3 Penny Stocks With Promising Growth And Market Caps Up To US$2B

Reviewed by Simply Wall St

As global markets continue to react positively to the Trump administration's policy shifts and AI enthusiasm, major U.S. indexes have reached record highs, reflecting investor optimism. In this context, penny stocks—often representing smaller or emerging companies—remain a relevant investment category despite their somewhat outdated name. By focusing on those with strong financials and clear growth potential, investors can uncover valuable opportunities in these lesser-known stocks.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.885 | £491.62M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.75 | £182.42M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.71 | HK$42.65B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £780M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

Click here to see the full list of 5,722 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Zhejiang Yankon Group (SHSE:600261)

Simply Wall St Financial Health Rating: ★★★★★★

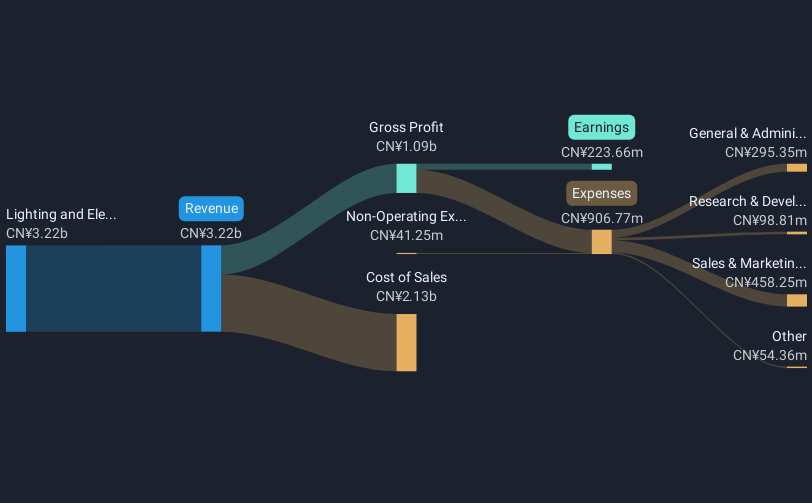

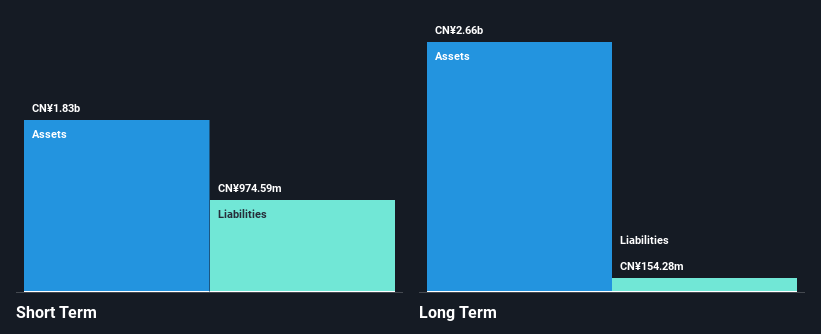

Overview: Zhejiang Yankon Group Co., Ltd. is involved in the research, development, production, and sales of lighting appliances in China with a market capitalization of CN¥4.74 billion.

Operations: The company generates revenue of CN¥3.22 billion from its Lighting and Electrical Industry segment.

Market Cap: CN¥4.74B

Zhejiang Yankon Group Co., Ltd. shows a stable financial position with short-term assets of CN¥3.8 billion exceeding both its short and long-term liabilities, indicating strong liquidity. The company's debt is well-covered by operating cash flow, and it holds more cash than total debt, reflecting sound financial management. Although earnings have grown by 13.3% over the past year, this follows a significant decline over five years, suggesting volatility in performance. The company has experienced some large one-off gains affecting recent results and maintains an unstable dividend track record, which may concern some investors seeking consistent returns.

- Navigate through the intricacies of Zhejiang Yankon Group with our comprehensive balance sheet health report here.

- Examine Zhejiang Yankon Group's past performance report to understand how it has performed in prior years.

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: V V Food & Beverage Co., Ltd is involved in the research, development, production, and sale of food and beverage products both in China and internationally, with a market cap of CN¥5.32 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for the company.

Market Cap: CN¥5.32B

V V Food & Beverage Co., Ltd. demonstrates a mixed financial profile with its debt-to-equity ratio significantly reduced to 10.5% over five years, indicating improved financial health. The company has more cash than total debt, but operating cash flow only covers 7.5% of its debt, suggesting potential liquidity concerns. Short-term assets of CN¥1.8 billion comfortably cover both short and long-term liabilities, highlighting solid liquidity management. Despite a low return on equity of 9.5%, earnings have surged by 146% in the past year, surpassing industry averages and reflecting strong recent performance albeit influenced by a large one-off gain of CN¥149.6 million.

- Click to explore a detailed breakdown of our findings in V V Food & BeverageLtd's financial health report.

- Understand V V Food & BeverageLtd's track record by examining our performance history report.

Zhejiang CONBA PharmaceuticalLtd (SHSE:600572)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang CONBA Pharmaceutical Co., Ltd. is involved in the research, development, manufacturing, and sales of medicines and general health products in China with a market cap of CN¥11.38 billion.

Operations: The company generates revenue of CN¥6.46 billion from its operations within China.

Market Cap: CN¥11.38B

Zhejiang CONBA Pharmaceutical Co., Ltd. exhibits a complex financial landscape, with its price-to-earnings ratio of 23.4x suggesting potential value against the broader CN market average of 35.1x. Despite a significant reduction in debt to equity from 55.6% to 6.2% over five years, recent earnings have declined by 35.3%, impacted by a large one-off gain of CN¥127 million, affecting profit quality. The company maintains strong liquidity with short-term assets exceeding both short and long-term liabilities significantly, although its dividend yield of 4.41% is not well covered by earnings or free cash flows, indicating sustainability concerns.

- Take a closer look at Zhejiang CONBA PharmaceuticalLtd's potential here in our financial health report.

- Examine Zhejiang CONBA PharmaceuticalLtd's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Get an in-depth perspective on all 5,722 Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang CONBA PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600572

Zhejiang CONBA PharmaceuticalLtd

Engages in the research, development, production, and sales of pharmaceuticals and health products in mainland China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives