Discovering Undiscovered Gems with Promising Potential in January 2025

Reviewed by Simply Wall St

As global markets continue to climb, buoyed by optimism around softer tariffs and advancements in artificial intelligence, small-cap stocks have lagged behind their larger counterparts. In this environment of cautious growth and shifting economic policies, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and the potential to capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Xili Intelligent TechnologyLtd | NA | 10.32% | 5.63% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 14.05% | -0.88% | 72.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Veidekke (OB:VEI)

Simply Wall St Value Rating: ★★★★★☆

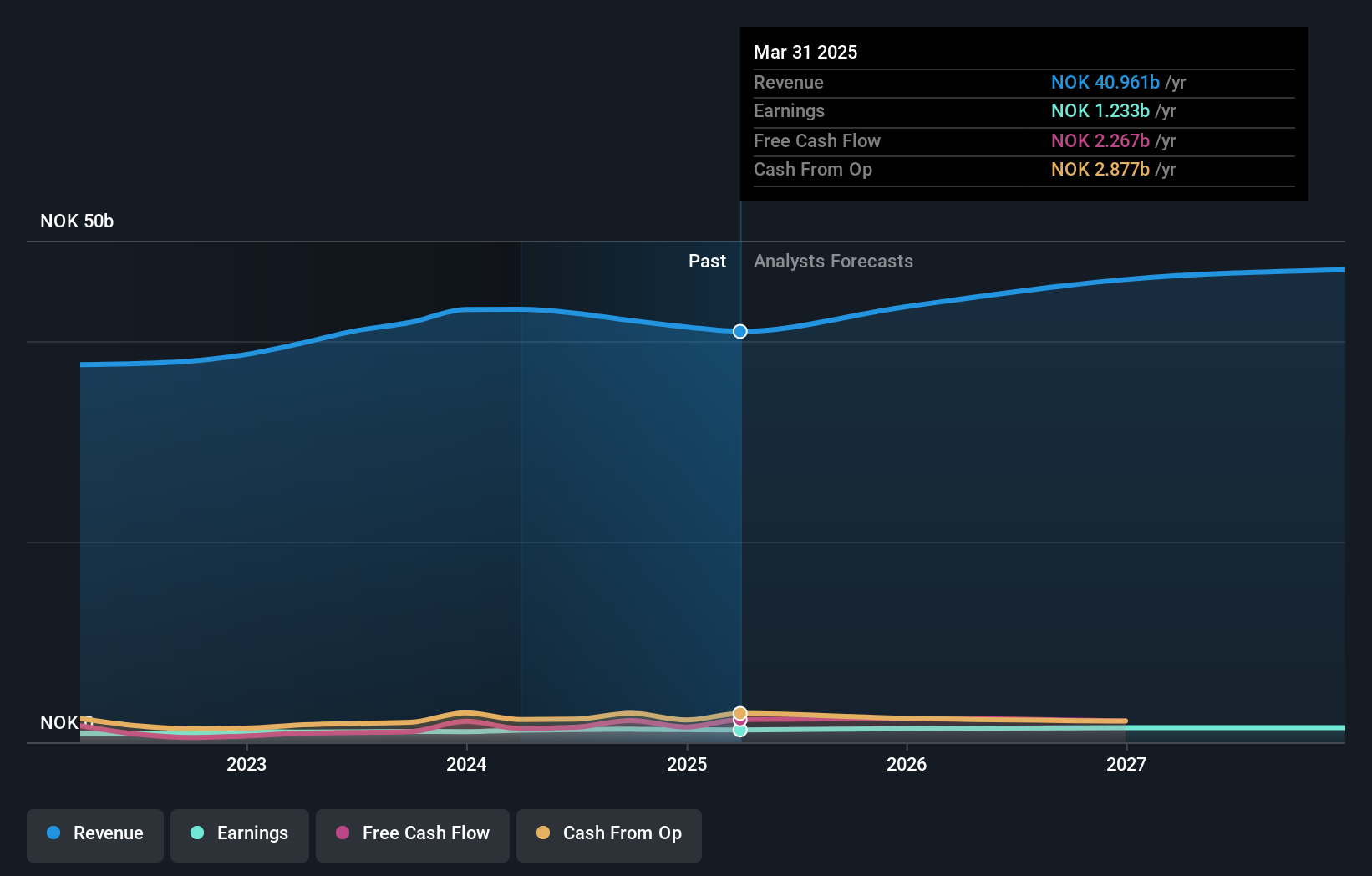

Overview: Veidekke ASA is a construction and property development company operating in Norway, Sweden, and Denmark with a market capitalization of NOK19.50 billion.

Operations: Veidekke generates revenue primarily from its construction and infrastructure segments in Norway and Sweden, with notable contributions of NOK15.16 billion from Construction Norway and NOK10.02 billion from Infrastructure Norway. The company also derives significant income from its operations in Denmark, amounting to NOK3.10 billion.

Veidekke, showcasing its small-cap prowess, has seen earnings grow 20.3% over the past year, outpacing the construction industry's 8.4%. With a debt to equity ratio dropping from 136% to just 19% in five years, it appears financially disciplined. The company trades at 15.2% below estimated fair value, suggesting potential undervaluation. Recent projects like the NOK 410 million Haslevangen apartments and a NOK 1.5 billion health center in Kristiansand bolster its order book and future revenue streams. Despite sales dipping slightly last quarter, net income rose to NOK 465 million from NOK 441 million year-on-year, reflecting strong operational performance.

- Get an in-depth perspective on Veidekke's performance by reading our health report here.

Gain insights into Veidekke's historical performance by reviewing our past performance report.

Shanghai Huitong EnergyLtd (SHSE:600605)

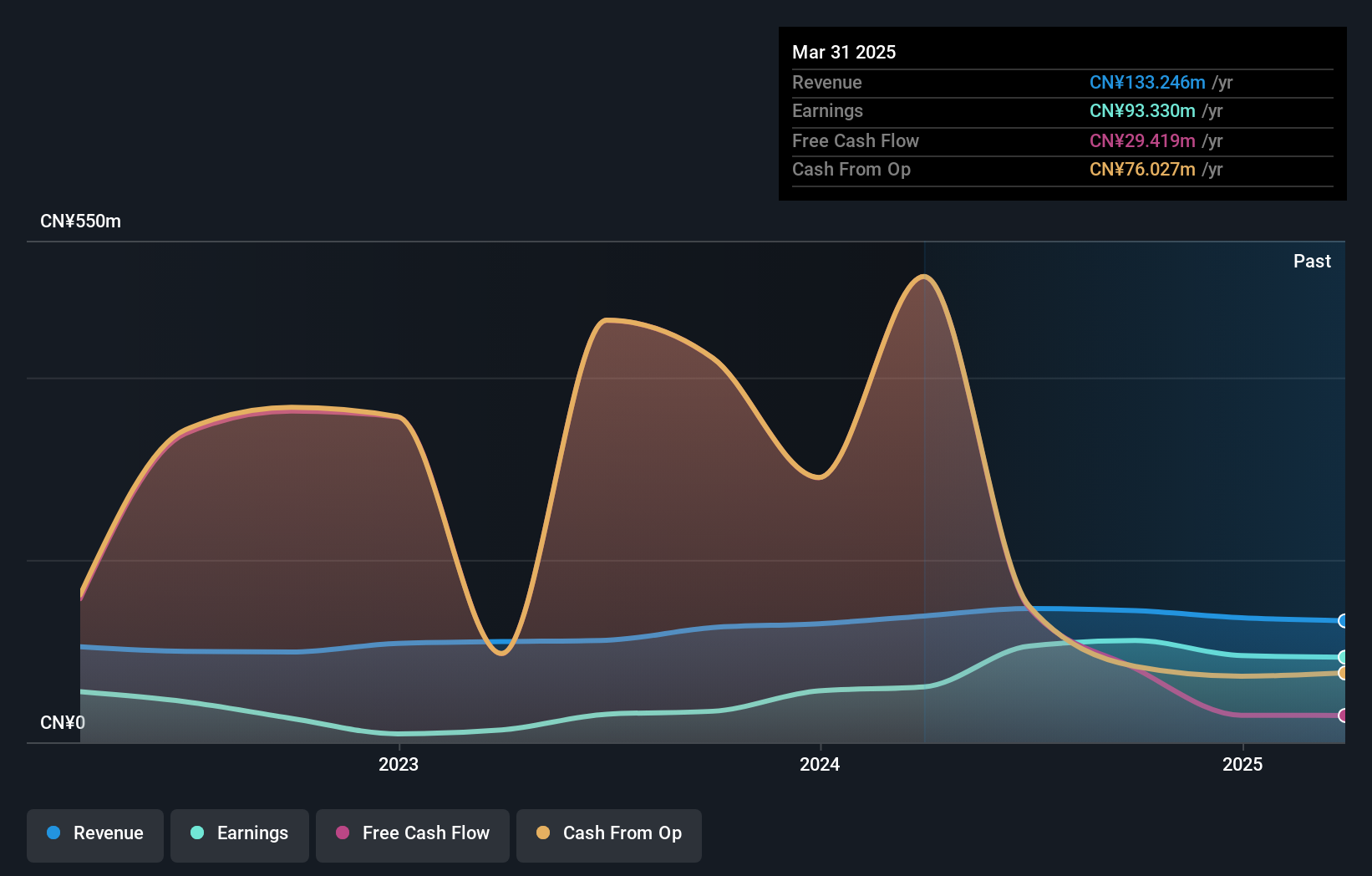

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Huitong Energy Co., Ltd operates in the real estate development sector in China and has a market capitalization of CN¥7.40 billion.

Operations: Huitong Energy generates revenue primarily from real estate development activities in China. The company has a market capitalization of CN¥7.40 billion, indicating its scale within the industry.

Shanghai Huitong Energy, a dynamic player in its sector, has shown remarkable growth with earnings surging by 228% over the past year, far outpacing its industry peers. The company is debt-free, which enhances its financial stability and eliminates concerns about interest coverage. A notable factor in its recent performance is a one-off gain of CN¥37 million impacting the last 12 months' results. In recent developments, private equity funds have acquired stakes worth CN¥310 million and CN¥350 million from Tibet Dejin Business Management Co., Ltd., indicating strong investor interest and confidence in Shanghai Huitong's future potential.

- Click here and access our complete health analysis report to understand the dynamics of Shanghai Huitong EnergyLtd.

Gain insights into Shanghai Huitong EnergyLtd's past trends and performance with our Past report.

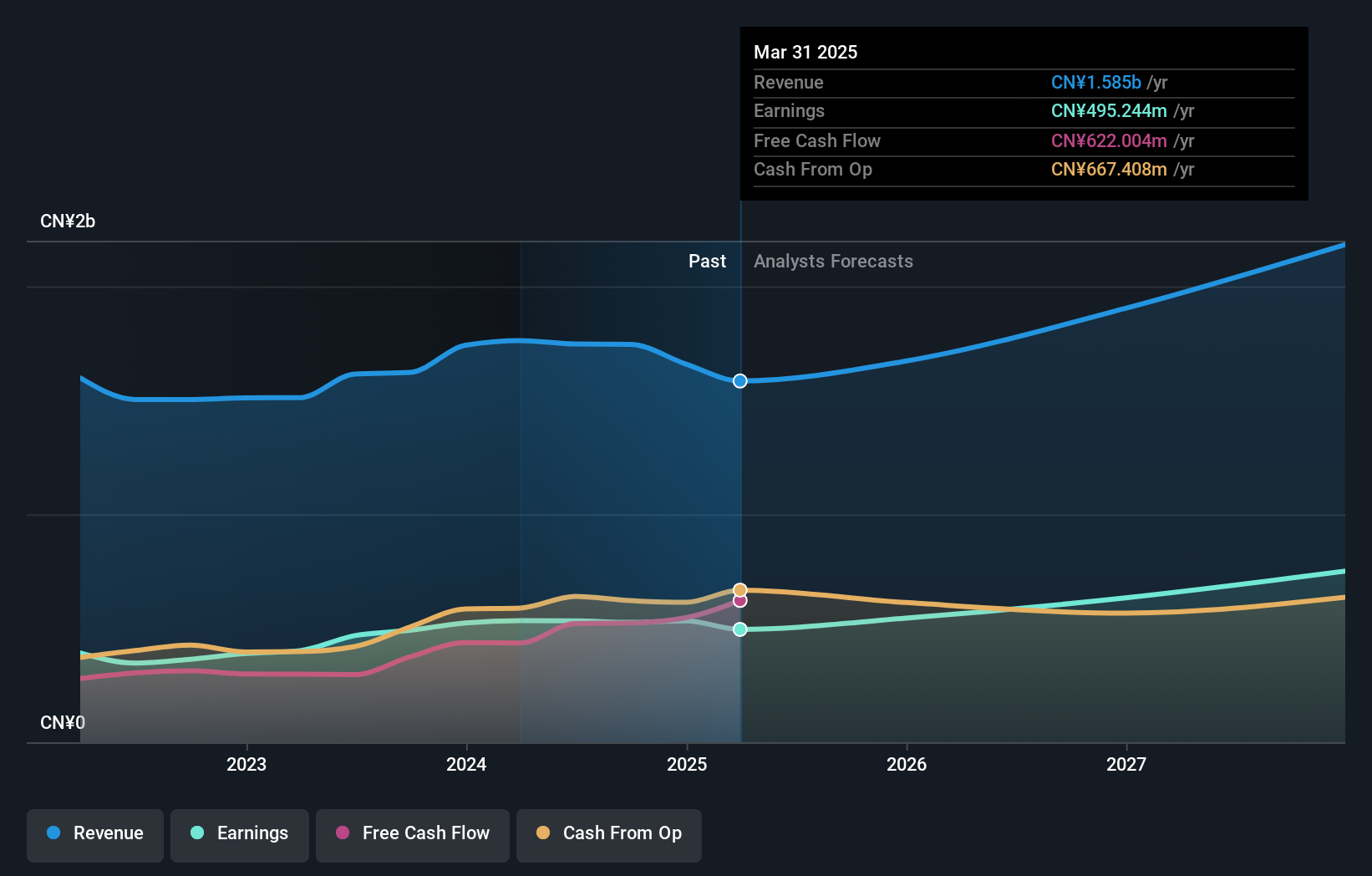

Beijing Strong BiotechnologiesInc (SZSE:300406)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Strong Biotechnologies, Inc. offers in-vitro diagnostics products and services both domestically and internationally, with a market capitalization of CN¥7.70 billion.

Operations: The company generates revenue primarily from its biomedicine segment, which reported CN¥1.75 billion. The gross profit margin for its operations stands at 65%.

Beijing Strong Biotechnologies, a promising player in the biotech space, has shown impressive earnings growth of 7.1% over the past year, outpacing the industry average of 1.3%. The company's debt to equity ratio has risen to 29.4% over five years, yet it maintains a satisfactory net debt to equity ratio of 4.3%, indicating prudent financial management. With interest payments well covered by EBIT at 28.3 times and trading at an attractive valuation—52.2% below estimated fair value—this entity seems poised for continued growth with projected earnings expansion of 23.15% annually and high-quality past earnings enhancing its appeal.

Turning Ideas Into Actions

- Access the full spectrum of 4671 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Strong BiotechnologiesInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300406

Beijing Strong BiotechnologiesInc

Researches, develops, manufactures, and sells in-vitro diagnostics (IVD) products and services in China and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives