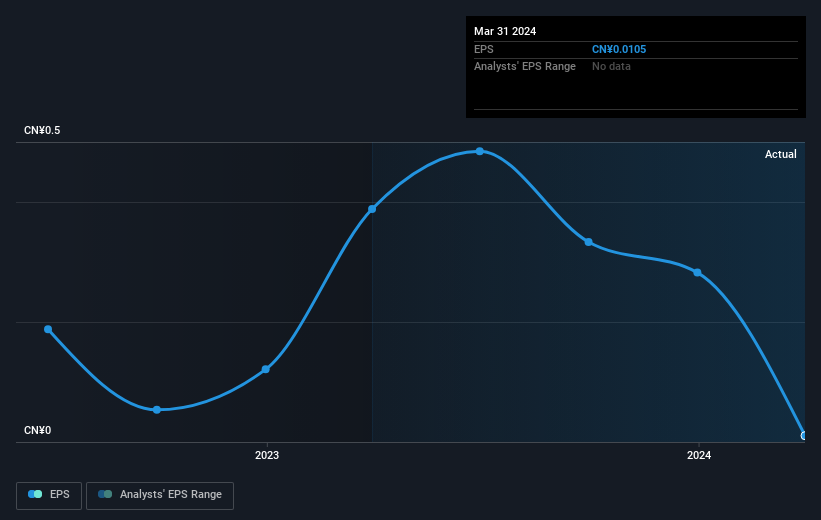

Unfortunately Shanghai Material Trading reported an EPS drop of 97% for the last year. This was, in part, due to extraordinary items impacting earnings. This fall in the EPS is significantly worse than the 33% the share price fall. It may have been that the weak EPS was not as bad as some had feared. With a P/E ratio of 842.43, it's fair to say the market sees an EPS rebound on the cards.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Shanghai Material Trading's key metrics by checking this interactive graph of Shanghai Material Trading's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 17% in the twelve months, Shanghai Material Trading shareholders did even worse, losing 33%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Shanghai Material Trading has 2 warning signs we think you should be aware of.

Of course Shanghai Material Trading may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600822

Shanghai Material Trading

Engages in the wholesale and retail business of automobile trade, chemical and other production materials, non-ferrous metal trade, and logistics business in China and internationally.

Flawless balance sheet and slightly overvalued.