Qinghai Huading Industrial And 2 Other Penny Stocks In Global To Watch Closely

Reviewed by Simply Wall St

Global markets have recently been weighed down by concerns over AI-related valuations and mixed economic signals, leading to a cautious sentiment among investors. In such a climate, identifying stocks with solid financial foundations becomes crucial for investors seeking stability and potential growth. Penny stocks, though an outdated term, still represent an intriguing investment area as they often involve smaller or newer companies that can offer surprising value when backed by strong financials. This article will explore three penny stocks that stand out for their financial resilience and potential long-term success.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$424.18M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.40 | MYR203.39M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.47 | HK$2.05B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €232.45M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.05 | SGD425.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.34 | SGD13.14B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.66 | $383.68M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ✅ 5 ⚠️ 0 View Analysis > |

Click here to see the full list of 3,581 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Qinghai Huading Industrial (SHSE:600243)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Huading Industrial Co., Ltd. is involved in the research, development, production, and sale of CNC machine tools, gear boxes, and elevator accessories in China with a market cap of CN¥2.19 billion.

Operations: The company generates revenue of CN¥247.66 million from its operations within China.

Market Cap: CN¥2.19B

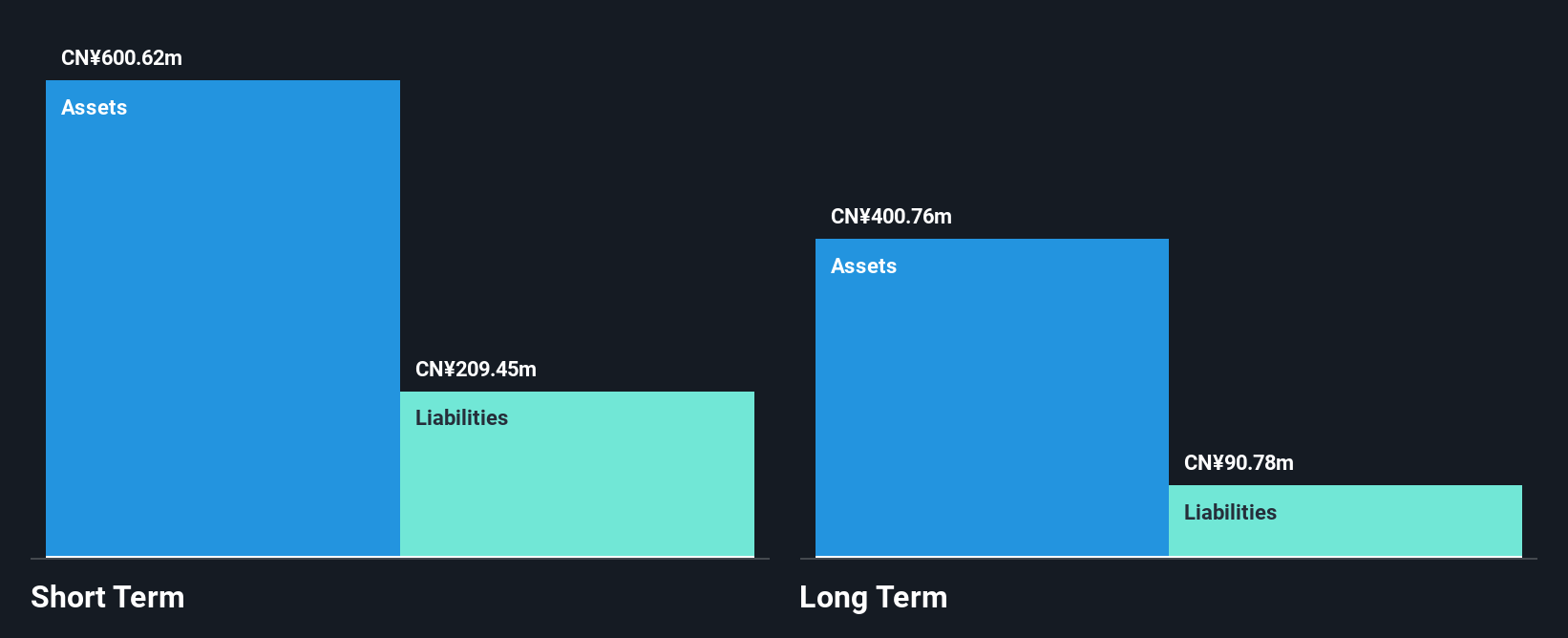

Qinghai Huading Industrial presents a mixed picture for potential investors in penny stocks. The company is currently unprofitable with earnings declining by 8.5% annually over the past five years, and it has a negative return on equity of -11.77%. However, its short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity. Recent developments include Langning Yihe's acquisition of a substantial stake, suggesting external interest in the company's prospects despite its financial challenges. Additionally, Qinghai Huading reported reduced net losses for the nine months ending September 2025 compared to the previous year, signaling some operational improvement.

- Click here and access our complete financial health analysis report to understand the dynamics of Qinghai Huading Industrial.

- Evaluate Qinghai Huading Industrial's historical performance by accessing our past performance report.

NanJi E-Commerce (SZSE:002127)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NanJi E-Commerce Co., LTD operates in China, offering brand licensing and comprehensive mobile Internet marketing services, with a market cap of CN¥8.60 billion.

Operations: The company generates its revenue of CN¥2.94 billion from operations within China.

Market Cap: CN¥8.6B

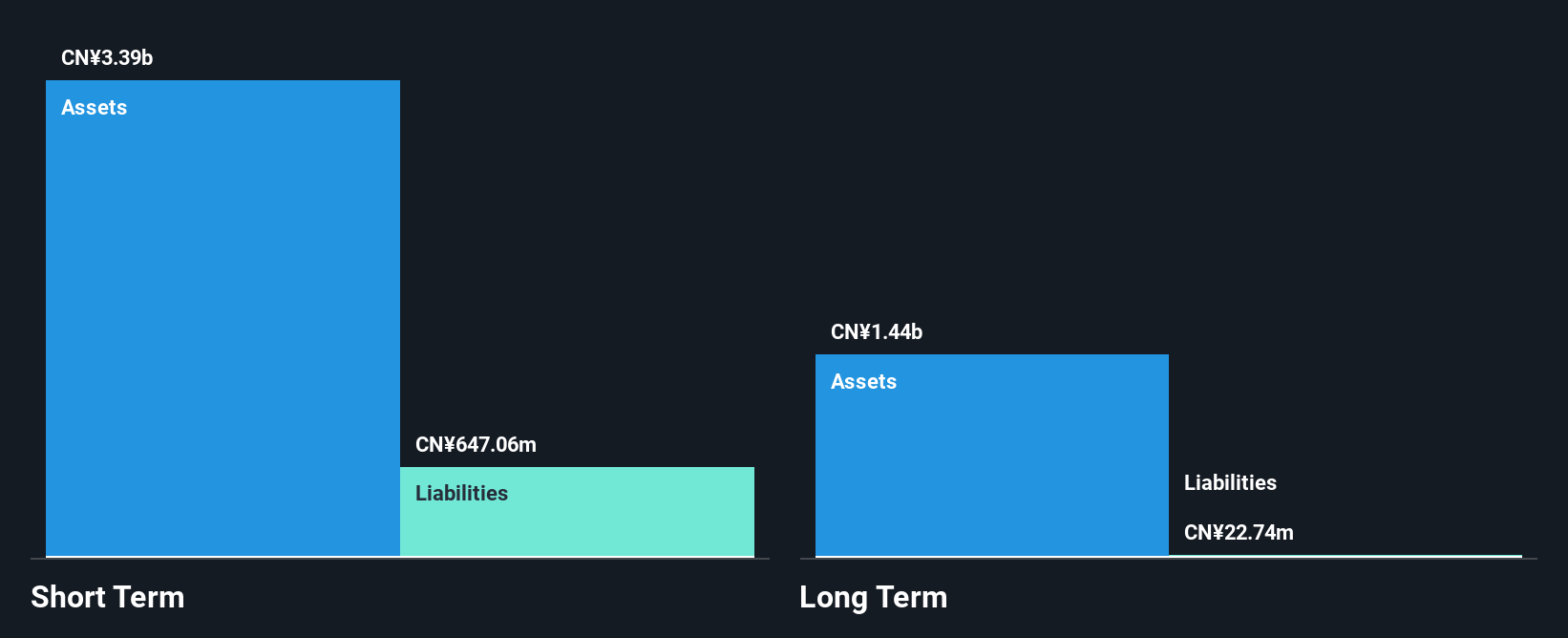

NanJi E-Commerce Co., LTD, operating without debt and with substantial short-term assets of CN¥3.4 billion surpassing its liabilities, demonstrates strong liquidity. Despite being unprofitable and experiencing increased losses over the past five years, the company reported sales of CN¥1.99 billion for the nine months ending September 2025, down from CN¥2.41 billion a year earlier. The management team is relatively experienced with an average tenure of 3.3 years, although the board lacks extensive experience with an average tenure of 2.6 years. Recent amendments to its articles of association may indicate strategic shifts underway.

- Click here to discover the nuances of NanJi E-Commerce with our detailed analytical financial health report.

- Learn about NanJi E-Commerce's future growth trajectory here.

Zhejiang Reclaim Construction Group (SZSE:002586)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Reclaim Construction Group Co., Ltd. operates in the construction industry, focusing on engineering and infrastructure projects, with a market cap of CN¥4.91 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥2.42 billion.

Market Cap: CN¥4.91B

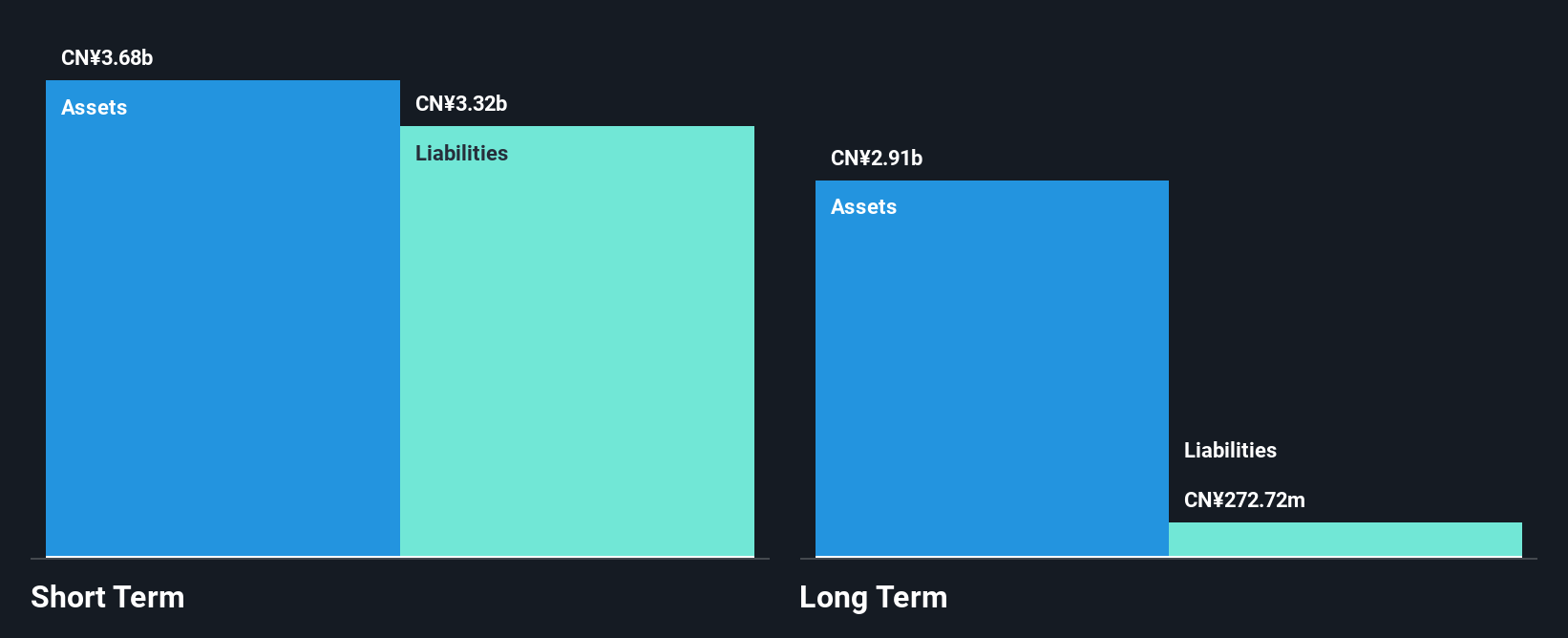

Zhejiang Reclaim Construction Group Co., Ltd. has demonstrated financial resilience despite being unprofitable, with a notable reduction in losses over the past five years and earnings growth of 38.6% annually. The company reported nine-month sales of CN¥1.29 billion, showing a slight decline from the previous year but achieving net income of CN¥37.52 million compared to a prior loss. With more cash than debt and short-term assets exceeding liabilities, it maintains solid liquidity while its board is experienced with an average tenure of three years. Upcoming amendments to its articles may signal future strategic adjustments.

- Take a closer look at Zhejiang Reclaim Construction Group's potential here in our financial health report.

- Assess Zhejiang Reclaim Construction Group's previous results with our detailed historical performance reports.

Where To Now?

- Gain an insight into the universe of 3,581 Global Penny Stocks by clicking here.

- Seeking Other Investments? Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJi E-Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002127

NanJi E-Commerce

Provides brand licensing and comprehensive and mobile Internet marketing services in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success