Discovering Three Undiscovered Gems in Asia with Strong Foundations

Reviewed by Simply Wall St

As global markets navigate through a mix of economic indicators and geopolitical tensions, Asian markets have shown resilience, with China's technology sector and Japan's fiscal policies offering promising signals. In this dynamic environment, identifying stocks with robust foundations becomes crucial, as these can potentially weather market fluctuations while capitalizing on regional growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| GakkyushaLtd | 18.85% | 4.12% | 13.58% | ★★★★★★ |

| Lelon Electronics | 19.10% | 5.19% | 9.27% | ★★★★★★ |

| Nantong Guosheng Intelligence Technology Group | NA | 6.38% | -0.97% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.06% | -13.76% | -28.84% | ★★★★★★ |

| Shandong Sacred Sun Power SourcesLtd | 18.69% | 12.95% | 39.68% | ★★★★★★ |

| Quality Reliability Technology | 8.30% | 1.20% | -45.53% | ★★★★★★ |

| Grade Upon Technology | 3.39% | 16.93% | 65.43% | ★★★★★★ |

| First Copper Technology | 19.69% | 3.43% | -2.37% | ★★★★★☆ |

| Shandong Keyuan Pharmaceutical | 7.11% | 2.69% | -8.42% | ★★★★☆☆ |

| Suzhou Fushilai Pharmaceutical | 0.04% | -6.05% | -29.68% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Black Peony (Group) (SHSE:600510)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Black Peony (Group) Co., Ltd. operates in the construction and textile sectors in China, with a market capitalization of approximately CN¥9.02 billion.

Operations: The company generates revenue primarily from its construction and textile segments. The construction segment contributes significantly to overall revenue, while the textile segment also plays a crucial role. Gross profit margin has shown variability over recent periods, reflecting changes in cost structures or pricing strategies.

Black Peony has shown resilience with its debt to equity ratio improving from 74.2% to 67.5% over five years, though the net debt to equity remains high at 48.7%. Despite a challenging environment, the company reported earnings growth of 117.8% last year, outpacing the construction industry's -7.6%. However, net income for the recent nine months was CNY 63.79 million compared to CNY 79.37 million previously, reflecting some headwinds in profitability despite sales rising from CNY 1,812.35 million to CNY 2,442.94 million; it trades at a substantial discount of 87% below estimated fair value indicating potential undervaluation opportunities for investors familiar with its dynamics and risks involved.

- Delve into the full analysis health report here for a deeper understanding of Black Peony (Group).

Evaluate Black Peony (Group)'s historical performance by accessing our past performance report.

Xiamen King Long Motor Group (SHSE:600686)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen King Long Motor Group Co., Ltd. is involved in the research, development, design, manufacturing, and sale of passenger vehicles both in China and internationally with a market capitalization of CN¥10.10 billion.

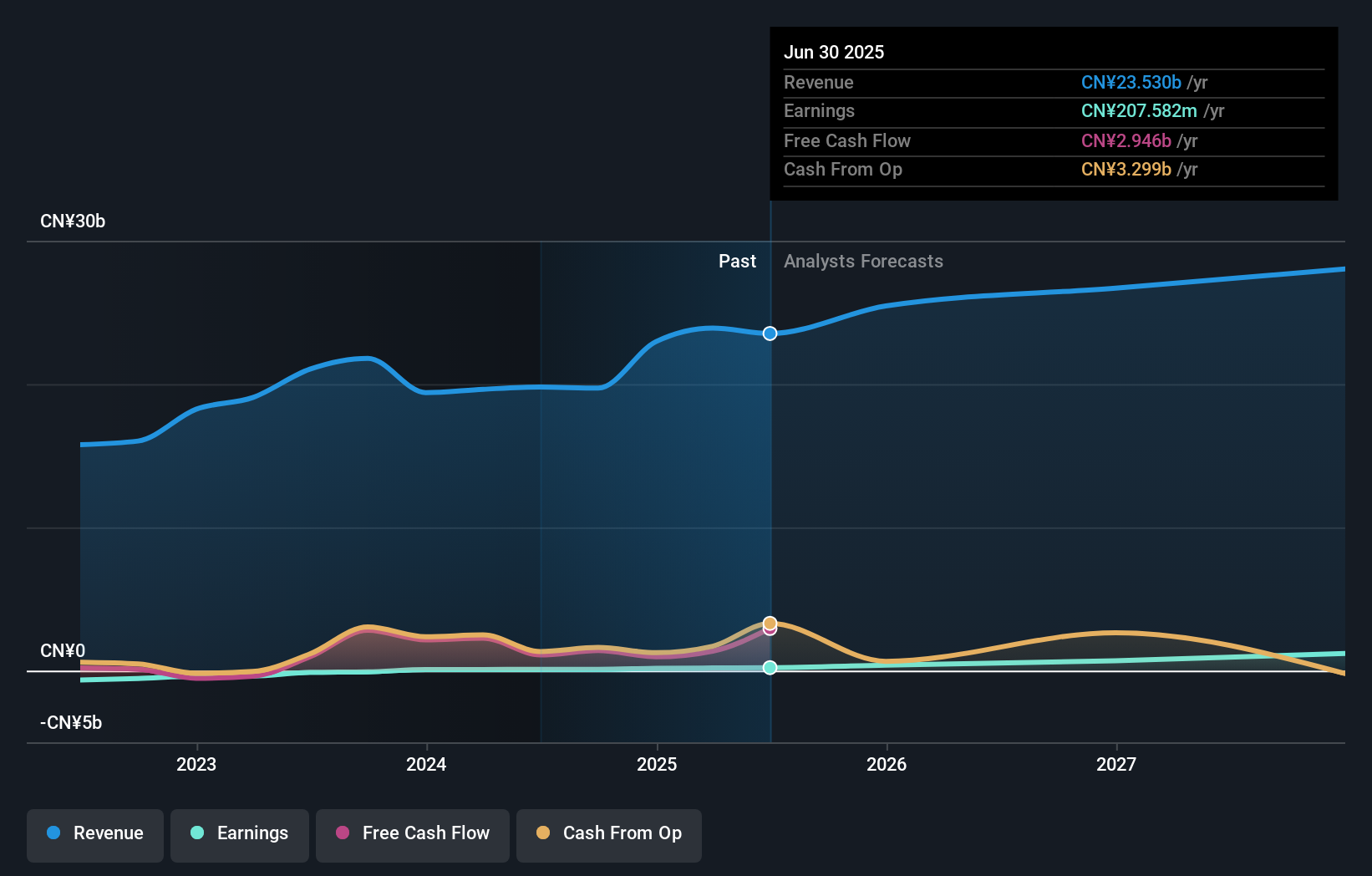

Operations: King Long generates revenue primarily from the sale of vehicles and vehicle parts, totaling CN¥23.53 billion. The company's financial performance is influenced by its gross profit margin trends over time.

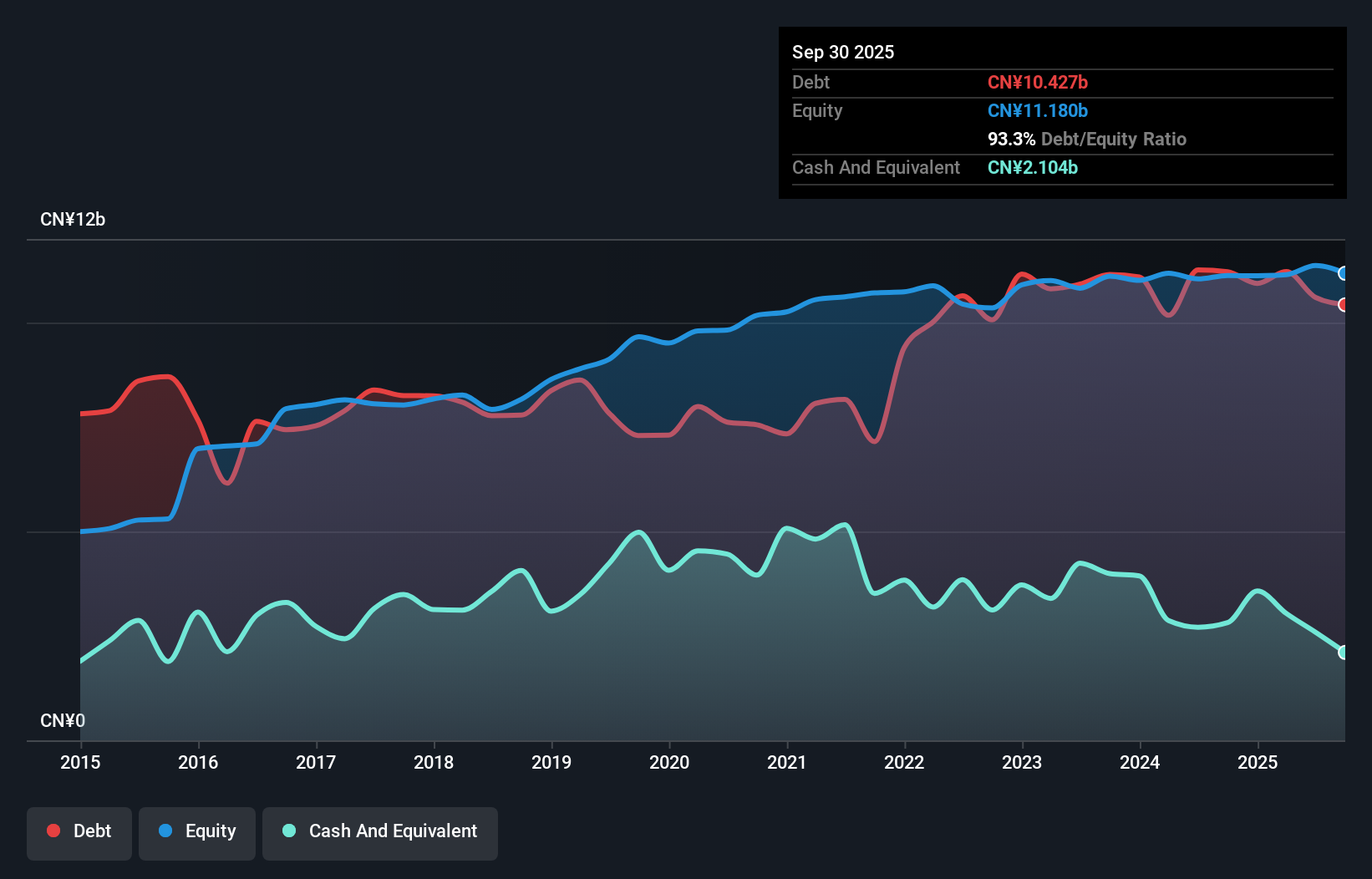

Xiamen King Long Motor Group, a notable player in the machinery sector, has demonstrated impressive earnings growth of 119% over the past year, significantly outpacing the industry average of 3.5%. Despite an increase in its debt-to-equity ratio from 73.5% to 128.7% over five years, it holds more cash than total debt, suggesting solid financial footing. Recent earnings reported for H1 2025 show sales at CN¥9.77 billion and net income rising to CN¥116 million from CN¥66 million a year ago. Trading at a discount of about 92% below estimated fair value indicates potential undervaluation in this vibrant market segment.

JirFine Intelligent Equipment (SZSE:301603)

Simply Wall St Value Rating: ★★★★☆☆

Overview: JirFine Intelligent Equipment Co., Ltd. focuses on the research, development, production, and sale of CNC machine tools with a market capitalization of CN¥9.53 billion.

Operations: JirFine derives its revenue primarily from the sale of CNC machine tools. The company's net profit margin is 11.5%, reflecting its efficiency in managing costs relative to earnings.

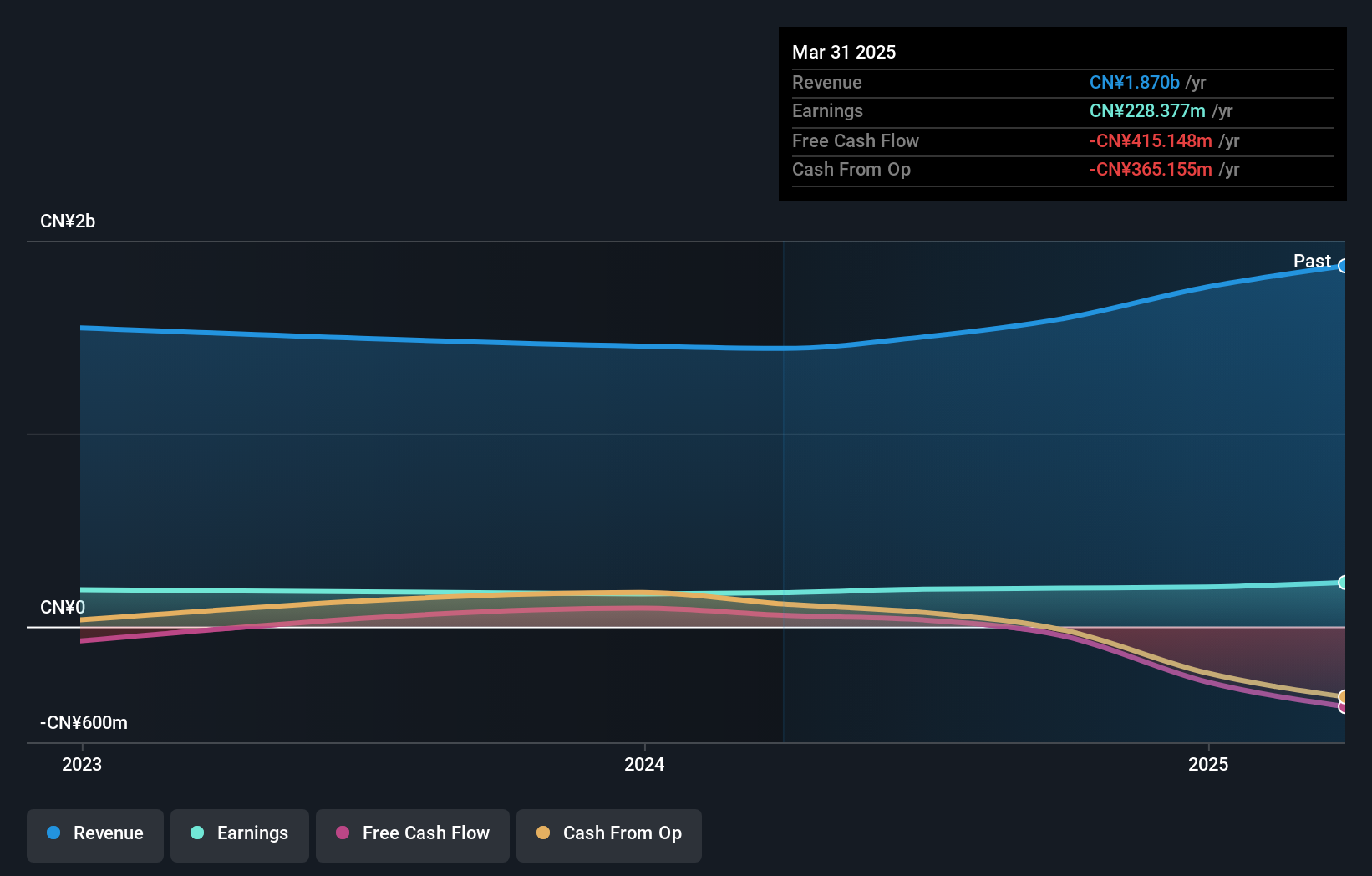

JirFine Intelligent Equipment, a nimble player in the machinery sector, has shown impressive earnings growth of 39% over the past year, far outpacing the industry's 3.5%. Despite a volatile share price recently, its debt-to-equity ratio remains low at 0.8%, indicating prudent financial management with more cash than total debt. However, free cash flow isn't positive yet. The company's net income for the first half of 2025 reached CNY 178.98 million from CNY 114.41 million in the previous year, reflecting robust operational performance and an attractive P/E ratio of 35x compared to China's market average of nearly 45x.

Seize The Opportunity

- Get an in-depth perspective on all 2388 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301603

JirFine Intelligent Equipment

Engages in the research and development, production, and sale of CNC machine tools.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives