- China

- /

- Communications

- /

- SZSE:300711

Discovering Hidden Gems: Three Promising Small Caps on None

Reviewed by Simply Wall St

As global markets continue to show resilience, with U.S. indexes approaching record highs and smaller-cap stocks outperforming their larger counterparts, investors are increasingly turning their attention to the potential of small-cap companies. This positive sentiment is bolstered by strong labor market data and a recovering housing sector, creating an environment ripe for uncovering promising opportunities in lesser-known stocks. In such a dynamic market landscape, identifying a good stock often involves looking at companies that demonstrate solid fundamentals and have the potential to capitalize on emerging trends or economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shanghai Huitong EnergyLtd (SHSE:600605)

Simply Wall St Value Rating: ★★★★★★

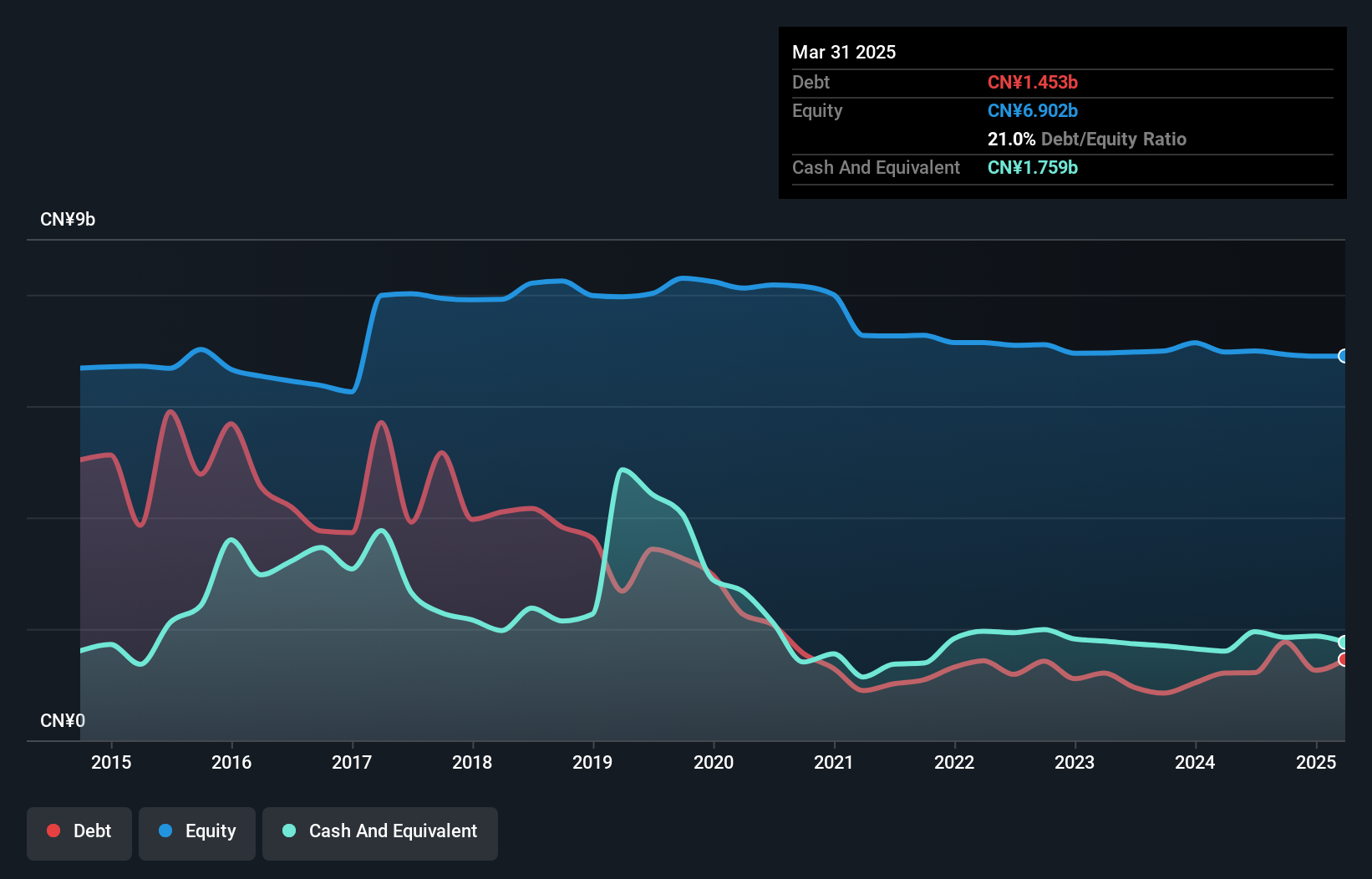

Overview: Shanghai Huitong Energy Co., Ltd is engaged in house leasing and property services in China, with a market capitalization of CN¥8.81 billion.

Operations: Shanghai Huitong Energy Co., Ltd generates revenue primarily through house leasing and property services. The company's market capitalization stands at CN¥8.81 billion, reflecting its scale in the industry.

Shanghai Huitong Energy Ltd., a nimble player in the energy sector, has demonstrated impressive financial resilience with earnings skyrocketing by 227.7% over the past year, outpacing its industry peers. The company is debt-free, eliminating concerns about interest coverage and showcasing a robust balance sheet compared to five years ago when its debt-to-equity ratio was 0.1%. Recent strategic maneuvers include multiple equity acquisitions by private equity funds, such as Element Gold Shining acquiring a 5.50% stake for CN¥310 million and Xiamen Driving Force purchasing another 5.53% for CN¥350 million. These moves highlight investor confidence in Shanghai Huitong's growth trajectory amidst strong financial performance marked by net income of CN¥98.42 million for the nine months ending September 2024, up from CN¥43.35 million last year.

- Click here and access our complete health analysis report to understand the dynamics of Shanghai Huitong EnergyLtd.

Understand Shanghai Huitong EnergyLtd's track record by examining our Past report.

Beijing Hualian Department Store (SZSE:000882)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Hualian Department Store Co., Ltd operates and manages shopping malls in China with a market capitalization of CN¥5.39 billion.

Operations: The company generates revenue primarily from operating and managing shopping malls in China. It has a market capitalization of CN¥5.39 billion.

Beijing Hualian, a smaller player in the retail sector, has shown resilience with recent financials indicating a mixed performance. Over the first nine months of 2024, sales reached CNY 1.09 billion, up from CNY 1.00 billion last year, while net income dipped to CNY 30.23 million from CNY 35.62 million. Despite this slight drop in earnings per share to CNY 0.011 from CNY 0.013, the company repurchased approximately 26 million shares for about CNY 30 million between July and September, reflecting confidence in its value proposition amidst fluctuating profits and strategic buybacks.

- Take a closer look at Beijing Hualian Department Store's potential here in our health report.

Learn about Beijing Hualian Department Store's historical performance.

GHTLtd (SZSE:300711)

Simply Wall St Value Rating: ★★★★★★

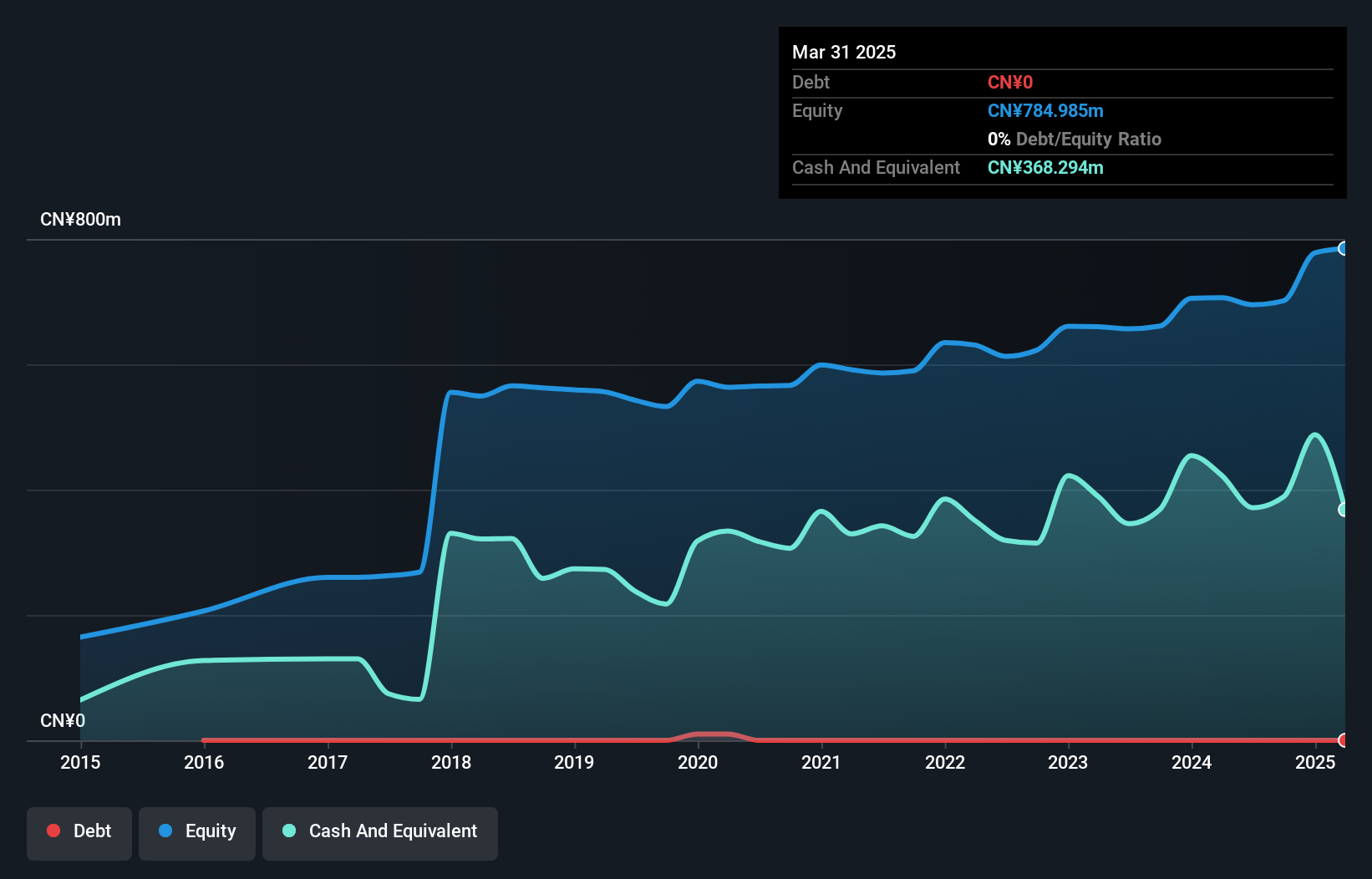

Overview: GHT Co., Ltd is involved in the research, development, production, sale, and servicing of information and communication technology-related products both in China and internationally, with a market cap of CN¥6.78 billion.

Operations: GHT Ltd's revenue is primarily derived from its information and communication technology products. The company has a market cap of CN¥6.78 billion.

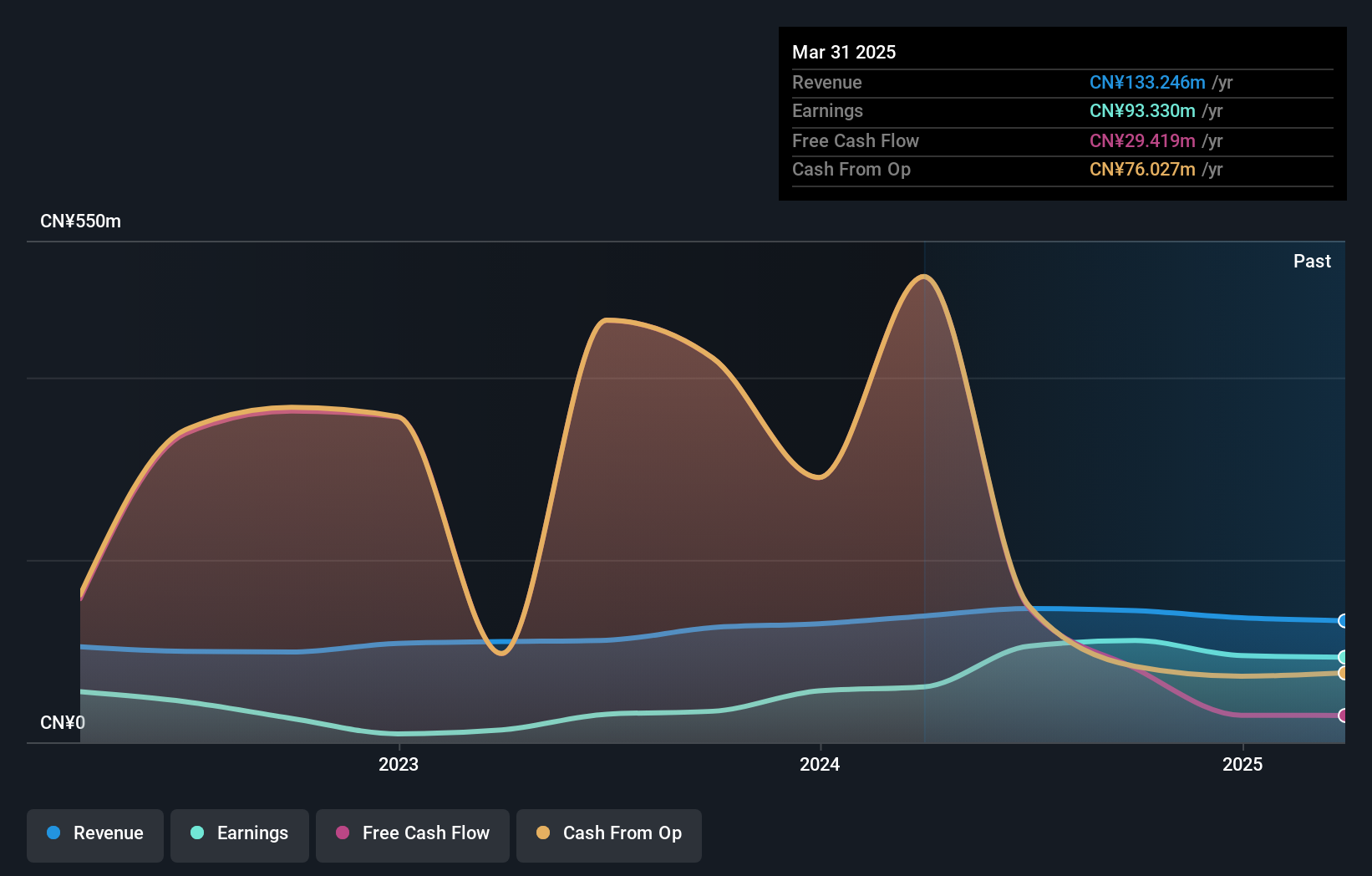

GHT Ltd. has shown promising growth, with earnings rising by 18.6% over the past year, outpacing the Communications industry's -3%. The company reported sales of CN¥233.98 million for the first nine months of 2024, up from CN¥202.73 million a year prior, reflecting its strong market position. Net income also climbed to CN¥20.96 million from CN¥16.85 million last year, while basic earnings per share increased to CN¥0.0841 compared to CN¥0.0676 previously. Despite a highly volatile share price recently, GHT remains debt-free and enjoys positive free cash flow, indicating robust financial health and operational efficiency amidst industry challenges.

- Click to explore a detailed breakdown of our findings in GHTLtd's health report.

Evaluate GHTLtd's historical performance by accessing our past performance report.

Make It Happen

- Delve into our full catalog of 4621 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300711

GHTLtd

Engages in the research and development, production, sale, and servicing of information and communication technology related products in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives