- China

- /

- Construction

- /

- SHSE:600133

If EPS Growth Is Important To You, Wuhan East Lake High Technology Group (SHSE:600133) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Wuhan East Lake High Technology Group (SHSE:600133). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Wuhan East Lake High Technology Group

Wuhan East Lake High Technology Group's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Wuhan East Lake High Technology Group managed to grow EPS by 6.5% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Wuhan East Lake High Technology Group's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Wuhan East Lake High Technology Group's EBIT margins have actually improved by 5.5 percentage points in the last year, to reach 11%, but, on the flip side, revenue was down 64%. While not disastrous, these figures could be better.

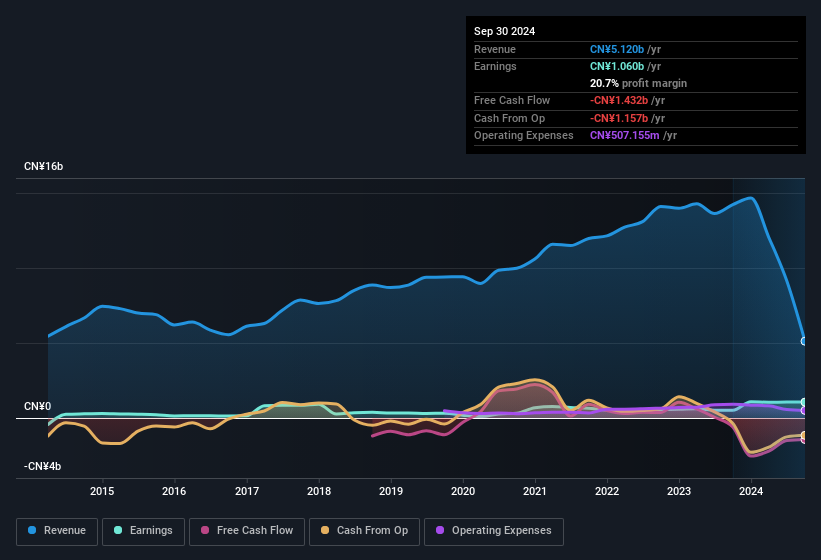

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Wuhan East Lake High Technology Group's balance sheet strength, before getting too excited.

Are Wuhan East Lake High Technology Group Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. Our analysis has discovered that the median total compensation for the CEOs of companies like Wuhan East Lake High Technology Group with market caps between CN¥7.3b and CN¥23b is about CN¥1.2m.

Wuhan East Lake High Technology Group offered total compensation worth CN¥783k to its CEO in the year to December 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Wuhan East Lake High Technology Group Worth Keeping An Eye On?

As previously touched on, Wuhan East Lake High Technology Group is a growing business, which is encouraging. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. So all in all Wuhan East Lake High Technology Group is worthy at least considering for your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Wuhan East Lake High Technology Group (of which 1 can't be ignored!) you should know about.

Although Wuhan East Lake High Technology Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan East Lake High Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600133

Wuhan East Lake High Technology Group

Wuhan East Lake High Technology Group Co., Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives