In the current global market landscape, U.S. stocks have experienced a dip amid tariff uncertainties and mixed economic indicators, with major indices like the S&P 500 seeing slight declines. Despite these challenges, opportunities remain for discerning investors who can identify promising small-cap stocks that may benefit from shifting market dynamics and economic conditions. In this environment, finding a good stock often involves looking for companies with strong fundamentals that can weather volatility and capitalize on growth opportunities despite broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Feida Environmental Science & Technology (SHSE:600526)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Feida Environmental Science & Technology Co., Ltd. operates in the environmental protection industry and has a market cap of CN¥4.25 billion.

Operations: Feida Environmental Science & Technology generates revenue primarily from its environmental protection services. The company's financial performance is characterized by a notable net profit margin trend, reflecting its operational efficiency and cost management strategies.

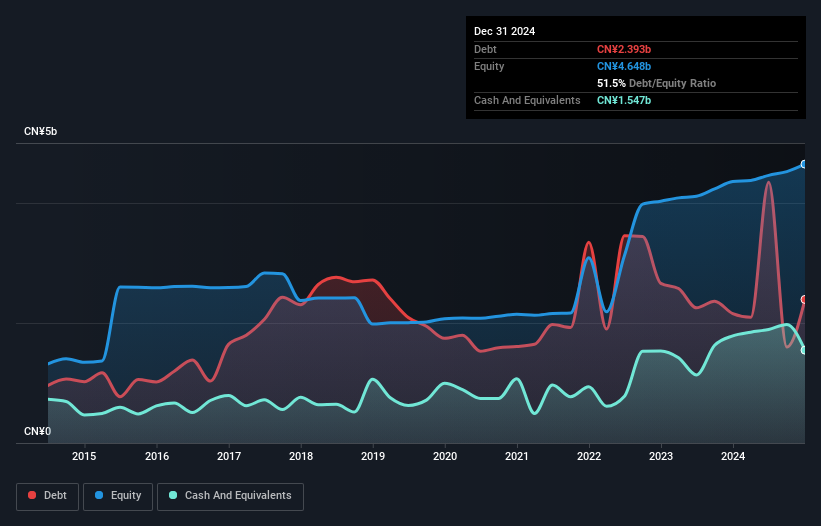

Zhejiang Feida Environmental Science & Technology, a nimble player in its field, has demonstrated notable financial resilience. Over the past five years, the company reduced its debt to equity ratio from 96.4% to 35.4%, indicating improved financial health. Its earnings growth of 38.8% last year outpaced the broader machinery industry, which saw a -0.06% change, showcasing robust performance amidst industry challenges. With interest payments well-covered by EBIT at 30x and a price-to-earnings ratio of 16x below the CN market average of 37x, Feida seems positioned for value-conscious investors seeking opportunities in emerging sectors.

Shinnihonseiyaku (TSE:4931)

Simply Wall St Value Rating: ★★★★★★

Overview: Shinnihonseiyaku Co., Ltd. is engaged in the production and distribution of cosmetics, pharmaceuticals, and health food products both domestically in Japan and internationally, with a market cap of ¥44.94 billion.

Operations: Shinnihonseiyaku generates revenue through the sale of cosmetics, pharmaceuticals, and health food products across domestic and international markets. The company's market cap stands at ¥44.94 billion.

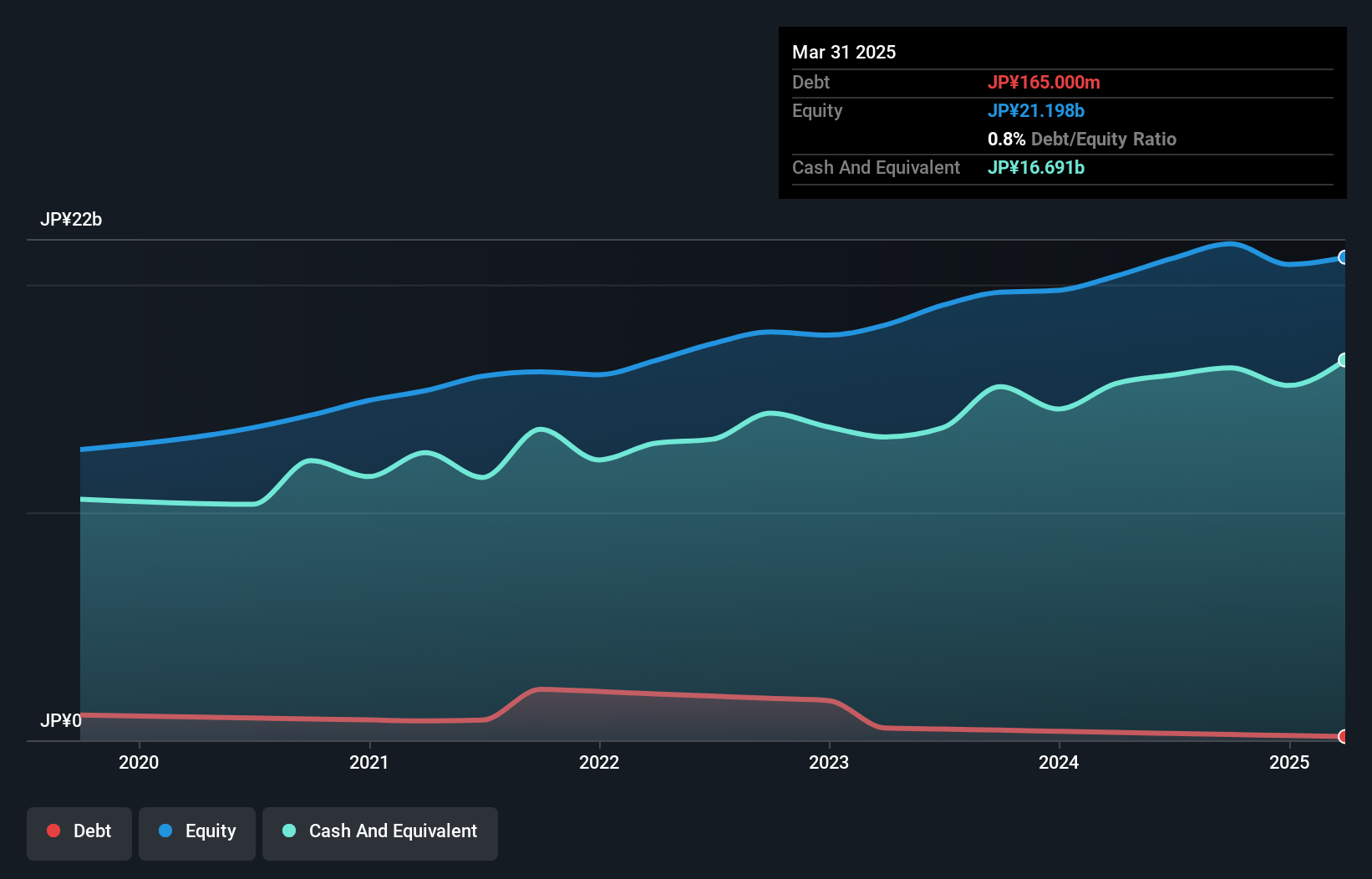

Shinnihonseiyaku, a noteworthy player in the personal products industry, has shown impressive financial resilience. Over the past year, its earnings surged by 16.5%, outpacing the industry's -6.6% performance dip. The company is trading at 46.2% below its estimated fair value and boasts a debt-to-equity ratio reduction from 8.1 to 1 over five years, indicating prudent financial management. Additionally, it maintains more cash than total debt and consistently generates positive free cash flow—US$3.24 million as of September 2024—which suggests robust liquidity positioning for future growth opportunities amidst evolving market conditions.

- Click here and access our complete health analysis report to understand the dynamics of Shinnihonseiyaku.

Examine Shinnihonseiyaku's past performance report to understand how it has performed in the past.

Jess-link Products (TWSE:6197)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jess-link Products Co., Ltd. is engaged in the production and distribution of electronic products and components across Taiwan, China, the United States, Japan, Thailand, and other international markets with a market cap of NT$17.46 billion.

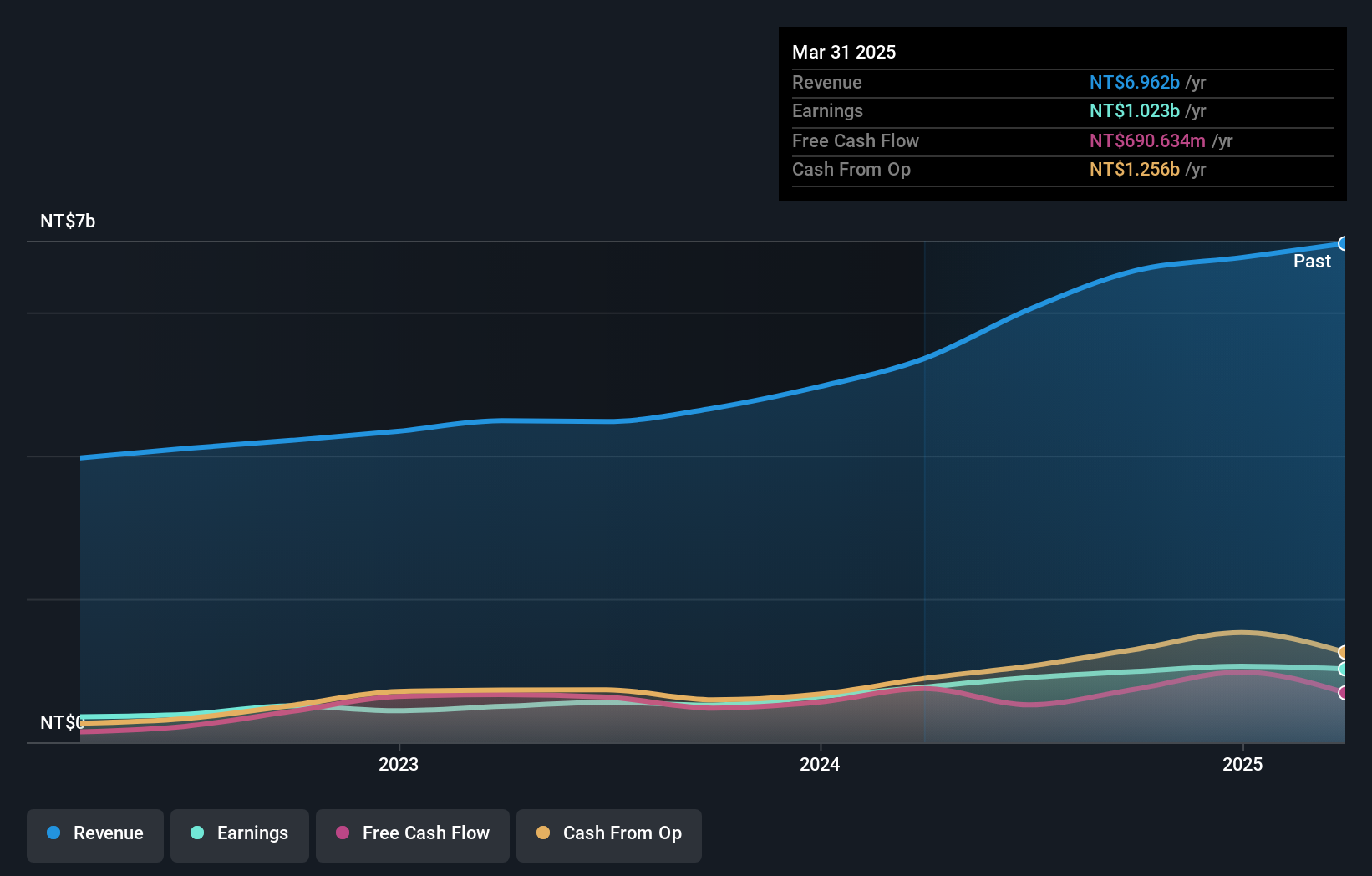

Operations: Jess-link generates revenue primarily from its Electronic Components Manufacturing segment, which accounts for NT$6.30 billion. The company's market cap stands at NT$17.46 billion.

Jess-link Products, a promising player in the tech sector, has seen its earnings soar by 90.7% over the past year, outpacing the industry average of 12.9%. Trading at 65.3% below its estimated fair value, it appears to offer significant upside potential for investors seeking undervalued opportunities. The company is free cash flow positive and maintains a healthy balance with more cash than total debt despite a rise in its debt-to-equity ratio from 4% to 12.3% over five years. Jess-link's high-quality earnings and robust interest coverage further underscore its financial stability amidst rapid growth dynamics.

- Dive into the specifics of Jess-link Products here with our thorough health report.

Gain insights into Jess-link Products' past trends and performance with our Past report.

Make It Happen

- Dive into all 4703 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Feida Environmental Science & Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600526

Zhejiang Feida Environmental Science & Technology

Zhejiang Feida Environmental Science & Technology Co., Ltd.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives