In the current landscape, global markets have shown resilience with U.S. indexes nearing record highs and smaller-cap indexes outperforming their larger counterparts. This positive sentiment is bolstered by strong labor market indicators and encouraging home sales reports, despite ongoing geopolitical uncertainties. In such an environment, undiscovered gems in the stock market often exhibit qualities like solid fundamentals, growth potential within their sectors, and a capacity to capitalize on prevailing economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Beijing AriTime Intelligent Control (SHSE:600560)

Simply Wall St Value Rating: ★★★★★★

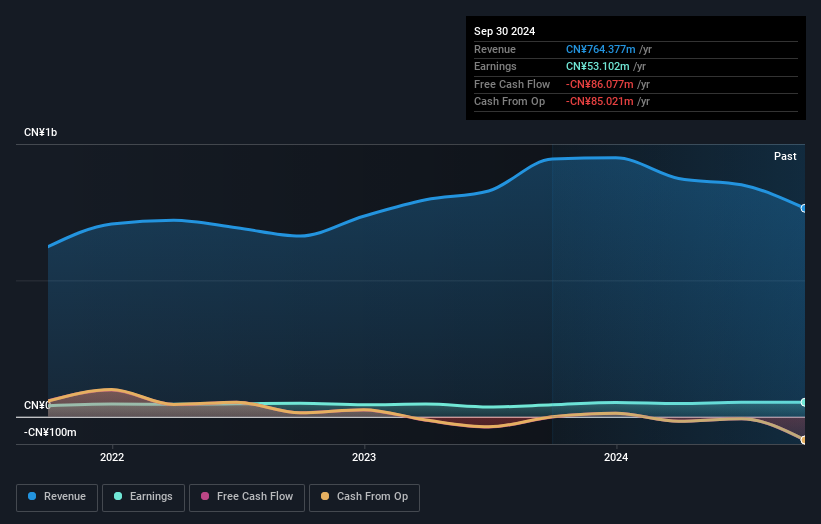

Overview: Beijing AriTime Intelligent Control Co., Ltd. operates in the intelligent control industry with a market cap of CN¥3.41 billion.

Operations: The company generates revenue from its operations in the intelligent control industry. It has a market capitalization of CN¥3.41 billion, reflecting its financial standing within the sector.

AriTime, a nimble player in the electrical industry, has demonstrated impressive earnings growth of 21.7% over the past year, outpacing the industry's modest 1.1%. Despite its small size, it boasts high-quality earnings and maintains a debt-free status, which is quite an achievement. However, free cash flow remains negative, posing potential challenges for future investments or expansions. Recent reports show sales at CNY 482.63 million for nine months ending September 2024 compared to CNY 667.83 million a year ago; yet net income slightly rose to CNY 38.23 million from CNY 37.63 million previously—showcasing resilience amidst revenue dips.

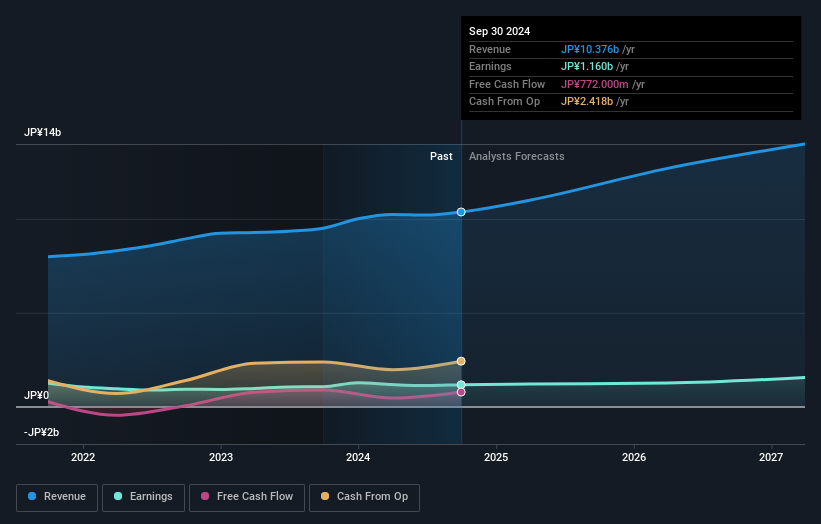

OPTiM (TSE:3694)

Simply Wall St Value Rating: ★★★★★☆

Overview: OPTiM Corporation offers IoT platform, remote management, and support services in Japan with a market cap of ¥400.02 billion.

Operations: Revenue for OPTiM Corporation is primarily derived from its IoT platform, remote management, and support services. The company has a market capitalization of approximately ¥400.02 billion.

OPTiM, a tech company with a modest market presence, has shown robust financial health. Its interest payments are impressively covered by EBIT at 1971 times, indicating strong earnings quality. Over the past five years, earnings have grown annually by 15%, and forecasts suggest an 11% yearly growth ahead. The firm holds more cash than its total debt, enhancing its financial stability. Recent guidance projects net sales of ¥11.3 billion and operating profit of ¥1.95 billion for the fiscal year ending March 2025. However, it's noteworthy that OPTiM was recently dropped from the S&P Global BMI Index in September 2024.

- Get an in-depth perspective on OPTiM's performance by reading our health report here.

Understand OPTiM's track record by examining our Past report.

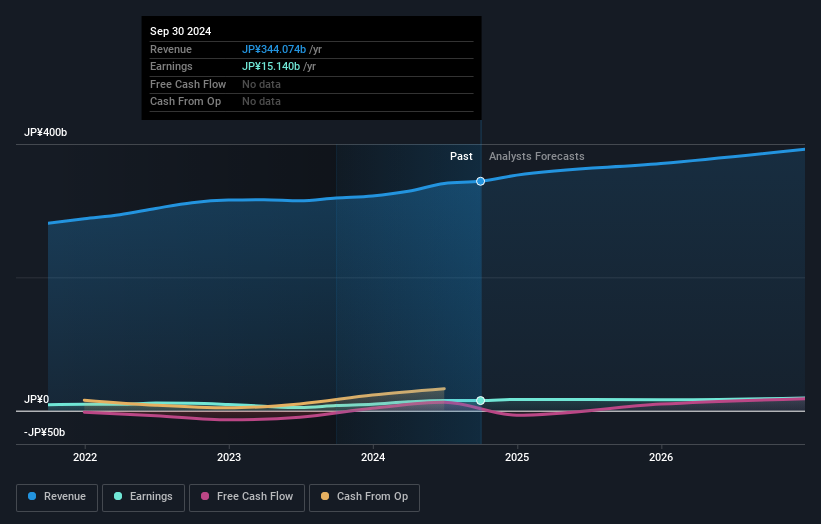

artience (TSE:4634)

Simply Wall St Value Rating: ★★★★★☆

Overview: Artience Co., Ltd. operates in the colorants and functional materials, polymers and coatings, printing and information, and packaging materials sectors across Japan, China, Europe, Africa, Asia, the Americas, and globally with a market cap of ¥164.50 billion.

Operations: Artience Co., Ltd. generates revenue primarily from its Packaging Materials Related Business at ¥89.02 billion, followed by Polymers and Coatings at ¥85.51 billion, and Colorants and Functional Materials at ¥85.52 billion. The Printing and Information segment contributes ¥82.75 billion to the overall revenue stream.

Artience, a nimble player in its sector, showcases impressive earnings growth of 94.9% over the past year, outpacing the Chemicals industry average of 14%. With a debt to equity ratio that has nudged from 27.3% to 30.4% over five years, it remains at a satisfactory net debt level of 9.1%. The company seems well-positioned with high-quality earnings and trades at an attractive value—78.4% below estimated fair value. Recently, Artience repurchased shares worth ¥1,291 million, reflecting confidence in its market position despite recent share price volatility.

- Click here and access our complete health analysis report to understand the dynamics of artience.

Gain insights into artience's past trends and performance with our Past report.

Summing It All Up

- Reveal the 4632 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4634

artience

Engages in the colorants and functional materials, polymers and coatings, printing and information, and packaging materials businesses in Japan, China, Europe, Africa, Asia, the Americas, and internationally.

Undervalued with solid track record and pays a dividend.