- Hong Kong

- /

- Specialty Stores

- /

- SEHK:881

3 Top Dividend Stocks Offering Up To 6.5% Yield

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core U.S. inflation and strong bank earnings, investors are increasingly looking for stable income sources amid fluctuating economic indicators. In this climate, dividend stocks offer an attractive proposition, providing consistent returns that can help offset market volatility while capitalizing on sectors showing robust performance.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bank of China (SEHK:3988)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of China Limited, along with its subsidiaries, offers a range of banking and financial services across Chinese Mainland, Hong Kong, Macao, Taiwan, and internationally with a market cap of HK$1.54 trillion.

Operations: Bank of China Limited generates revenue through its diverse banking and financial services operations across multiple regions, including the Chinese Mainland, Hong Kong, Macao, Taiwan, and international markets.

Dividend Yield: 6.6%

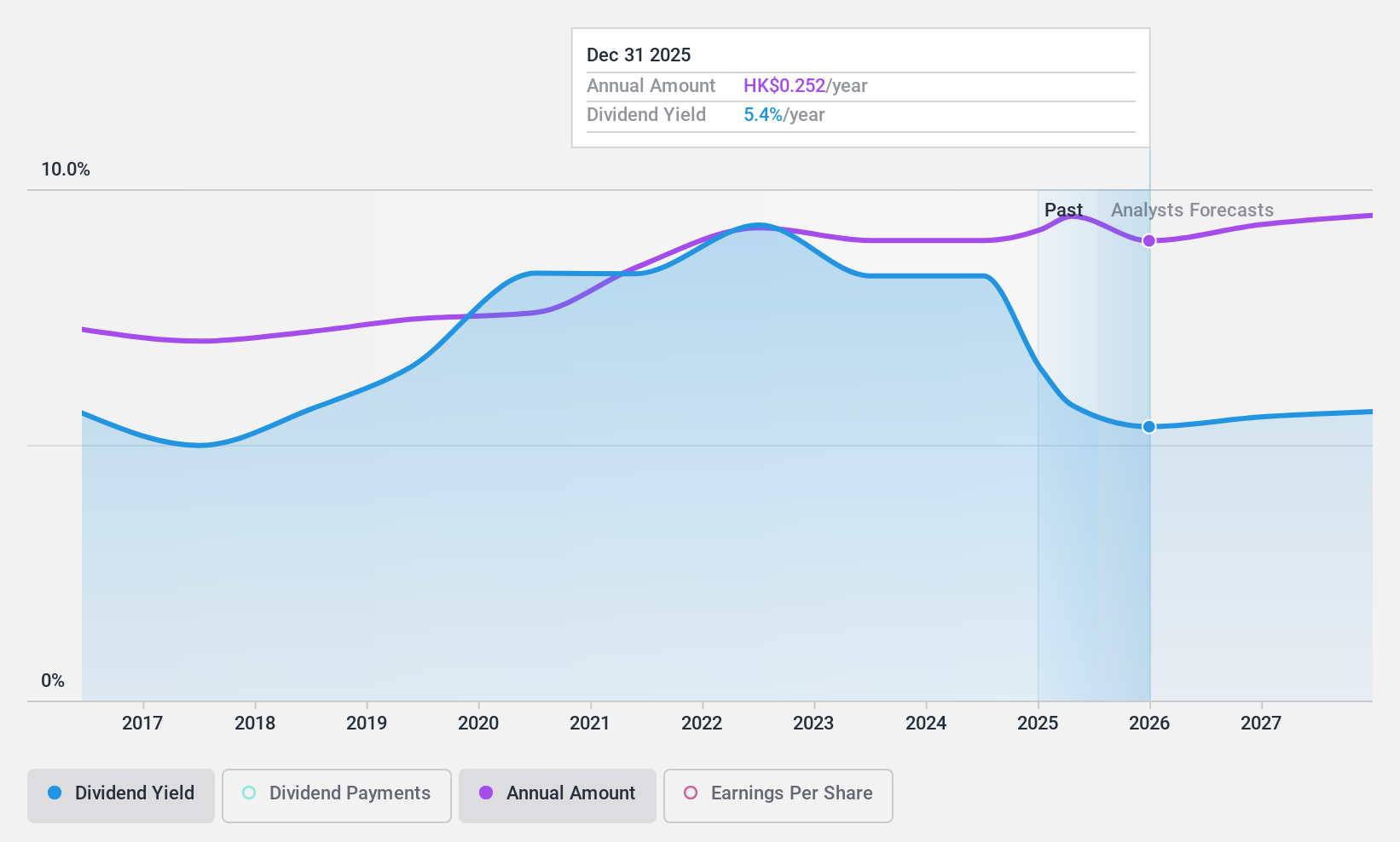

Bank of China offers a stable dividend profile with payments increasing over the past decade and a payout ratio currently at 48.5%, indicating sustainability. Although its 6.59% yield is lower than the top quartile in Hong Kong, dividends are well-covered by earnings and forecasted to remain so. The bank's recent board changes, including Mr. Zhang Hui's appointment as Vice Chairman, could influence strategic direction but do not directly impact dividend stability or growth potential.

- Dive into the specifics of Bank of China here with our thorough dividend report.

- According our valuation report, there's an indication that Bank of China's share price might be on the cheaper side.

Zhongsheng Group Holdings (SEHK:881)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhongsheng Group Holdings Limited is an investment holding company that operates in the sale and service of motor vehicles in the People’s Republic of China, with a market cap of approximately HK$28.78 billion.

Operations: The company's revenue primarily comes from the sale of motor vehicles and related services, totaling CN¥179.81 billion.

Dividend Yield: 6.3%

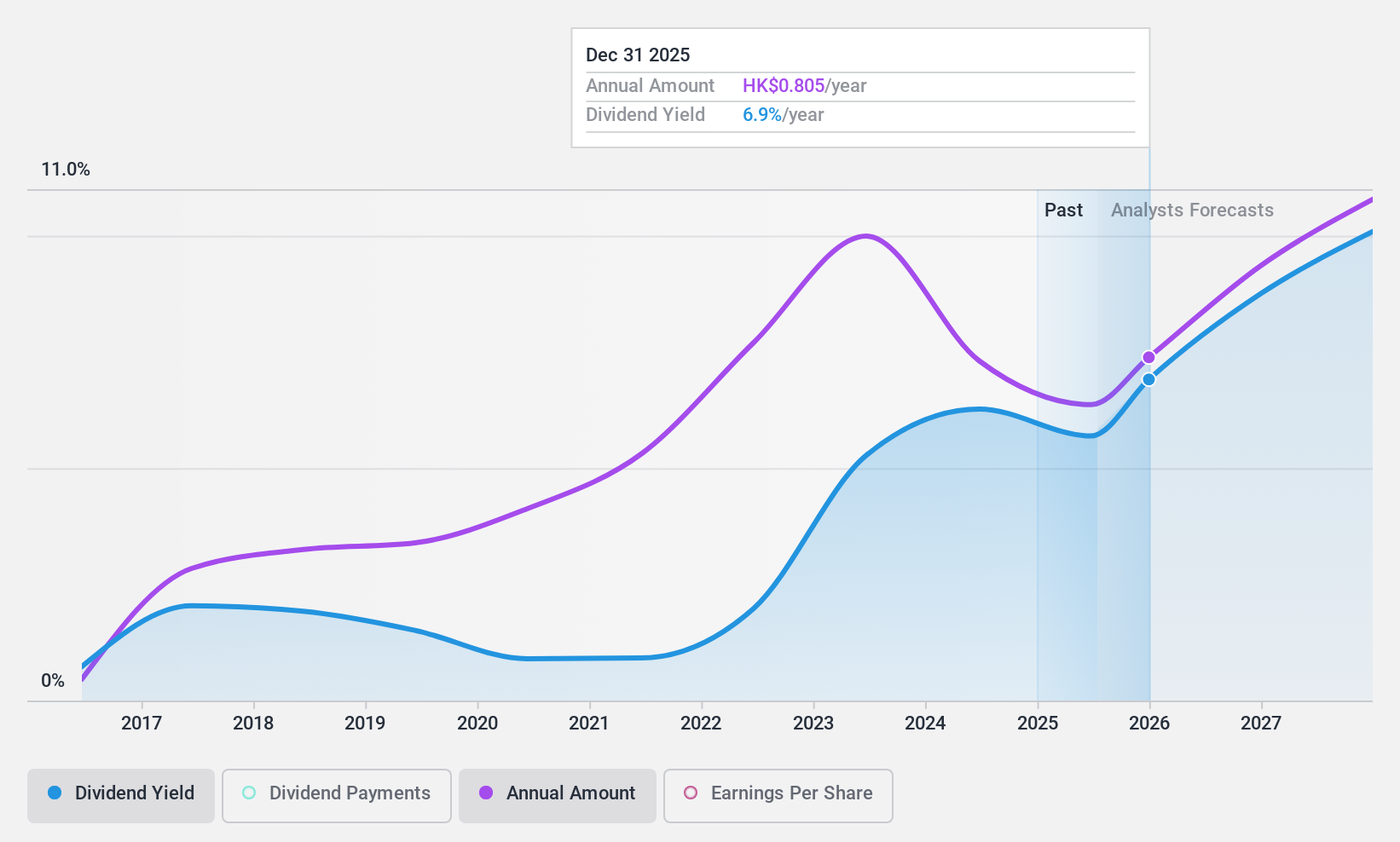

Zhongsheng Group Holdings' dividend profile shows both strengths and weaknesses. The dividends are covered by earnings and cash flows, with a payout ratio of 49% and a cash payout ratio of 51.6%. However, the dividend payments have been volatile over the past decade, reflecting an unstable track record. Despite this volatility, there has been growth in dividend payments during this period. The current yield of 6.29% is below Hong Kong's top quartile benchmark of 8.04%.

- Click to explore a detailed breakdown of our findings in Zhongsheng Group Holdings' dividend report.

- In light of our recent valuation report, it seems possible that Zhongsheng Group Holdings is trading behind its estimated value.

Tiandi Science & TechnologyLtd (SHSE:600582)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tiandi Science & Technology Co. Ltd operates in China, focusing on mine safety, smart equipment, design and construction, green development, and clean and low carbon initiatives, with a market cap of CN¥24.38 billion.

Operations: Tiandi Science & Technology Co. Ltd generates revenue through its operations in mine safety, smart equipment, design and construction, green development, and clean and low carbon sectors within China.

Dividend Yield: 4.8%

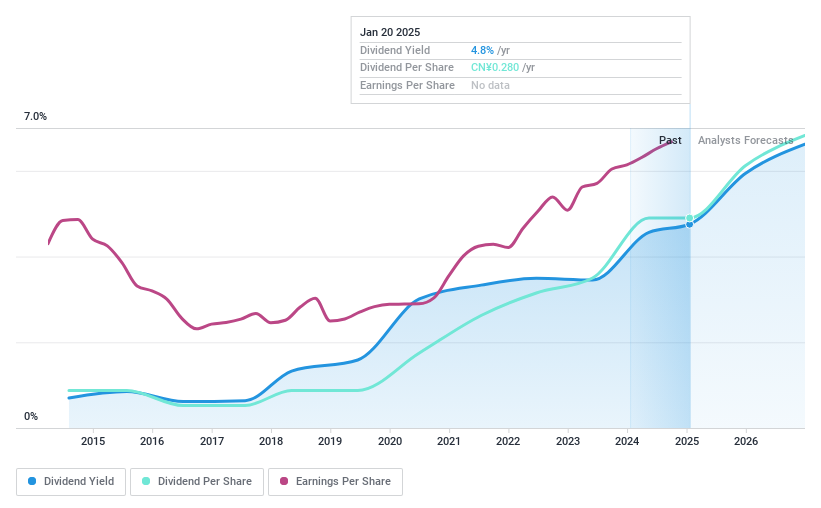

Tiandi Science & Technology Ltd's dividend profile is characterized by both growth and volatility. While dividends have increased over the past decade, they have been unstable with significant annual drops. The current yield of 4.75% places it among the top 25% of dividend payers in China. Dividends are well-covered by earnings (payout ratio: 45.2%) and cash flows (cash payout ratio: 65.9%). Recent earnings show steady revenue and net income growth, supporting potential future stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Tiandi Science & TechnologyLtd.

- Our valuation report here indicates Tiandi Science & TechnologyLtd may be undervalued.

Make It Happen

- Embark on your investment journey to our 1981 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongsheng Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:881

Zhongsheng Group Holdings

An investment holding company, engages in the sale and service of motor vehicles in the People's Republic of China.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives